The transcript from this week’s, MiB: Lisa Shalett, CIO Morgan Stanley, is below.

You can stream and download our full conversation, including any podcast extras, on Apple Podcasts, Spotify, YouTube, and Bloomberg. All of our earlier podcasts on your favorite pod hosts can be found here.

~~~

This is Masters in business with Barry Ritholtz on Bloomberg Radio

Barry Ritholtz: This week, really an extra, extra special guest. Lisa Shallet, chief Investment Officer at Morgan Stanley has had a number of fascinating roles in Wall Street, which is kind of amusing considering she had no interest in working on Wall Street, and yet she was CEO and chairman at Sanford Bernstein. She was CIO at Merrill Lynch Asset Management, and now CIO at both Morgan Stanley Wealth Management and runs their asset allocation models and their outsourced chief investment officer models. So she’s seen this industry from all sides. Not only is CEO running operations, running a a substantial firm, but as CIO for Morgan Stanley is over $6 trillion. She’s directly responsible for a hundred billion dollars. There are a few people in this industry who understand what it’s like to work with institutions, work with families, work with individuals, as well as work with advisors and brokers the way Lisa does. She, she absolutely has a unique background and a unique perch on, on wealth management and what’s going on in the world. I found this conversation to be absolutely fascinating, and I think you will also, with no further ado, my conversation with Morgan Stanley’s. Lisa Schack.

Lisa Shalett: Thank you. It’s great to be here, Barry.

Barry Ritholtz: It’s great to have you. I’ve really been looking forward to this conversation. You, you have an absolutely bonkers cv. We’ll, we’ll get into that in a little bit.

00:01:58 [Speaker Changed] I’m just old.

Barry Ritholtz: Better than the alternative I like to say. Right? Yes. But let’s start with your background in your career, applied mathematics and economics from Brown and then a Harvard MBA. That sounds like you were on a career path to a Wall Street Quant from early on. Tell us what, what the career plans were.

Lisa Shalett: Not at all. Right. I, I, in college, I was a drive time disc jockey. I, you know, abhorred the idea of working on Wall Street. And so, you know, coming outta school once I realized that journalists and folks in radio don’t make much money in the long run, no offense,

Barry Ritholtz: This is my side hustle. Not offended at all.

Lisa Shalett: Not to anyone around here. You know, I thought I was gonna take the high road and, and be a management consultant. So that’s what I did for the first job.

Barry Ritholtz: So what changed your mind to say, all right, let me, let me go see what these finance bros on Wall Street are all about.

Lisa Shalett: Yeah, so, you know, I, I did the consulting thing both before and after business school. And, you know, fundamentally I was never home. I was traveling and on an airplane all the time. I was literally arriving back home Saturday mornings, leaving Sunday nights. You know, I was starting to hit that, you know, those magic numbers in the thirties when women are like, if I don’t get it done now, it’s not now or never it’s not, it’s now or never. So I took the plunge, I quit. I did not have a job, and I said, okay, I am gonna go out there and, and see what’s going on. I knew that I wanted to work with clients. That was one of the pieces of the consulting gig that appealed to me. I wanted to work with super smart people. Also, something I had loved in that career.

And I, and I really just, you know, wanted to be somewhere where I was constantly learning and growing. Right. And I’m a New Yorker, so I was coming home. Most of the search people at that time, you know, said to me, the only place to go if you wanna do that is Wall Street. I kind of balked and they said, but there’s just this one place, there’s this one place. And the one place for, for those on Wall Street in, in the mid nineties that was very special, was very independent, was Sanford Bernstein. I walked in the door and I literally fell in love. I can honestly tell you wow, from the minute I walked in the door, I knew I was home and I always thought I would die there. But obviously, you know, life is long and stuff happens. But it was a wonderful, wonderful, it was the seminal chapter in my career.

Barry Ritholtz: I’m trying to remember, did they get rolled up with PIMCO and from Alliance? Is that right? SoThat’s how became Alliance Bernstein?

Lisa Shalett: So Sanford C Bernstein was independent. When founder Mr. Bernstein passed, we needed to settle his estate and a decision was made to, to merge with Alliance Capital, which was a growth shop at the time, we thought it would be synergistic. ’cause the asset management business of Sanford Bernstein, as everyone I think knows, was a deep value shop. Right? And so that merger happened, I wanna say somewhere in the, in the early two thousands we became Alliance Bernstein. And you know, then, you know, we kind of wrote it to till the, the great financial crisis and our deep value exposure to financials kind of helped unwind us quite a bit. And I think, you know, Alliance Bernstein really spun for quite a long time. It took, you know, a long, long time to get out of that mess. I left ’cause I got tired of firing all my friends. Oof.

Barry Ritholtz: That’s tough. Because you were not just in the investing side, correct. You were chair and CEO Chief Executive Officer. Yes. That’s gotta be a very difficult experience right. In the teeth of the financial crisis.

Lisa Shalett: It, it was god awful. And really, you know, the trauma was when Lou Sanders, who at the time had been the storied CEO of the firm. He had been my personal rabbi when he was asked to step down. And, you know, therein began, I think the unraveling and, and a little bit of the, the loss of that, you know, cultural juice that had kind of historically made that firm special.

Barry Ritholtz: So you leave Sanford Bernstein and then, which had really become Alliance Bernstein end up at Merrill Lynch, where eventually your same role Chief Investment Officer for Bank of America Merrill Lynch Wealth Management first, what did, was there still remnants of Mother Merrill when you joined post merger? There

Lisa Shalett: Were certainly remnants. So, you know, just to, to reframe, you know, folks who are Wall Street historians will understand this chapter. One of the reasons I went to Merrill is I was recruited by one of my best friends, who is Sally Crotch? Sally. Oh really? Sally and I grew up at Sanford Bernstein together Oh. As baby analysts. And at that time she was running, you know, the Merrill Lynch brokerage business for B of A. And she hired me to come in and, and be the chief investment officer at Wealth Management. If you remember, during this period of time was right after the financial crisis, the worst of it, it was 20 10, 20 11. And, you know, she had kind of gone to bat very controversially asking the bank to protect clients on, on some of the products that had gone bad. And that didn’t go so well for her. And within four months of of my arrival, she actually heard that she was fired on tv. We were together in her office. And there was literally a chiron on the bottom of the screen that says, you know, CRO check to leave Bank of America Merrill Lynch.

Barry Ritholtz: Well, that was sweet of them to do it that way…

You know, I have a vivid recollection from the people I, we, we were talking about Josh Frankel and Dave Rosenberg, and I know a lot of Rich Bernstein, all these people I know from the 2000 Era Merrill Lynch. And one of the fascinating things about Sallie Krawcheck was her defense of the Merrill Lynch brands Post merger. And she really helped turn around a malaise, just a lack of office morale amongst here you have this storied name that was picked up on the cheap during the financial crisis and was wildly underperforming as an organization. And full credit to her for really saving Merrill Lynch as a name and turning I tens of thousands of people’s jobs around. She really did yeoman’s work there, didn’t she?

Lisa Shalett: Yes, absolutely.

Barry Ritholtz: So you become Chief Investment Officer for Bank of America Merrill Lynch Wealth Management. What did you take away from that? You, you’ve had this role in several organizations. What was really unique and special about Bank America Merrill Lynch?

Lisa Shalett: Yeah, so what, you know, when I was running the wealth management business, you know, reflecting on my experience with Sanford Bernstein. Sanford Bernstein was what we call a closed shop, right? All the clients were getting proprietary Sanford Bernstein asset Management product. And when I arrived at Merrill Lynch, it was really my first exposure to really entrepreneurial, extremely talented and aggressive financial advisors who were operating with what we in the industry call an open architecture platform, right? Where they could, you know, kind of place best of breed product with their clients. And so that opened a whole new world for me in thinking about asset allocation and thinking about advice and thinking about active and passive constructions together, thinking about alternatives. And so, you know, what made Merrill extraordinarily special were the financial advisors who were just spectacular, to your point, the thundering hurt.

