This week's oil data for the week ending February 10th from the US Energy Information Administration showed that our imports of crude oil fell back from last week's 4 year high but still remained elevated, while our refining of that oil fell for the 5th week in a row to the second lowest rate in a year, and as a result there was another large surplus of crude that was added to our oil supplies, which were thus boosted to an all time high. Our imports of crude oil fell by an average of 881,000 barrels per day to an average of 8,491,000 barrels per day during the week, while at the same time our exports of crude oil rose by 459,000 barrels per day to an average of 1,026,000 barrels per day, which meant that our effective imports netted out to 7,465,000 barrels per day for the week, 1,340,000 barrels per day less than last week. At the same time, our crude oil production slipped by 1,000 barrels per day to an average of 8,977,000 barrels per day, which means which means that our daily supply of oil, from net imports and from wells, totaled an average of 16,442,000 barrels per day during the week.

At the same time, refineries reportedly used 15,458,000 barrels of crude per day during the week, 435,000 barrels per day less than during the prior week, while at the same time, 1,361,000 barrels of oil per day were being added to oil storage facilities in the US. Thus, this week's EIA oil figures seem to indicate that we consumed or stored 377,000 more barrels of oil per day than were accounted for by our net oil imports and oil well production. Therefore, in order to make the weekly U.S. Petroleum Balance Sheet balance out, the EIA inserted a phantom 377,000 barrel per day number onto line 13 of the petroleum balance sheet, which the footnote tells us represents "unaccounted for crude oil". That number is further described in the glossary of the EIA's weekly Petroleum Status Report as "the arithmetic difference between the calculated supply and the calculated disposition of crude oil.", which means they got that number by backing into it, using the same calculations we just performed.

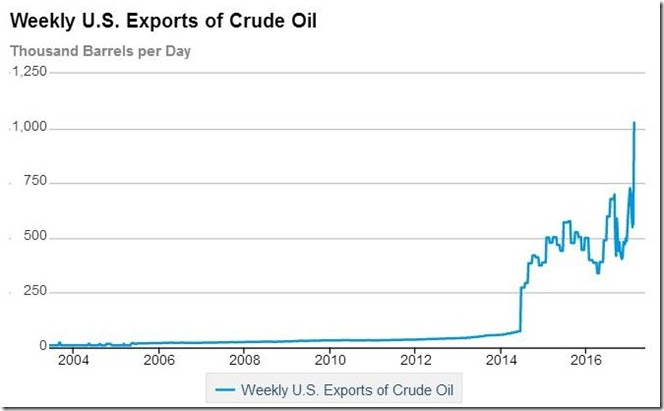

The weekly Petroleum Status Report also tells us that the 4 week average of our oil imports inched up to an average of 8.491 million barrels per day, 9.9% higher than the same four-week period last year. We should also note that our crude oil exports of 1,026,000 barrels per day is a new record for oil exports, beating the prior record set in the first week of this year by 299,000 barrels per day. So you'll be sure to see that, we'll include a self explanatory.graph of that jump in our exports from the EIA's crude oil exports page, directly below.

Meanwhile, this week's 1,000 barrel per day oil production decrease included a 6,000 barrel per day increase in oil production in the lower 48 states, offset by a 7,000 barrel per day decrease in output from Alaska. Our crude oil production for the week ending February 10th was 1.7% lower than the 9,135,000 barrels of crude that we produced during the week ending February 12th of last year, while it remained 6.6% below our June 5th 2015 record oil production of 9,610,000 barrels per day.

US refineries were operating at 85.4% of their capacity in using those 15,458,000 barrels of crude per day, down from 87.7% of capacity the prior week, and down from the year high of 93.6% of capacity just five weeks earlier, when they were processing 17,107,000 barrels of crude per day. Their processing of oil is also down by 2.5% from the 15,848,000 barrels of crude per day that were being refined during the week ending February 12th, 2016, when refineries were operating at 88.3% of capacity. With the refinery slowdown, gasoline production from our refineries fell by 854,000 barrels per day to 8,950,000 barrels per day during the week ending February 10th, which was 7.5% less than the 9,675,000 barrels per day of gasoline that were being produced during the week ending February 12th a year ago. At the same time, refineries' production of distillate fuels (diesel fuel and heat oil) fell by 271,000 barrels per day to 4,531,000 barrels per day, which was 2.8% less than the 4,663,000 barrels per day of distillates that were being produced during the week ending February 12th last year, also during a mild winter.

