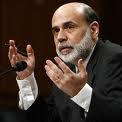

Federal Reserve Chair Ben Bernanke gave testimony before the Joint Economic Committee and the doves fell from the sky. Bernanke cut short Wall Street's addict like demand for more quantitative easing and instead suggested a host of policies to boost hiring and real economic output.

Federal Reserve Chair Ben Bernanke gave testimony before the Joint Economic Committee and the doves fell from the sky. Bernanke cut short Wall Street's addict like demand for more quantitative easing and instead suggested a host of policies to boost hiring and real economic output.

On the labor markets, Bernanke's testimony validated our analysis, that one cannot blame the pathetic jobs market on the weather.

More-rapid gains in economic activity will be required to achieve significant further improvement in labor market conditions.

In fact, Bernanke suggested the next FOMC meeting discussion question will ask: Will there be enough growth going forward to make material progress on the unemployment rate? This is good, Bernanke realizes the #1 threat to the U.S. economy is the jobs crisis.

The Fed Chair also warned on the ongoing sovereign debt crisis in the Eurozone:

Recent comments