Barry Ritholtz: Yep, yep. Remember those, those ads from like the sixties and seventies on tv, they were absolutely unique. So culturally, I have to think Sanford Bernstein and Merrill Lynch were both very different. What did you bring from those two organizations to your work at Morgan Stanley, either philosophically or cultural? Yeah,

Lisa Shalett: So I think from, from my time at, at Sanford Bernstein, I like to think I brought, you know, kind of my love of original research, my love of, you know, that independent streak, that desire to really, you know, call out conflict of interest and say, no, this is, you know, this is what the numbers really tell you. I like to think I brought that, I think, you know, from Merrill, it was really that appreciation of how do you work through financial advisor? So in, you know, as a chief investment officer, how do you earn the trust of financial advisors to have influence, right? Because they’re what stand between you and the client. And so, you know, I think, I think I started that process I, in my career at, at Merrill, I think in many ways I still wake up every day and I think I’ve got more to learn in terms of how to be a better partner to financial advisors today at Morgan Stanley.

Barry Ritholtz: And, and what is kind of interesting, given the open architecture at Merrill and the proprietary work at Alliance Bernstein, Morgan Stanley’s, a little bit of both, you, you have conscient research and a number of people running their own funds that are specific to Morgan Stanley as well as the open architecture. How, how do you look at the combination of, of both closed and open together? Yeah.

Lisa Shalett: Well, look, I, I think it, it does a lot of things. First, it avails me of some of the best colleagues on the planet, right? So I’m surrounded not only by folks in the wealth management business, but obviously I’m attached to one of the best equity and trading franchises globally. And then to your point, you know, connected to PMs that, you know, are walking the floors with me. But look, you know, I wanna be really clear when I think about my CLI clients, we’re arms length. So proprietary product might be appropriate for them if they’re open to it. If on the other hand they say, conflicts of interest matter a lot to me, I want everything to be totally transparent. We have that, those options as well. So, you know, I think about it as, as you know, we, we work with clients, we do what clients are in their best interest. And, and I know it sounds a little bit like an advertisement, but I really believe that,

Barry Ritholtz: Well the the next question, the obvious question is, who are the clients? Are they institutions? Are they households? Are they a little bit of both.

Lisa Shalett: Yeah. So as you may know, Barry, you know, over the last, you know, really decade since since Gorman acquired Smith Barney, we’ve been expanding our footprint in terms of the client segments that we are focused on serving really exponentially. So while you might once upon a time have thought about, you know, the Morgan Stanley financial advisors as, as, you know, serving that ultra high net worth, you know, core client, you know, now we’re, you know, serving folks in the mass market through E-Trade. We’re serving family offices, we’re serving institutions, we’ve done acquisitions in, in the stock plan businesses, in the retirement businesses. I, I, you noted in my bio that I, I run help run one of our OCIO businesses, our outsource, where we’re working with foundations and endowments and family offices. So now we’re everywhere and we’re serving every type of wealth client internationally, domestic self-directed through a brokerage account all the way through complete discretionary.

Barry Ritholtz: I recall back in the day Morgan Stanley as well, they’re kind of a Goldman Sachs wannabe. And, and that is no longer the case. It’s the best of Goldman, the best of Merrill. And on this is really inside baseball stuff. So I apologize to, to listeners, but on the league tables to say who’s number one in underwriting, who’s number one in attracting new wealth management, who’s number one in self-directed. Like you guys are competitive across the board. And it’s not like the old days where Goldman has a good year in their, you know, take the top spot everywhere. That doesn’t seem to happen anymore. It seems like the industry has become so competitive, you want to be in the top five or top 10. But the days of, you know, taking num number one with a bullet across all these different areas, they really seem to have faded.

Lisa Shalett: Yeah, they have. I mean, I think that ours is a business in almost every segment that requires a lot of scale. And as you know, developing scale very often means investing aggressively in tech, investing aggressively in talent. And you gotta pick your spots, right? And so, you know, to your point, I think every, you know, segment today is a little bit of a gunfight. I like to think that, you know, in core wealth management, Morgan Stanley, and, and you know, where we’ve come, you know, first under James Gorman and now hopefully under, under Ted Pick’s leadership is really, you know, differentiating us and allowing us to pull away from the pack, at least in wealth management.

Barry Ritholtz: And you, you mentioned the investment in technology and people and the ability to scale at your size. And there’s only, you know, a dozen or two companies that can make this claim that flywheel begins to become very self-reinforcing. And you have the ability to just continue to add divisions to fill in. Oh, we’re a little soft here. Let’s, let’s bulk this up a little bit and put a little muscle on it. ’cause we have the ability to offer these services to all our clients. What’s it been like watching the, how long have you there? You’re there almost a decade,

Lisa Shalett: So, and, and from 2012 to 2025, that’s a huge run.

Barry Ritholtz: A a lot of big financial players, Vanguard, BlackRock, go down the list, have really added some heft. So is Morgan Stanley, what’s it been like watching that over the past decade plus?

Lisa Shalett: Yeah, it’s been extraordinarily exciting for us. Obviously you always wanna be working in a growth business. And so, you know, we’ve been in a situation where we’re hiring people, which is always exciting. We’re going after new types of clients, new problems, new situations, which keeps you on your toes and keeps you growing and, you know, really completely new business segments. I mean, I can’t tell you how, to your point, that flywheel between moving up market into institutions feeds your self-directed business. I mean, let me just give you an example. Let’s assume that we are administering a stock plan for a large corporate client. Now we’re going in and we’re saying to that corporate client, instead of, you know, having a financial advisor going to the country club on Saturday, acquiring a client monoi mono one at a time, we’re now wa walking into a C- suite and saying to that CFO or that chief talent officer, Hey, can we provide all of your employees with a financial wellness program? Can we give every single one of your employees a free financial plan? Can we give every single one of your employees a account or advice, you know, to their first, you know, purchase in a 5 29 account? Things like that, where suddenly you’re acquiring clients at scale.

00:18:46 [Speaker Changed] Huh. Really, really interesting. So let’s talk a little bit about Morgan Stanley. We mentioned you were previously at Alliance Bernstein, and then you were at Bank America Merrill Lynch. What led you to make the jump to, to Morgan Stanley?

00:19:00 [Speaker Changed] So I had, when, as I noted, I’d gone to work at Merrill very much to, to partner with my very good friend Sally Crotch. And after she had left, I made the decision that without her there I kind of felt among the, you know, the thundering herd without a rabbi, if you will. And I left. And at that point I really thought I was gonna do my own thing. I thought I was gonna do something entrepreneurial. I thought I might join an RIA or form my own RIA at that point. And I just, I got a call from Greg Fleming. Greg Fleming was one of the co-presidents at Morgan Stanley at the time. And he said, look, you know, I have a lot of contacts over there at Merrill Lynch. The financial advisors really love you. You know, come on in and meet our team.

00:19:59 And so I did. And you know, I had a very similar feeling to that feeling I had when I first went into Bernstein of, you know, these are just great people and I would enjoy working with the people. And you know, before I knew it there I was, you know, sitting next to Mike Wilson, who I know, you know, Mike was taking a, a stint, a rotation through wealth management. And, you know, I joined, I joined him to, to build the team and, and really, you know, create the platform that we have today. When, when Morgan Stanley and and Smith Barney were merging, there was really no centralized CIO office. It was the only place that, that, that talent was coming from was from Smith Barney, from the Smith Barney side. And so we wanted to recraft a more Morgan Stanley integrated firm offering. And so I joined Mike Wilson to, to help build that.