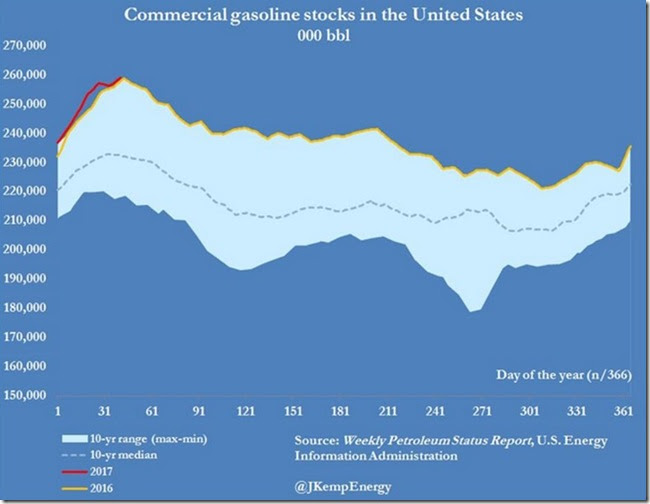

However, even with the big drop in our gasoline production, the EIA reported that our gasoline inventories rose by 2,846,000 barrels to a record 259,063,000 barrels as of February 10th, in the sixth increase in our gasoline supplies in the past 7 weeks. That happened as our domestic consumption of gasoline fell by 508,000 barrels per day to 8,433,000 barrels per day, again well below normal for this time of year. In addition, our gasoline exports, which have often served to reduce our excess supplies, fell by 447,000 barrels per day to 555,000 barrels per day, while our imports of gasoline fell by 207,000 barrels per day to 604,000 barrels per day, making for the first week our gasoline imports exceeded our gasoline exports since the week ending October 14th. Since this week's gasoline supplies are at an all time time high, we'll include a graph of their recent history here.

The above graph comes from the twitter feed of John Kemp, who is an energy analyst and columnist with Reuters. It shows US gasoline stores in thousands of barrels by "day of the year" for the past ten years, with the past ten year range of our supplies on any given date shown in the light blue shaded area, and the median of our supplies, or the middle of the daily range, traced by the blue dashes over each day of the year. The graph also shows our 2016 gasoline inventories traced weekly in a yellow line, with our year to date 2017 gasoline supplies represented in red. Even with the obvious seasonal variation of higher stocks in the winter and a drawdown of them in the summer, we can clearly see that for almost all of 2016, our gasoline supplies were at a seasonal high for nearly every given date, and so far in 2017, our weekly totals have broke those year old 2016 records.

And that's why what happened this week was an all time record. Last year, on February 12th, our gasoline supplies rose to a new record of 258,693,000 barrels, beating the February 13th 2015 record of 243,132,000 barrels by 6.4%. This week's 259,063,000 barrels thus topped last year's record by just a small fraction, but it is still a new record nonetheless. Recent years have shown that gasoline supplies usually start to fall after the 2nd week of February, (which is clearly visible on the graph), so that may very well happen again this year. Still, our gasoline stores are now up by nearly 32 million barrels since Christmas, and on track to continue setting seasonal records higher than those set last year..

Meanwhile, the big drop in distillates production served to reduce our supplies of distillate fuels by 689,000 barrels to 170,057,000 barrels by February 10th, as the amount of distillates supplied to US markets, a proxy for our consumption, fell by 57,000 barrels per day to 3,853,000 barrels per day, and as our exports of distillates fell by 105,000 barrels per day to 992,000 barrels per day. Even so, our distillate inventories are still 4.7% higher than the distillate inventories of 162,375,000 barrels of February 12th last year, and 33.5% above the distillate inventories of 127,409,000 barrels of February 13th, 2015.

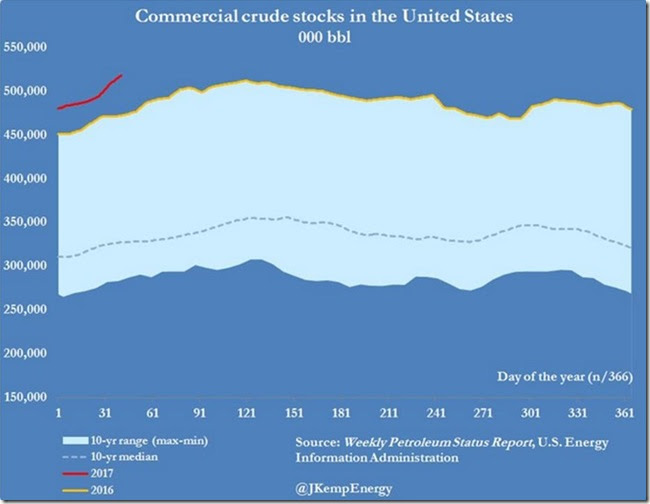

Lastly, the ongoing elevated level of our oil imports, combined with slack refining, led to another large addition to our weekly inventories of crude oil, which rose by 9,527,000 barrels to 518,119,000 barrels by February 10th, thus topping the previous record high oil supply of 512,095,000 barrels set on April 29th 2016. So another record high calls for yet another graph...

Like the previous graph, this graph also comes from the twitter feed of John Kemp, who seems to post several graphs daily, along with other energy news. Also like the prior graph, this one shows US oil supplies in thousands of barrels by "day of the year" for the past ten years, with the past ten year range of our supplies on any given date shown in the light blue shaded area, and the median of our oil supplies for any day traced by the blue dashes over each day of the year. This graph also shows our 2016 oil inventories traced weekly in yellow, with our year to date 2017 oil supplies in red. The difference here, as we saw last week, is that our 2016 oil supplies were not just fractionally higher than those of 2015, they averaged more than 10% higher, while our 2015 oil supplies ran as much as a third higher than those of 2014. Thus the 2017 oil inventories are that much higher again, and we've now set a new record for oil supplies on the 41st day of the year, which unlike gasoline supplies, tend to continue to rise seasonally until at least the 120th day of each year (when refining for summer gasoline supplies picks up). As a result, our oil supplies on February 10th were 9.6% higher than the then February record 472,823,000 barrels that we had stored on February 12th of 2016, 32.3% higher than the previous mid-February record of 391,516,000 barrels in storage on February 13th of 2015, and 56.6% higher than the closer to normal 330,956,000 barrels of oil that we had stored on February 12th of 2014.

note: the above was excerpted from my weekly synopsis at Focus on Fracking..

Recent comments