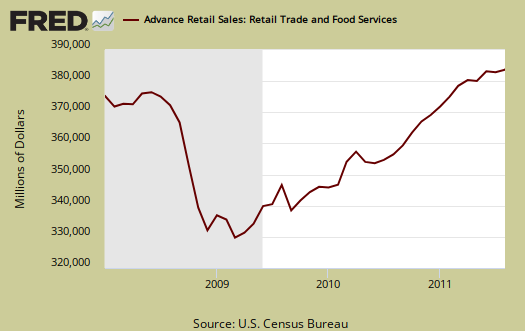

August 2011 Retail Sales flat lined, or no change from July. Retail sales are up 7.2% from the same time last year. July retail sales percentage change was revised downward, from +0.5% to +0.3%. Motor vehicle sales were -0.3% in August and are up 6.9% from August 2010. Considering the consumer was D.O.A. in Q2, this is not a good sign for Q3 GDP in terms of consumer spending, which accounts for 70% of economic growth. Retail sales are not adjusted for price increases, not reported in real dollars.

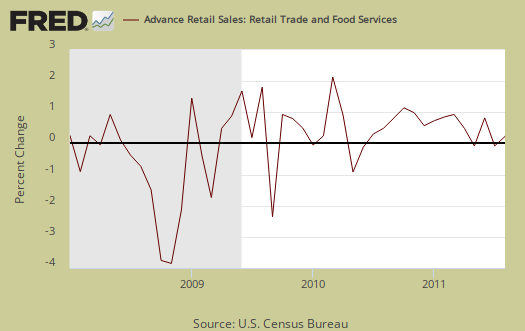

Retail sales has variance and is often revised as more raw data comes into the Census. This is also the advanced report. To keep the gains in perspective, below is the graph of monthly percentage changes since 2008. There is clearly a slowing in retail sales for the last 5 months.

Gas sales increased +0.3% from July and are up a whopping +20.8% for the year. All hail Exxon. Considering the weak growth in retail sales, having an economy based on filling the gas tank cannot be a good sign. Most gas is self-serve, not exactly a job creator. Grocery retail sales increased +0.5% and are up +6.8% from August 2010. Nonstore retailers increased +0.5% but are up +10.4% from the year previous. Nonstore retailers are online shopping, mail order, door to door. It's clear online shopping is increasing in market share.

Retail trade sales are retail sales minus food and beverage services and it increased +0.1% in August and are up +7.5% for the year. Retail trade sales includes gas.

Electronics and appliances increased +0.5% for August, all hail the never ending updated smartphone. Sporting goods are up +2.4%, furniture, which has been depressed for some time, is down -0.2% for August and +0.2% for the year.

Advanced retail sales are reported three month tallies. There is variation in the monthly reported figures as well as data reporting lag. The three month tally, from June to August, is up +7.9% in comparison to the same period in 2010.

Retail sales correlates to personal consumption, which is about 70% of GDP growth. Yet GDP has inflation removed from it's numbers. This is why Wall Street jumps on these retail sales figures. Lord help them if America stops shoppin'. That said, 2010 saw poverty rates as high as 1993, and it's clear things have gotten worse since then, so where the money is going to come from so Americans can keep shoppin' is anyone's guess.

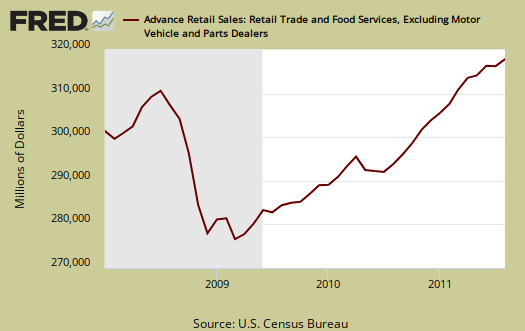

The below graph is retail sales minus autos & parts. Retail sales minus autos & parts increased +0.1% for August and is up +7.3% since this time last year.

"minus autos and parts"

It's confusing to me to lump auto parts with autos. The category of "auto and home supply stores" shows how different "autos" are from "auto parts." The great thing about the "auto" or "vehicle" categories is that they are well-defined by law and regulation, so can be tracked fairly accurately ... and separately from "parts" or "supplies." Of course, to some extent parts sales compete with auto or appliance sales, so there are interrelations.

Ratios of used to new autos -- or other durable goods -- are also interesting. It's puzzling to me (an impression that I have) that prices of used autos have not dropped as much as prices of existing homes during the current recession. I think it has something to do with the thing that Rep. Dennis Kucinich recounts about his childhood, that sometimes his parents had no residence, so they lived in cars. I am pretty sure that many working people have a greater bottom-line need for a car than for (any other) residence. Of course, people also live in boats ... and, I guess, international arms dealers live in airplanes (personal jumbo jets).

autos, parts, used autos

I try to give just autos and vehicle dealer sales which also was -0.3% so I think it's reasonable to say auto parts is a small percentage of that number. I believe this is both new and used vehicles, as sold by retail car dealerships. So those scum on craigslist as well as individuals aren't in these figures.

CPI gives used auto price increases as I recall.

Yeah, during 2008, used autos dropped like an absolute stone in price. I personally picked up a "all bells and whistles" older SUV for $4k, 89k mi., because it was a triple whammy, people simply could not get a loan, the credit score requirements were through the roof and many banks just flat out stopped loaning, gas prices were at record highs and everyone believed U.S. autos were about to go bankrupt, i.e. Chrysler and GM.

I think at that time you could also pick up a Jeep for peanuts. My fav was the hyped out Range Rover, used to cost ??? $50k or ?? ...anyway it was going for < $5k all over the place because it was cancelled.

Anyway, that's what I did personally, jumped on a true 4WD over it. ;) (yes I'm sorry all of you environmentalists!)

But now I think used have gone up because it's just insane for the typical salary to take on a $400/mon car payment, up to $700, so of course used becomes more in demand as do leases.

The infamous home price situation is ridiculous. They won't let people stay in their homes, take a hair cut so now a new wave of foreclosures is going on that will further repress prices.

I think prices plain need to come down but there is a huge problem with underwater mortgages and home values for those who are already paid up. These are huge losses to Americans, #1 pocket book killer.