00:20:56 [Speaker Changed] So, so let’s talk a little bit about what goes into managing a hundred plus billion dollars in assets. How do you develop that? How do you think about asset allocation and how do you think about the end clients, given how broad your audience and clients are? How do you create a, a, a set of options that checks all the boxes that, you know, you need to check to do this right? But also gives a broad variety of clients what they’re looking for?

00:21:28 [Speaker Changed] Yeah, so, so Barry, for us asset allocation, all asset allocation starts with financial planning and all financial planning starts with the client. But you can’t do a financial plan without having what we call capital market assumptions. You know, what do, what do we think every asset class is gonna do over the next 3, 5, 10, 20 years? Our customization of asset allocation really starts with financial planning. That is the linchpin. We fundamentally believe that you’ve gotta understand a client’s cash flow, that the client has to understand their own cash flows. You know, one of the things that I know, you know, having worked with a lot of clients is very often clients don’t know themselves. Right? The, the good old fashioned, Hey, I’m kind of aggressive, I’m kind of conservative. Those are such non-normative terms. You never know. Are we talking about politics? Are we talking about, you know, how you dress?

00:22:27 [Speaker Changed] Usually you’re talking about whatever the market did in the past six months, and that’s what the

00:22:31 [Speaker Changed] Determiner And so, so working through the behavioral pieces, the getting to know your client, the working through a plan with them, really getting into what are their hopes, wishes, dreams, you know, what does money mean to them? Why have, have they accumulated it? How have they accumulated it? What do they hope their legacy will be? Does it have to do with a charity a, you know, a cause a family member or members and build a plan from there.

00:23:00 [Speaker Changed] Huh. Really, really quite interesting. So, since you’ve joined Morgan Stanley, and I’m gonna assume this isn’t a coincidence, their focus has increasingly been on the wealth management side of the business, which was a big change to the 1990s and the two thousands. Tell us a little bit about why and how this focus shifted and what your role is in that.

00:23:25 [Speaker Changed] Sure. So look, I, I think, you know, this is, I think history is going to be extraordinarily kind to James Gorman. I, I think James, I I feel so extraordinarily lucky to have served in the firm while he was the CEOI think, you know, strategically, you know, back during the financial crisis, he developed a vision. And that vision was, I believe that the wealth management business is a growth oriented business. I believe it needs scale. And I believe that when combined with a more cyclical market space, businesses or the, the, the banking based businesses can add ballast and create shareholder value. And I think that he embraced that vision. And that vision had kind of three chapters to it. The first was, you know, let’s buy Smith Barney and get physical scale, right? Just the physical scale of a large number of advisors. Let’s invest aggressively in technology to, to support those advisors.

00:24:32 I think the, the second part of that growth was to say, let’s transform how we serve our clients and the client segments that we serve. And they started to explore these other acquisitions. First the acquisitions of these stock plan businesses, which are essentially tech businesses, tech platform businesses, but would allow us to go from acquiring clients one at a time to in groups. And then, you know, the last piece of the strategy was really, you know, let’s, let’s go after E-Trade and Eaton Vance and acquire those. And then we’ll have the machinery so that you can, you know, acquire clients at, at the early stages of their life cycle, allow them to be self-directed and ultimately graduate to advice so that your financial advisors actually constantly have a source of new clients, of new wealth clients. That they don’t have to be at the country club every single weekend.

00:25:36 [Speaker Changed] So, so what you’re describing is you’re starting with clients that have no minimum and they’re self-directed at E-Trade. I don’t mean this in a, a negative way. They sort of move up or graduate to a little more advice, full service. They want a financial plan, they want some advice, they want to think about whether it’s saving for a home or college or, or retirement. And then the next step up seems to be full on wealth management, where you’re dealing with philanthropy, generational wealth transfer, a lot of bells and whistles including estate planning tax. You guys offer the full suite of services.

00:26:17 [Speaker Changed] Absolutely. And, and I think one of the things that a lot of folks don’t know about us is we’re the 800 pound gorilla in actually offering alternatives to private wealth clients. You know, we are larger than some of our well-known competitors by a factor. And so what that means is we’re now in a position where literally about 80% of the alternatives that I would show you as a client are either, you know, first look, meaning we’re getting the first look or, or best price by a lot.

00:26:52 [Speaker Changed] So it’s funny because you, you mentioned Gorman taking over from his predecessor Yeah,

00:26:58 [Speaker Changed] John Mack.

00:26:59 [Speaker Changed] John Mack, who I’ve had on the show who was just delightful. But the Mack era of Morgan Stanley seemed to have more successfully navigated the financial crisis than many of their competitors. And part of me can’t help but feel that coming out of the crisis in better shape than so many others really allowed Morgan Stanley to blow up over the next 15 when, when everybody else had blown up during the financial crisis in the bad way. They really bulked up in the good way following that. Is, is that a fair assessment? That

00:27:36 [Speaker Changed] That is a fair assessment, Barry? I I think I look at it in a very particular way, a host of, of our competitors were forced, quote unquote into the arms of the big banks, right? So the, the B of a Merrill situation, right. And had

00:27:55 [Speaker Changed] Bear Sterns, 00:27:57 [Speaker Changed] JP

00:27:57 [Speaker Changed] Morgan

00:27:57 [Speaker Changed] Chase. Exactly. You had, you had, you know, Citi had to make choices around Smith Barney. It was very, very hard what, what Mack and James Gorman did to rescue Morgan Stanley. And literally they talk about it as an overnight rescue where half the employees were packing the boxes just like everybody else. And the other half were, were on the phone with colleagues in Japan. And as you may recall, what saved Morgan Stanley was a huge equity infusion from MUFG, from Mitsubishi Right. Financial group. And what was wonderful about that is not only was it premised on a, a fantastic, you know, partnership, but it was an arms length partnership that allowed the business to be rescued but not devoured. Right. And I think that for some of our competitors who were suddenly during the great financial crisis inside, you know, systemically important banks, their needs, right? Just by sheer dent of size got squashed a little bit because the bank obviously had, you know, the CEOs of, of Citi, the CEO of chase, the CEO at wells, the CEO at B of a, you know, they’re sitting there with the Fed and, and and SEC every five minutes. Now, I’m not saying Morgan Stanley wasn’t at those meetings, but the stakes were different because we weren’t a commercial bank with a balance sheet the size that those guys had.

00:29:29 [Speaker Changed] But even more importantly is you’re at Alliance Bernstein, Bernstein gives up control in the merger you’re at Merrill, Merrill gives up control in the merger, third time’s a charm when you end up at Morgan Stanley Mitsubishi had a substantial stake, but they didn’t take a controlling stake. And the local US based management were able to continue making the choices they made. I, I have to think that was just a giant home run investment for MUFG that has to be just a giant winner for them. It

00:30:02 [Speaker Changed] 100%. And I, and you know, I think if, again, if you go back and look at it, you know, where where are the Morgan Stanley stock bottomed and, and where we are today. I, like I said, I think the history books are going to be quite kind to Mr. Gorman.

00:30:19 [Speaker Changed] And, you know, you, you talked about some of the acquisitions, Smith Barney, Eaton Vance, I’m trying to remember the direct indexer you bought. I didn’t know if it came through Eaton Vance.

00:30:31 [Speaker Changed] Yes.

00:30:31 [Speaker Changed] Was that parametric? Am I ing

00:30:33 [Speaker Changed] That correctly? Yes. So, yeah, so fantastic memory, Barry, because that has been transformational as you know, indexing tax management, direct indexing, or the ability to customize our, you know, all demands and, and it’s a tech, it’s a very tech heavy business. So parametric was buried inside of Eaton Vance. It is, you know, definitely diamonds in the rough that we got. And now is a, is a key capability offering within the, within the suite of products.

