Federal Reserve Chair Ben Bernanke says the Housing Bubble is Regulator's Fault and the Fed had nothing to do with it:

“The best response to the housing bubble would have been regulatory, rather than monetary,” Bernanke said today in remarks to the American Economic Association’s annual meeting in Atlanta. The Fed’s efforts to constrain the bubble were “too late or were insufficient,” which means that regulatory actions “must be better and smarter,” he said.

Right o! Bernanke supported all of Alan Greenspan's cheap money policies:

Under former Chairman Alan Greenspan, the Fed lowered its benchmark interest rate to 1.75 percent from 6.5 percent in 2001 and cut the rate to 1 percent in June 2003. The central bank left the federal funds rate, or overnight interbank lending rate, at 1 percent for a year before raising it at a “measured pace” of quarter-point increments over two years, from 2004 to 2006.

While it's probably true to put a lot of the housing blame on the lack of regulatory oversight, the absurd claim of this speech is Bernanke's refusal to admit the Federal Reserve itself did not do anything in terms of their existing regulatory power and has done, did nothing for consumer protections.

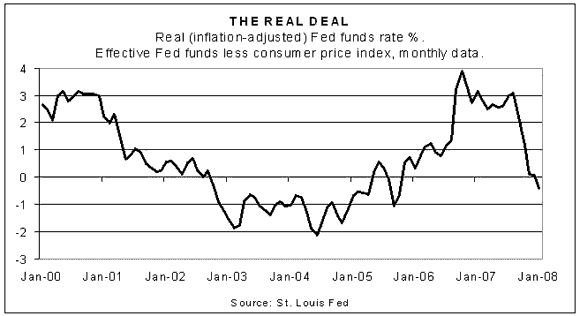

The Wall Street Pit also notes low interest rates at least exacerbated the problem. Below is their graph of the Fed Funds Rate adjusted for CPI (inflation):

Now we have a Federal Reserve Economist saying Fannie Mac and Freddie Mae should be expanded. Wayne Passmore thinks a new agency should be created to give U.S. taxpayer guarantees to Asset Backed Securities (ABS). Right, the U.S. taxpayer should be on the hook to give guarantees, government backed money guarantees on mortgages, mortgage backed securities and even credit cards.

Meanwhile James Kwak says no on Bernanke being confirmed.

Kwak has similar views pointed out in the linked frying pan to fire post, Burning Ben.

I’m less confident about whomever Obama and his advisers would pick. This is a deeply centrist administration, at least on economic issues, and one that is absolutely not going to make a major policy shift anytime soon; whether or not we agree with them, their current message is that they have done a good job fixing the financial system and running the economy. So I think that if Bernanke by some miracle were not confirmed, Obama would take pains to appoint someone with the same policy positions.

At the same time Kwak says this Bernanke speech has convinced him that Bernanke should not be confirmed for a second term as Federal Reserve Chair.

He notes Bernanke is actively lobbying against a Consumer Financial Protection Agency all the while claiming consumers need better protection and now the above claim that more regulatory oversight was needed, while the Federal Reserve pretty much did nothing at the time.

Recent comments