The Consumer Price Index for November 2009 rose 0.4%.

The reason was energy (gasoline, home heating oil (9%), electricity, gas) rose 4.1%.

Shelter dropped -0.2% while used cars increased 6%.

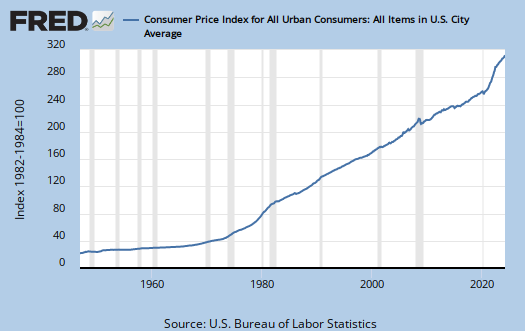

From the above graph, one can see what the oil futures bubble did to the U.S. economy in 2008 and the U.S. surely cannot afford another event like a critical commodity speculative bubble.

Calculated Risk believes the falling rents will keep consumer inflation low and also put pressure on home prices.

I think I read yesterday on Bloomberg

that CPI increase was also due to medical care. Medical care!

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Medical care

Next time round I'll look into weights for the index but yeah, one can do a "rocket slope" of medical costs, insurance premiums by itself. That's why I stopped monitoring health care "reform" because the minute they gave in to the insurance lobby I knew the real thing, which is costs, isn't going to come down. We are plain captured and getting ripped off and also the system is beyond inefficient.

Like I have to call to communicate with my Doctor. No email, no text (and these are for non-emergency type things).

So, I go on hold for 15 minutes through a huge obnoxious voice menu, then I have to talk to some intake person, who then takes forever to write down the message of what I'm talking to ask about, who then hands it to the physician's assistant, who then asks the Doctor about it, who them must interpret what I asked about through 2 different people's interpretation and then decide what to do or to call me...which is another 10 minutes of me explaining what I said earlier.

Just one minor example but it's so inefficient and these sorts of things which don't cost a dime....

not getting fixed. I have insurance which I can get "mental health treatment" acupuncture, chiropractic visits...

but when it comes to lab work, tests, oops, that's assigned to the deductible. It's insane, that's the #1 tool Doctors need for early detection and they have it set up so of course people will avoid diagnostic/maintenance tests because they are out of pocket....yet I can go waste thousands on nebulous treatments like a glorified back rub, which in many cases show no results and can even be caused by an underlying untreated medical condition.

i.e. at every turn in the U.S. system one can find gross inefficiencies and stupidity.

Now the Senate just gives a mega gift to the insurance industry which is going to cost the middle class like 20% of their net pay and they are just making it mandatory to pay these sharks. They need to kill the bill and start over and put together something that makes sense....

but D.C. won't kick out the lobbyists.

Today you post 3 graphs

Today you post 3 graphs describing price changes. And, they are all going up.

On 12/15 your posting “PPI for November 2009”, you presented 4 graphs describing price changes. And, they are all going up.

Nevertheless in your 12/15 posting you concluded: “…one can see inflation is still really at bay.” So I guess those 7 up trend lines fall into the category of “My lying eyes”?

Your eyes do not lie

but...if you notice the time of the graphs. That's for the start of this recession and we had a major deflationary period.

If I expanded the timeline, which I guess I should next time I write these up to go back 10 years, you'll see this deflationary period more in context.

So, those upward trends more (at the moment) show we're pretty much out of a deflationary period.

Then, in terms of "inflation at bay", I guess I should say "for the short term".

The main reason I think this is because this month, which these EIs haven't captured yet, oil futures tanked.

That's going to bring down the cost of energy soon.

Here is CPI for 2000 to present:

and here is PPI from 2000 to present:

Next time I do these I'll look into how weighted is energy, for to me, the oil futures bubble pop, which last I looked into was being manipulated by speculators, never taking possession of the actual physical commodity, has a lot to do with the deflation we've just witnessed.

Housing is weighted heavily in the CPI too. (big chunk of your paycheck why it's weighted for CPI is cost of living for Urban consumers).

Weak Dollar.

Don't forget that the USD has been pummeled throughout the fall. Everything consumers buy that is imported and/or oil related is looking relatively more expensive. We are starting to see some global risk aversion due to Dubai/Greece/Spain/et al. The USD has strengthened dramatically just in the past 2/3 days. The USD carry trade will start to unwind fairly soon I would think, which will really send the USD rebounding. This could get messy in the not too distant future.

unwind anytime soon?

You see the details of the Federal Reserve Minutes?

I don't think so from their free money position, although the strengthening of the dollar is happening right now because of Greece imploding and major concern of a domino effect.

I got burnt by this the first time round. I had assumed with so much debt the dollar would deflate and didn't get "safe haven" still with dollars. i.e. my gold play didn't pan out (yes this little silly metaphor is intended).

Poor choice of words.

I should have said that dollar carry trade will collapse in the not too distant future. A lot of forecasters are looking for the Fed to increase their rate by August, 2010. Thereby, they see an unwind coming in the Spring of 2010, probably May.

OTH, there are numerous articles warning against the dangers of this extended ZIRP policy by the Fed. Here's one from Bloomberg today. The USD carry trade has encouraged excessive "investment" in emerging markets that are maintaining high interest rates. In other words, it is creating new investment bubbles in those countries.

I just get the feeling that everything the Fed and Treasury have been attempting for the past 14/15 months is tantamount to defying the laws of nature. And every schoolboy knows that you fon't duck with Mother Nature!

carry trade joy ride

over at econompicdata.

Herd behavior too.....oh the profits are in EEs (emerging economies), run, invest there and fund it with dollars (come on everybody!) oops, Greece is collapsing, run away, run back to the dollar (come on everybody!) Yo-yo critical commodities. Real Economy on investments that are in the national interest and plan make sense....nowhere. Middle class? Squeezed as usual.