00:31:05 [Speaker Changed] Huh. Real, really fascinating. So let’s talk a little bit about what’s going on these days. And I wanna start with a quote of yours that I really like. We’re all long-term investors until the market goes down and we’re recording this in the midst of a pretty healthy sell off in, in February and and March, especially now that the new North American tariffs seem to be taking place. Tell us what, why do we give up our long-term perspectives once the market starts heading south?

00:31:40 [Speaker Changed] So there’s the emotions and then there’s the math, right? So what I always say is that, you know what the Nobel Prize winners and behavioral economics will tell you is that emotionally losses hurt four to five times more than gains satisfy. And that’s actually intuitively appropriate because typically our wealth we feel has taken blood, sweat, and tears to acquire or accumulate. And when we experience a loss, right, a 50% loss can happen right? In a very short period of time. But to round trip and recover our high watermark, we’ve gotta be up a hundred percent, right? Right. Which may take us twice to three times as long. And so the math is asymmetric, the emotions are asymmetric and fear as we know, just the same way when things are running hard and you feel like you’ve got the FOMO and the missing out, it’s greed when you know there’s a lot of red on the screen, people are, you know, your stomach’s, you know, totally seizing up. And it’s about fear. I don’t wanna experience loss. I don’t wanna have to make a decision of what do I do here.

00:32:59 [Speaker Changed] Yeah. The asymmetries are really fascinating. I am not a fan of Vegas or casinos, but I go there as a sociologist and I always find it amusing that right off the casino floor is a big, beautiful jewelry store filled with lots of expensive watches and ’cause those gains, it’s house money, it’s ephemeral, but losses are an existential thread. Correct. It really feels like the world is coming to an end. Exactly. Forget down 50%, right? We’re recording this five, six, 7% off the highs and people are talking like it’s the end of the world. Let, let’s talk about another one of your quotes that kind of caught my eye, which was discussing the great normalization. What, what is the great normalization?

00:33:45 [Speaker Changed] So, you know, we’ve been trying to remind clients how extraordinary in financial history the past 15 years have been since the great financial crisis. We’ve had an unprecedented level of Federal reserve involvement. We’ve had markets that have been buttressed by the Federal Reserve balance sheet that have been buttressed by a disproportionate amount of time having financial repression or low rates, rates being held down. We’ve had gone through the, the Covid crisis, which stimulated unprecedented fiscal stimulus as a share of GDP and performance, what clients have actually experienced, if you go back to March of 2009, right? And you, and I remember March of 2009, the bottom, we were probably looking at an s and p 500 that was trading in the mid 606 6 6.

00:34:49 [Speaker Changed] I remember the devil’s bottom. The devil’s

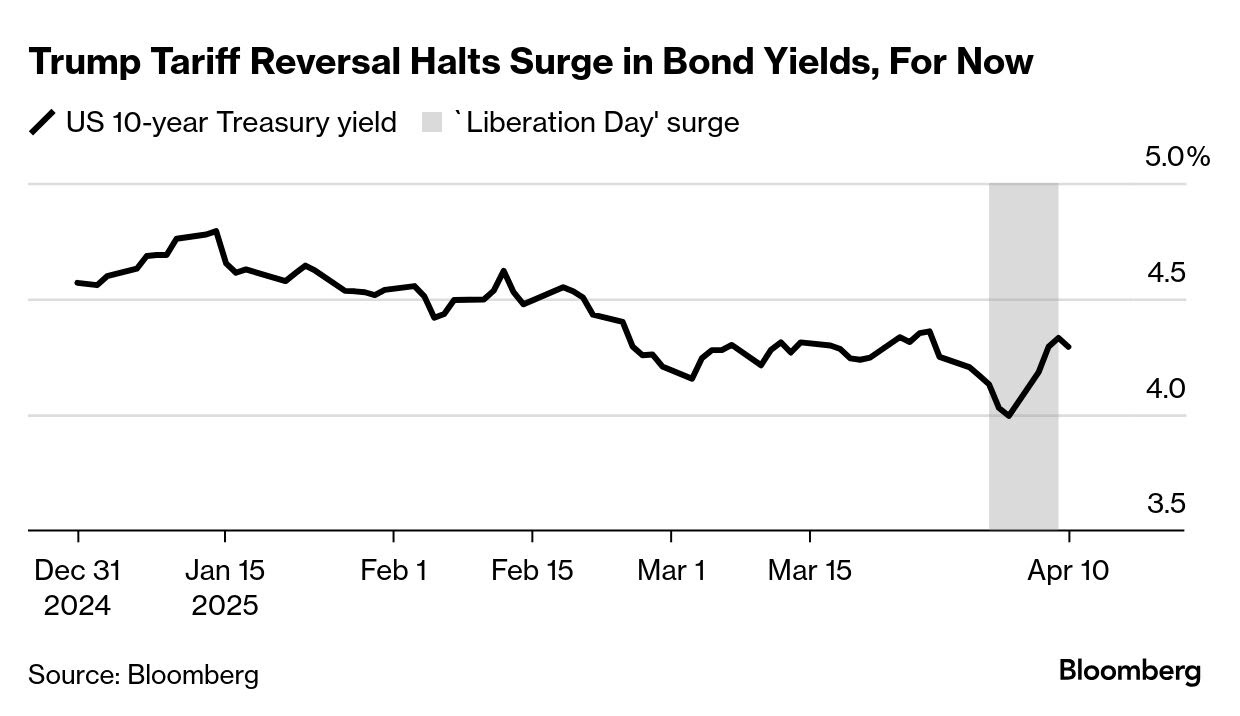

00:34:51 [Speaker Changed] Absolutely devil’s bottom. And look at where we are now even though we’re off, we’re still up during that time. Nine x right. Nine x over 15 years. So I tell people what, let’s put this in perspective, what that kind of mathematically translates to as we’ve, for 15 years, we’ve compounded at about 15% per year. So that’s two times normal for a business cycle. Let’s call it a, you know, where we had two very short recessions, two back to back, very long business cycles, not normal. Right. What was also not normal is during that time, the degree to which US exceptionalism and the US outperformed the rest of the world. I mean, we were outperforming every year, year in year out by 600, 700 basis points per year. And so when we, you know, kind of came into January of 2025, we were starting to talk to folks about, look at where the dollar is versus virtually every other currency super strong.

00:35:56 Look at the share of US equities versus the rest of the world. We’re 10% of the world’s population were 25% of the world’s GDP or 33% of, of global corporate profits. But we were 67% of all stock market cap. Just extreme. And so what we were starting to talk to clients about is, look, this is an extraordinary amount of large s and a lot of it has come from fed accommodation from stimulus. Now we’re on the other side of that. We have a very robust economy. We’ve re levered the economy, if you will, where the leverage of the private sector, the household sector, the corporate sector that got us into the great financial crisis that’s been healed. Right. We have households that can still carry, for the most part they’re interest burdens very,

00:36:52 [Speaker Changed] Very low historically. Right? Right. It’s not the total debt, it’s the debt relative to discretionary income

00:36:58 [Speaker Changed] That matters. Exactly. Exactly. Corporations that still have an extraordinarily relative low locked in cost to capital. And what’s become re levered is the federal balance sheet and the government balance sheet. And now here we are, and every couple of decades we have to go through these periods where there’s heat in the economy and inflation is one manifestation of the heat. Real growth and investment is another manifestation of the heat. But the other manifestation is you probably have overdone it on the stimulus and you gotta pull it back and there’s gonna be some pain. So when we talk about normalization, we say, look, we’re not going back to 2% interest rates. Right. Normal cost of capital in an, in an economy like Americas that has real fundamental growth of 2% and real inflation or experienced inflation of two and a half to three, which is what we’ve had for the last 80 years.

