The Mortgage Monitor for February (pdf) from Black Knight Financial Services (BKFS, formerly LPS) reported that there were 655,311 home mortgages, or 1.30% of all mortgages outstanding, remaining in the foreclosure process at the end of February, which was down from 659,237, which was also 1.30% of all active loans, that were in foreclosure at the end of January, and down from 1.72% of all mortgages that were in foreclosure in February of last year. These are homeowners who had a foreclosure notice served but whose homes had not yet been seized, and the February "foreclosure inventory" remains at the lowest percentage of homes that were in the foreclosure process since the fall of 2007. New foreclosure starts, which have been volatile from month to month, rose to 84,305 in February from 71,900 in January and from 77,208 in February a year ago. That was the highest number of new foreclosures in any month since March 2015, when 92,164 were foreclosed on. Over the past year, the average of new foreclosure starts monthly remains at a level about one-third higher than the average number of new foreclosures we saw monthly in the precrisis year of 2005...

In addition to homes in foreclosure, BKFS data also showed that 2,251,899 mortgages, or 4.45% of all mortgage loans, or were at least one mortgage payment overdue but not in foreclosure at the end of February, down from the 5.09% of homeowners with a mortgage who were more than 30 days behind in January, and down from the mortgage delinquency rate of 5.30% in February a year earlier. Of those who were delinquent in February, 772,441 home owners, or 1.53% of those with a mortgage, were more than 90 days behind on mortgage payments, but still not in foreclosure at the end of the month, which was also down from 831,284 such "seriously delinquent" mortgages in January. Combining the total delinquent mortgages with those in foreclosure, we find that a total of 2,907,210 mortgage loans, or 5.75% of homeowners with a mortgage, were either late in paying or in foreclosure at the end of February, and that 2.82% of all homeowners were in serious trouble, ie, either "seriously delinquent" or already in foreclosure at month end.

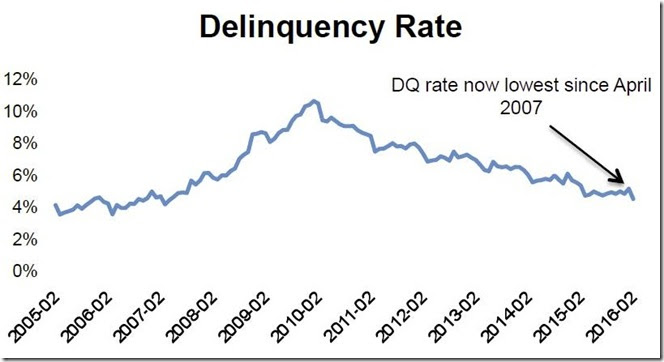

The first graph below, from page 5 of the Mortgage Monitor, show the mortgage delinquency rate, or the percentage of mortgages at least one mortgage payment overdue but not in foreclosure, at the end of each month since the beginning of 2005. As noted on the graph, at 4.45%, the national mortgage delinquency rate is now at the lowest its been since April 2007. That's down by much more than half from January 2010, when 10.57% of all mortgages nationally that weren't yet in foreclosure were behind by at least one house payment. Before the mortgage crisis, the delinquency rate was generally in a range between 3.75% and 4.25%, with the seasonal highs typically in December...

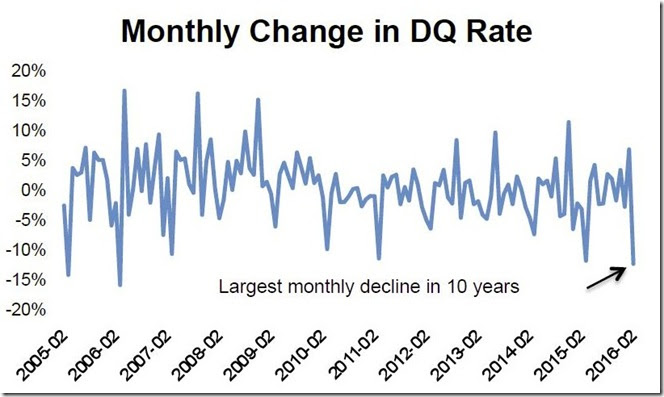

The next graph, also from page 5 of the Mortgage Monitor, shows the monthly percentage change in the mortgage delinquency rate over that same span. As they note on the chart, the 12.57% decrease in mortgage delinquencies we saw in this February report was the largest monthly drop in mortgage delinquencies in 10 years, percentage wise. What they don't note is that followed a 6.62% increase in mortgage delinquencies in January, the first time that mortgage delinquencies had increased in January in at least 5 years, and possibly the largest increase in any January, a month when mortgage delinquencies normally fall, as homeowners catch up on their overdue bills after Christmas spending. What appears to have caused both aberrations was that January 31st fell on a Sunday, and hence mortgage payment checks that would have arrived January 30th or the 31st were not processed on the weekend, leaving those mortgages technically delinquent at the end of January. That "check in the mail" scenario did not repeat in February, however, since the 29th fell on a Monday, and as a result of having two checks processed during the month, those January delinquent mortgages thus "cured" in February, resulting in the near record drop in the delinquency rate..