00:37:58 Right? Right. Not 2% target that the Fed says. Right. What that tells you is that long-term rates used to be normal at five to 6%. Right. That’s not crazy. Right. And yet the market continued to sell at a 22 times forward multiple. So what we’ve been saying is part of the great normalization is over the next couple of years, we think long rates start to move towards five to 6%. Like they were in the aughts in the two thousands and in the nineties. Right. And multiples start mean reverting a little bit to 17. And that’s the great normalization your earnings actually start growing into those multiples.

00:38:40 [Speaker Changed] You mentioned the 2% target of the Federal Reserve. Did you work with Roger Ferguson when he was at Merrill?

00:38:47 [Speaker Changed] No, I did not. But

00:38:48 [Speaker Changed] He eventually became vice chairman Yes. Of the Federal Reserve. Yes. And put out this delightful research piece that said the 2% inflation target comes from a New Zealand television show in the 1980s. And it has nothing whatsoever to do with the modern economy. I’m to this day, I delighted by that. And I don’t understand why the Federal Reserve continues to be so locked in on 2%, which we had in the 2010s when Yes. Deflation was the risk. Correct. Correct. Now that we’ve moved from a monetary regime to a fiscal regime, fiscal

00:39:24 [Speaker Changed] Regime,

00:39:25 [Speaker Changed] 3% seems to make more sense. And we’re there, we’re there, I don’t know why they’re stuck on that. I think they’re just afraid of, of making mistake again, part of the normalization that hey, the fed’s a little behind the curve with what’s going on in the rest of the economy.

00:39:43 [Speaker Changed] No, exactly. And and I think one of the things that, that has the market having to adjust is this idea of a data-driven fed. Right. In a world where the fed’s the only headline and the Fed is giving forward guidance, it’s really easy to have low vol and for everyone to just ride momentum. But in a normal world where the Fed has to respond to economic data, you and I know economic data is a manifestation of human behavior. It’s volatile. Right? So the Fed is gonna be more volatile. Policy is going to be more volatile. It means your interest rate curve. Your yield curve needs to have some term premium in it. Remember that. And, and that’s part of the great normalization. I, you know, I, I do do the math when I, when I do some of my, my chats with the younger folks on the, on the team and I say, okay, real growth inflation term premium, you see this thing, it’s been zero or negative for the last 15 years. That’s not normal.

00:40:51 [Speaker Changed] So wait, you’re, you’re saying the 30 year bond should pay a higher yield than the 10 year bond Exactly.

00:40:56 [Speaker Changed] And higher

00:40:56 [Speaker Changed] Than the

00:40:57 [Speaker Changed] Two year. Yes. I’m not familiar with exactly. It’s been

00:41:00 [Speaker Changed] Opposite for so long.

00:41:02 [Speaker Changed] It’s so hard.

00:41:02 [Speaker Changed] Exactly. So, so another quote of yours, which I assume is related to this is the era of set it and forget it is over. Yes. Is that what we’re saying here?

00:41:13 [Speaker Changed] Yes, exactly. So, you know, what comes out of this idea of the great normalization is it’s also an era where we can’t just passively close our eyes, buy the s and p 500 market cap weighted index and go to bed. It was a great 15 year run. But our view is that as cost of capital readjusts as it’s actually a positive number, this is where the skill of corporate management starts to differentiate winners and losers. And we move back to a world, right? And you and I grew up in this world that, that that fun world where you’re actually stock picking, where the research that individual fundamental analysts were doing mattered. And you had to say, Hey, these guys are gonna win. ’cause these management teams are taking strategies that can work and these management teams are dropping the ball.

00:42:09 [Speaker Changed] Huh. Really, really super interesting. Given all of these changes that we’re witnessing, and again, this is something else you’ve written about. How do you separate the signal from the noise? What’s your process for filtering out what’s just na noisy data that’s within the margin of error or, or just slightly beyond and genuine important market information.

00:42:35 [Speaker Changed] So this is the art, right? This is the art of all of it is separating the noise and the signal. For us, the signal is always operates ultimately on just two axes, is what’s really going on in terms of the rate of change in growth and what is going on in terms of the rate of change of inflation. Because the rate of change of inflation is gonna give you an indication of policy bias, of rate bias. And if you can focus on those two things and every single piece of data you get, you say, what does this mean for growth? What does this mean for inflation? You can, you can try to keep yourself sane at night.

00:43:12 [Speaker Changed] Huh. So I’m curious as to, February was a a a tough month. We’ve seen volatility spike now up to 23 or so, I haven’t even looked at it today with markets off a couple of percent. The questions you’re getting from clients, what are you hearing, what are you hearing about tariffs, about the post-election regime change, about what’s going on in geopolitics? What’s lighting your phone up and, and what are you telling these folks?

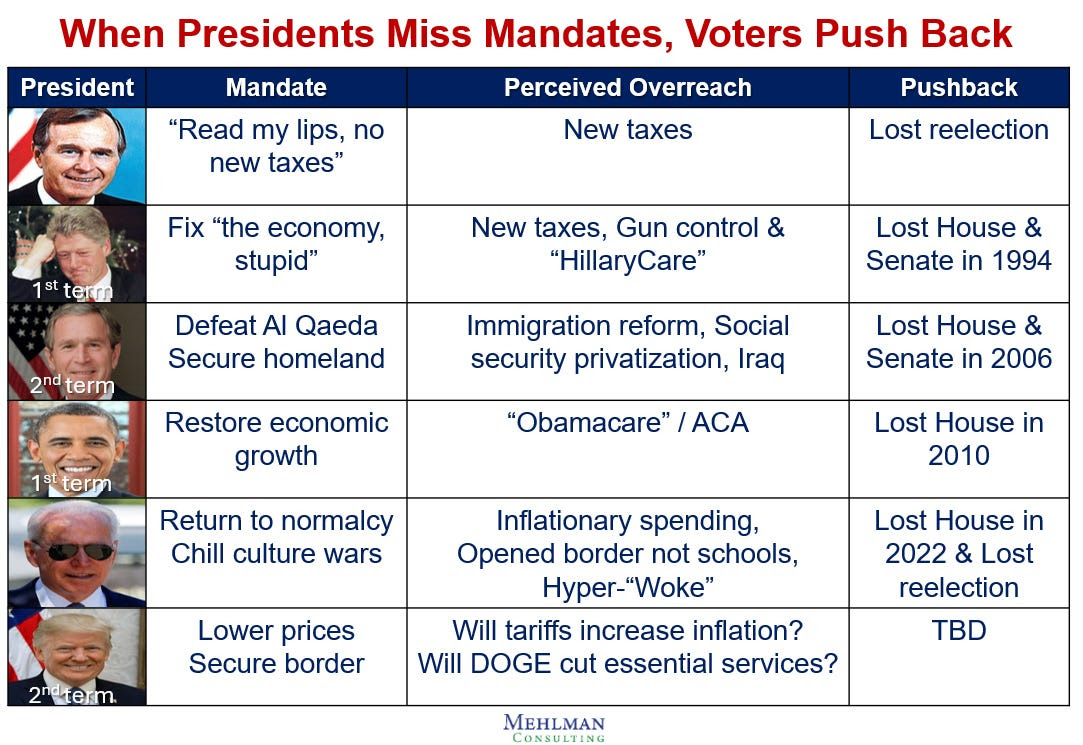

00:43:43 [Speaker Changed] You know, obviously we would love to spend the bulk of our time talking about asset allocation as it as it corresponds to growth and inflation. Unfortunately. Exactly. To your point, Barry, we’re spending a disproportionate amount of time out of our comfort zone being asked to respond to our understanding and our expectations for the economic impacts of policy. And what has complicated things, as you know, is that this administration has chosen to implement policy fast and furious and in many cases, quote unquote in parallel, right? I I think that, you know, coming off of the election, coming off of the campaign season, a lot of us were trying, you know, to build models based on, well they’re gonna sequence things, right? They’re gonna, you know, deliver some of the bad news early and then, you know, the candy will come at the end. I think what we’re experiencing, especially after the last 15 years of this kind of one or two note market, right? Where it’s been, what is the Fed saying, oh, generative AI looks like good headlines to 17 headlines a day of policy,

00:45:02 [Speaker Changed] Flood the zone,

00:45:02 [Speaker Changed] Flood the zone. So clients are asking for certainty, they’re asking for clarity, and it’s hard, I’m gonna be honest with you. So look, we are in the camp, and this is a pure economic view. I, i, I hope I’m not gonna be accused of, of being political. Pure economists will tell you that tariffs, particularly if implemented over long periods of time, and to the extent that they cause trade war or reciprocity, tend to be destructive to total global trade in aggregate, tend to be a one-time inflationary problem and tend, you know, to, to, to really, you know, kind of hurt the efficiency of markets. And so I think we’re seeing some of that. I think it’s very hard for CEOs and CFOs today to be making decisions, not knowing what the policy duration is gonna be. It’s one thing to have a policy and say, okay, we’re deregulating X or here’s the new tax policy for the next four years. I can work with that. When you tell me we’re having 25% tariffs on lumber, well how long, how much, where, where, how’s it going? You know, I think that’s the big question is, is the inconsistency of it and the questions of, is this a negotiating tactic? What are we negotiating for? How do I model it? That kind of thing.

00:46:30 [Speaker Changed] And you know, it’s really hard to get a handle on this because let’s just look, use Canada and Mexico. The first tariff was floated and then it was quickly resolved and it felt, oh, this is just a negotiating tactic, the effect of the second 25% tariffs on Mexico and Canada and 10% tariffs on China. And it’s, it’s not only surprising that it was done, it’s kind of perplexing. What did, what are we getting out of the tariffs with Canada? When you look at some of the supposed basis for this, the fentanyl that comes into the United States is mostly brought in by US citizens and smugglers. It’s not coming in from either Canadian lumber or oil or televisions that are being built in Mexico and sent over the border. It’s, you know, it’s kind of odd, especially given the North American free trade agreement that was negotiated to replace NAFTA was Trump’s treaty. So the whole thing is kind of, you know, clients don’t like to hear you say, I have no idea what’s going on, and be wary of people who say they do. But it really feels like this is sort of arbitrary and capricious and we don’t really know how this resolves. It’s sort of grit your teeth and write it out. Is, is brace yourself moth or that’s what it feels like. Just hold

00:48:09 [Speaker Changed] On. And, and it, the way I always frame things is I say to people, look what kind of risk premiums are there in the markets when stocks are very expensive as they have been for a while here, it tells you risk premiums are tight, right? Things are, quote unquote price for perfection. When credit spreads are tight, it tells you people are not requiring a premium for fear or default or uncertainty, right? When there are no term premiums in the, in the United States Treasury curve, it’s telling you the same thing. So look, if this were all happening against a backdrop where stocks were selling it 15 times where, you know, we had 800, you know, basis points, spreads in high yield, all this kind of stuff, you and I might be saying, Hey guys, yes, there’s uncertainty, but this is a buying opportunity. Look, you know, things are selling off off of a 15 multiple. Where do you think they’re gonna land at 13? We’re gonna buy here, but we’re not there. Markets hate uncertainty and they really hate uncertainty when things are priced for perfection.

00:49:19 [Speaker Changed] Does, does it give you a lot of room for error? So, so let’s talk about something more positive. AI has been the big story for the past couple of years. Let’s talk a little bit about that and other emerging technologies or innovations you think might impact the investing landscape over the next decade. What are you, what are you looking at?

00:49:40 [Speaker Changed] Yeah, so we’re looking at a, at a lot of things, but look, clearly generative AI is transformative. There’s no doubt about it. I think the conundrum for investors is how do you stay ahead of the revolution itself? And what I mean by that is that, you know, technology innovation tends to, to follow very clear scripts over history. And by that I mean you tend to get the big infrastructure build, then you get the software applications, and then you get mass economy wide deployment. And in that sequence you get new killer apps and, and the quote unquote the winners of that era. I’m not entirely sure that all the winners have been identified with regard to generative ai. And while the magnificent seven are magnificent on many, many, many financial attributes, on many innovation attributes, you know, I I think the market is telling you that maybe they are not the only winners here and that maybe the growth in the infrastructure build doesn’t go on forever.

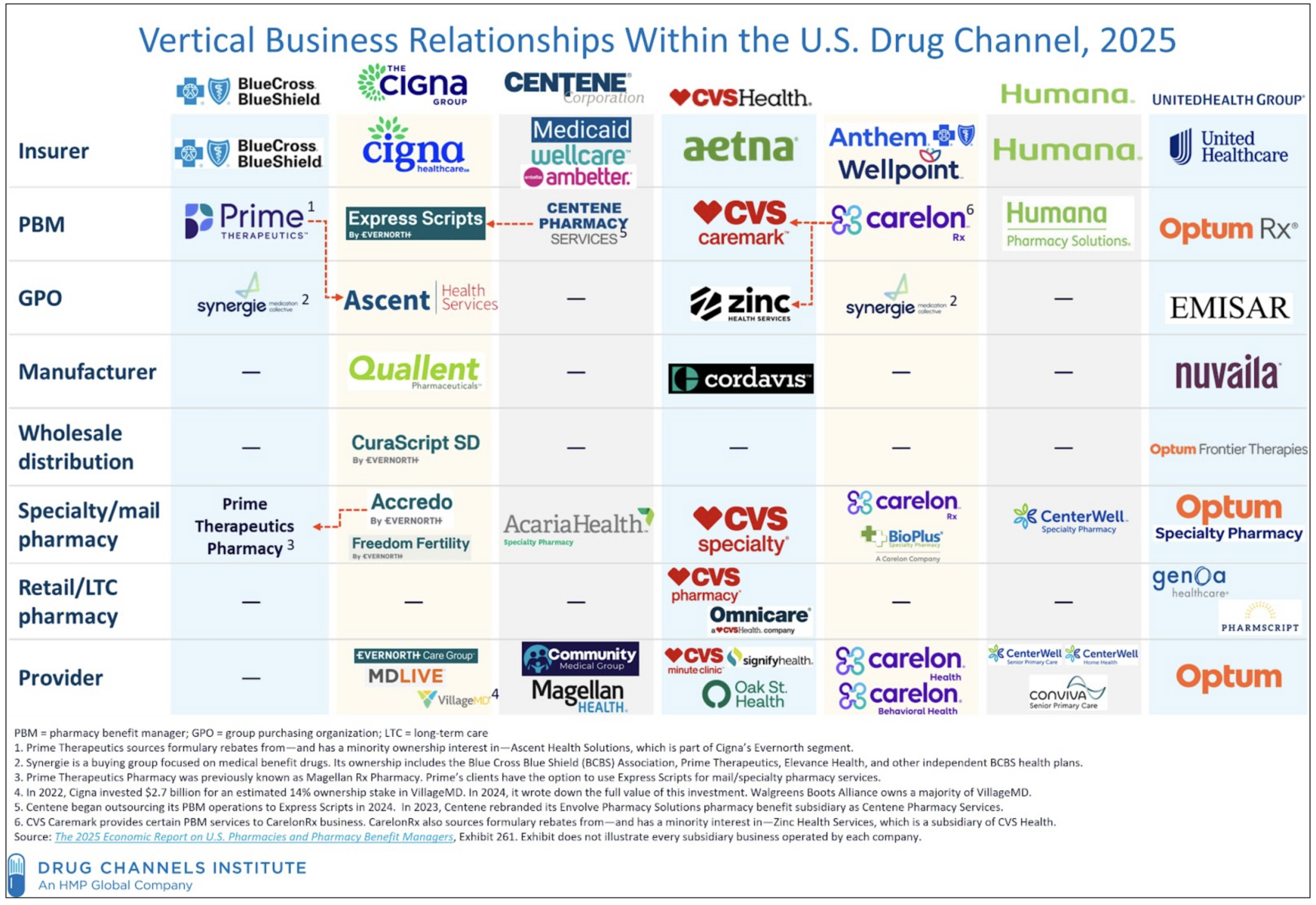

00:50:56 And certainly our experience with the internet validates that. So, you know, what are we super excited about right now? We’re, we’re super excited about some of these AI adopters. We’re looking at areas, whether it’s document recognition, voice recognition, all these various applications, the agents, you know, how we’re gonna deploy AI into learning agents to, to help human beings do things almost become the white collar robot, if you will. I think, you know, that’s all very interesting. But where AI is likely to have some of its most profound impacts is in healthcare. And the, the extent to which we’re going to be able to use large language models just to process data and personalize medicine and personalized diagnostic and solutions treatment plans so much faster.