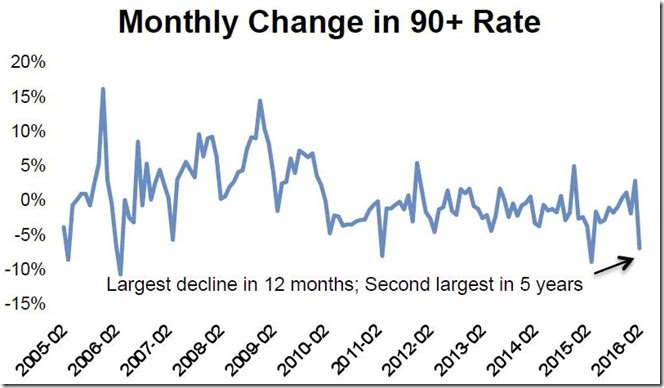

The next graph, also from page 5 of the Mortgage Monitor, shows the monthly percentage change in the serious delinquency rate over the same period, beginning in 2005. As we noted earlier, the number of seriously delinquent mortgages had dropped from 831,284 in January to 772,441 in February, a 7.1% drop, which BKFS notes on the graph was the largest drop in serious delinquencies in 12 months and the 2nd largest drop in 5 years. But once again, that had followed a 2.9% spike in serious delinquencies in January, again at a time of year when such serious delinquencies are normally falling. Taking January and February together, the drop in both the simple delinquencies and the more serious ones was not outside the range of the normal drop in delinquencies that would usually occur over the first two months of the year.

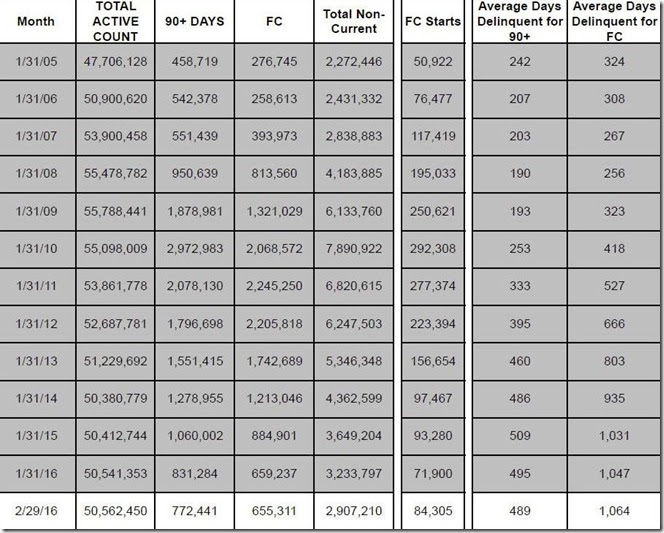

Finally, we're including below that part of the Mortgage Monitor table showing the monthly count of active home mortgage loans and their delinquency status, which comes from the bottom part of page 16 of the pdf, even though the 2015 data has now been cycled off this month (for monthly 2015 data, see here). The columns in the table below show the total active mortgage loan count nationally for each month shown, number of mortgages that were delinquent by more than 90 days but not yet in foreclosure, the monthly count of those mortgages that are in the foreclosure process (FC), the total non-current mortgages, including those that just missed one or two payments, and then the number of foreclosure starts for each January shown going back to January 2005. In the last two columns, we see the average length of time that those who have been more than 90 days delinquent have remained in their homes without foreclosure, and then the average number of days those in foreclosure have been stuck in that process because of the lengthy foreclosure pipelines. The average length of delinquency for those who have been more than 90 days delinquent without foreclosure has fallen from the April 2015 record of 536 days and is now at 489 days, while the average time for those who’ve been in foreclosure without a resolution has increased again and at 1064 days has now topped the record high last set in November. That means that the average homeowner who is in foreclosure now has been there nearly three years, which, considering that new foreclosure starts are less than 30 days old, suggests that many foreclosures started early in the crisis are still not yet completed.

(Note: the above was excerpted from my weekly coverage at Marketwatch 666)

Recent comments