00:51:55 [Speaker Changed] I saw a fascinating video the other day about AI being used. So when you look at the history of healthcare, it really started out as a little bit of chemistry and then it became biology and then it became genomics. And one of the challenges is trying to figure out how protein folds and how different molecules interact with the body’s receptors and immune system. And it turned out that, like for the prior 50 years, we’ve identified a few thousand different combinations of molecules and protein foldings, which is key to figuring out what the genetic code operates in, in actual life. And so they went from like the library of 2,500 protein folding protocols to using ai identifying like 400,000.

00:52:51 [Speaker Changed] That’s exactly

00:52:51 [Speaker Changed] Like, it’s an insane order magnitude. And we’ve only begun figuring out how do these different proteins work on different parts of the body in response to different diseases, infections, virus. It’s like, it, it’s shocking that these aren’t headlines yet. Yes. They’re just academic research. Yes. But it seems like when people are talking about longevity, it’s not the cold plunge that’s gonna do

00:53:19 [Speaker Changed] It, right?

00:53:20 [Speaker Changed] It’s gonna be all of these half a million new correct. Protein designs. Yeah. Tell us a little bit about the investment opportunities that exist in the healthcare space.

00:53:29 [Speaker Changed] So right now, you know, healthcare is one of the sectors that we have moved overweight, you know, clearly the healthcare sector over the last, you know, decade and much of this bull market in large part’s been left behind. And valuations have been, you know, with the exception of, of some of the obesity drugs, the pharmaceutical industry has been squashed by, by worries about regulations squashed by the power of the insurance companies, you know, squashed by patent, expire, you know, squashed by a lot, a lot of things. But we think that that valuations are there. We think that that’s a great place to invest and, and you can do it obviously through venture and in the public markets. Other themes that we’re super, super excited about are defense and space and the, and the conjoint between those two. You know, the, this idea that ultimately the way we think about weaponry, the way we think about defense will be human less, not unlike, you know, some of what you see in, in the sci-fi movies and Star Wars, unmanned vehicles doing the, the very surgical games of war, if you will. So I think, you know, that’s something we’re super excited about, some of the innovations in the energy space, not so much purely around clean tech or powering data center, but really thinking about how do we more creatively use and reduce dependency on some of these rare earth materials to create battery autonomous vehicles. Another one. So all of these areas, it’s a very, very fascinating time to be an investor in new tech.

00:55:15 [Speaker Changed] Yeah. You, you mentioned autonomous and defense, this giant New York Times article Yeah. Came out about the war in Ukraine and the transition from World War one and two type trench warfare, armored vehicles, tanks. And exactly 70% of the casualties inflicted in the war as of recently are being driven by drones. Drones. It’s absolutely futuristic sci-fi. Yeah. When warfare changes that rapidly, it has to make you raise the question, how do the geopolitical alignments change? How do the,

00:55:53 [Speaker Changed] Here we are, Barry, here we

00:55:54 [Speaker Changed] Are. How do the tech com how do the big defense companies Yep. Like there’s a reason Palantir has been super hot and not necessarily Lockheed Martin or Boeing Correct. It, it’s really quite fascinating. I I have two personal questions Yes. To ask you before we get to our favorite questions. All right. Starting with you wake up every morning at 5 0 7. Yeah. So first, why 5 0 7? It’s such a specific number as opposed to just setting the alarm for five or five 30. And then if you’re up at 5 0 7, give us a day in the life of Morgan Stanley’s Chief Investment

00:56:33 [Speaker Changed] Officer. Oh geez. So I am extraordinarily superstitious about odd numbers.

00:56:39 [Speaker Changed] Really? Yes. 00:56:41 [Speaker Changed] And wait,

00:56:42 [Speaker Changed] You were, you were applied mathematics undergraduate. Yep. That doesn’t,

00:56:47 [Speaker Changed] It’s just, it’s scream a superstition I guess. I guess it’s part of my lived experience is that, you know, I always say, say to people, Hey, it’s an odd number year, we’re good. You know, really? Oh my God. I’m very, I’m very, so I’m,

00:57:01 [Speaker Changed] I’m trying to remember the Nobel Laureate in physics, I’m drawing a blank on his name, who a grad student visited his house and there’s a, a horseshoe over the doorway. Yeah. And the grad student says, professor, you don’t, you don’t believe in, in Lucky Charms and things like that. And the response was, maybe it was plank. I, I’m not sure, but the response was, I’m told it works whether you believe in it or not, which is, which is pretty charming. So, so,

00:57:29 [Speaker Changed] But I believe in it. Odd numbers, I do odd five 00:57:32 [Speaker Changed] Seven is really

00:57:33 [Speaker Changed] Specific, so it’s an odd number. So, so look, it was something, you know, back in the day, one of my jobs was, I was a director of research and so I always had to be at my desk right at six 30. So I got into the routine of, you know, up 5 0 7, you know, do the quick 20 minutes on the treadmill, grab the coffee, shower out the door. And so that’s, you know, still, still me, you know, old dogs, new tricks, right? It’s been, it’s been really hard.

00:57:59 [Speaker Changed] And how different is every day as CIO is like, I like to sometimes ask what’s a day in the life like? But I suspect no two days are the same for you.

00:58:08 [Speaker Changed] No, no. Two days are the same. But, but Barry, let me just tell you, I, I wake up 5 0 7 every day and the very first thing I say is, I am blessed that I have the career that I have, that I have the seat that I have at this point in my life because I am learning every day. No two days are the same. I get to hang out with the most amazing people like you, you know, like my colleagues at Morgan Stanley, like my clients, all of whom are, you know, so, so interesting and successful in different ways. Going to meetings where you get to hear Scott Vasant speak at the New York Economics Club and you know, you’re just really feel alive. You feel plugged into the world and, and what’s going on. So I feel blessed e every day and, and no two days are the same.

00:59:02 [Speaker Changed] So last, last career question. You’ve been watching the state of the economy, the markets, just what’s going on in the world for just about 25, 30 years. What’s been the most significant shift you’ve observed in wealth management over that period?

00:59:22 [Speaker Changed] Wow, that’s a fantastic question. Look, I, I think if there was one theme that I would say over my 30 year career that has characterized everything, it has been the democratization of reasonably sophisticated product, right? So whether, you know, you talk about, you know, first coming into the business and the advent of, you know, first mutual funds was about democratization of, you know, diversified stock investing and then, you know, passive investing as a way to get access to an index in a, you know, more technology efficient way. Or you talk about the original rollout of quote unquote liquid alternatives or evergreen type products. And now we’re at the point where, you know, we’re talking about very sophisticated private equity, private credit products being contemplated for 401k plans, right? And being packaged in, in these structures to give folks periodic liquidity. So democratization of, you know, sophisticated alpha and beta. That, that once upon a time, I think, you know, when I, you know, started in the industry, people would say, well, there’s the market and then there’s the extra stuff and that, and you gotta figure it out. And if you don’t like that, own some bonds. I think now it’s, it’s the, the democratization of very sophisticated access of access to sophisticated products.

01:01:00 [Speaker Changed] So, so let’s jump to my favorite questions that I ask all of my guests, starting with, what are you streaming these days? What are you watching? To relax? Yeah. Or on the treadmill or just to keep you entertained.

01:01:13 [Speaker Changed] Love streaming. The most recent thing I finished was something called shrinking. So good. Yeah. So Apple TVs, so yeah, so good. I’ve been watching Prime Targets.

01:01:23 [Speaker Changed] What are prime targets?

01:01:25 [Speaker Changed] So Prime Target is a show about a mathematician who’s working in Oxford, who is working on a, a thesis to generate prime number combinations and permutations that supposedly if he’s able to develop this algorithm as part of his p PhD thesis would unlock or give folks the ability to hack almost any system. And so of course it becomes a scenario where, you know, there’s the bad guys are chasing him to try to get his, his thing. And of course, you know, the national security agencies are trying, are chasing him, and it’s kind of a spy versus spy kind of thing. And it’s a poor, innocent nerd guy in the middle.

01:02:14 [Speaker Changed] And what is surface or surfacing?

01:02:16 [Speaker Changed] So Surface is a, is a show also on Apple tv. It’s in its second season. It’s about a woman who kind of fakes her death as a way of leaving behind her life and going back to England. She’d been living in the United States she was married to in a marriage that wasn’t great and she fakes her death to go back to England to investigate what she thinks was her mother’s murder. Huh. When she was a kid.

01:02:46 [Speaker Changed] Huh. Really interesting. Let’s talk about your early mentors who helped shape your career.

01:02:51 [Speaker Changed] Sure. You know, Bernstein was that seminal place. So the two I would, I would speak to one, Lou Sanders. Lou Sanders was the CEO at Sanford Bernstein, in my humble opinion, one of the greatest value investors certainly that I ever met in my career. Just brilliant, A numbers person, very, very high integrity, taught me how to be objective, to get the emotions out of it, to build the model and have the discipline to build the model. Sally Crouch, we talked about one of my best friends in the business. You know, someone that I, I care a lot about, someone who showed me how to lead, although we were peers, she has a natural charisma, natural instinct for leading people. She and I kind of worked side by side through the nine 11 crisis. I learned a lot from her in terms of what people need from leaders when things are tough. They, they look to leaders to say the right things and do the right things and be strong people and not get, you know, bogged into headlines or theories. But just to, to say, remember what we are here to do.

01:04:11 [Speaker Changed] Let’s talk about books. What are some of your favorites? What are you reading

01:04:14 [Speaker Changed] Currently? Ah, what am I reading? So now this is gonna reveal my, my politics. The last book I finished was a book called Prequel by Rachel Maddow. And it’s a very,

01:04:26 [Speaker Changed] My wife is in the middle of reading that.

01:04:27 [Speaker Changed] It’s fantastic.

01:04:28 [Speaker Changed] That’s what she said.

01:04:30 [Speaker Changed] It’s captivating and it’s fantastic and it’s captivating and fantastic, not for good reasons, but it lays out some of the dynamics of American history and, and American political dynamics between the warts between World War I and World War ii and the first America first movement in the United States. That was very much against America ever getting into World War ii.

01:05:01 [Speaker Changed] Very isolationist, very anti,

01:05:04 [Speaker Changed] Yes. And it was, and it was in this a way that’s similar to our current political dynamic. It ended up bringing in some very different factions, right? Where you had interestingly, coalitions of people who ended up being a political block, who came at things from very different points of view. So you had kind of the father Coghlan part of the movement. Father Coghlan for those who, who know, was a very, very famous Sunday radio show. Catholic preacher and, and

01:05:38 [Speaker Changed] Pacifist, correct.

01:05:39 [Speaker Changed] Yeah. But, but very isolationist. That was one dimension of it. And then you had, you know, kind of the anti-communist and the anti-immigrant sides of the party and, and some other, other dimensions to it. But it’s a fascinating book. Prequel, Rachel Maddow, really recommend it.

01:05:58 [Speaker Changed] Our final two questions. What sort of advice would you give to a recent college grad interested in a career in either wealth management or finance or anything related to your work?

01:06:11 [Speaker Changed] Yeah, so, and people hate when, when I say this ’cause it belies the, the path that I took. But I, I am a big believer in liberal arts education. I don’t think that to work on Wall Street to be a great portfolio manager, to be a great, you know, economist, to be a great strategist that you have to study finance or business administration or go to the Wharton School of Business. I do not believe that. I believe we live in a world where if you know how to read books, if you know how to teach yourself things, if you know how to learn how to learn, you can have a phenomenal career. And, and it’s exactly to your point, Barry, that you and I, you know, entered the business 25, 30 years ago. Nothing’s the same. It’s all about adapting. And so if I, I, I tell folks, study what you love. Study what you’re passionate about. Learn how to learn and never lose that hunger for knowledge.

01:07:12 [Speaker Changed] Be become an autodidact. Learn how to learn, learn how to, what’s going on. Our final question, what do you know about the world of investing today that you wish you knew 30 years ago when you were first getting started? And I don’t mean by Amazon at two and Apple at one. I mean, what broad principle did you learn along the way that would’ve been useful to have found out much earlier?

01:07:37 [Speaker Changed] That being right is not what matters. I,

01:07:40 [Speaker Changed] You’re gonna have to expound on that.

01:07:42 [Speaker Changed] Being right is not what matters. What what matters in the long run is what Einstein said, you know, decades ago, remember the power of compounding, if you save, if you’re disciplined, if you just have a consistent plan, you will highly likely compound your wealth at at least 7.5 to 8% per year. Which means you will double your wealth every decade, double your savings, whatever that is. For most of us, if we’re lucky enough, we have, you know, three, four doublings in us. Just do that. And it’s not to say that what I do all day doesn’t matter, or what you do all day doesn’t matter. It’s just at the end of the day, we’re trying to guide people. But as I say to my team, I know the likelihood I’m gonna be right on any given decision is at best 50 50. What matters is do we have a good plan and are we being disciplined and consistent about it? ’cause compounding is your friend.

01:08:50 [Speaker Changed] Really fascinating stuff. Lisa, thank you for being so generous with your time. We have been speaking with Lisa Shallot. She is Chief Investment Officer at Morgan Stanley Wealth Management. If you enjoy this conversation, check out any of the 500 previous discussions we’ve had over the past 10 years. You can find those at iTunes, Spotify, YouTube, wherever you find your favorite podcast. Be sure to check out my new book, how Not to Invest the Ideas, numbers, and Behaviors that Destroy Wealth Out everywhere. March 18th. I would be remiss if I did not thank the crack team that helps put these conversations together each week. Andrew Gavin is my audio engineer. Anna Luke is my producer. Sage Bauman is the head of podcasts here at Bloomberg. Sean Russo is my researcher. I’m Barry ols. You’ve been listening to Masters in Business on Bloomberg Radio.

~~~

The post Transcript: Lisa Shalett, CIO Morgan Stanley appeared first on The Big Picture.

Recent comments