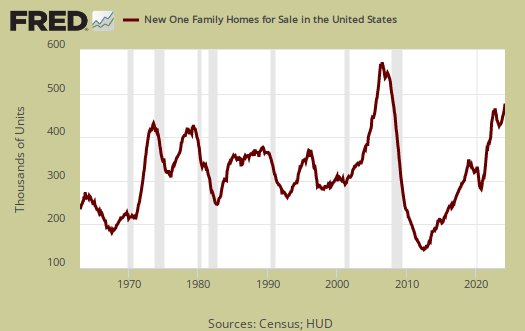

The January 2015 New Residential Single Family Home Sales decreased -0.2% to 481,000 in annualized sales. This change is maintaining six year highs and this month is well within the statistical error margin of ±22.2%. . For the year, new single family home sales are up 5.3% from the January 2014 457,000 sales levels. Figures are annualized and represent what the yearly volume would be if just that month's rate were applied to the entire year. These figures are seasonally adjusted as well. Beware of taking these monthly percentage changes in new home sales to heart, for most months the change in sales is inside the statistical margin of error and will be revised significantly in the upcoming months.

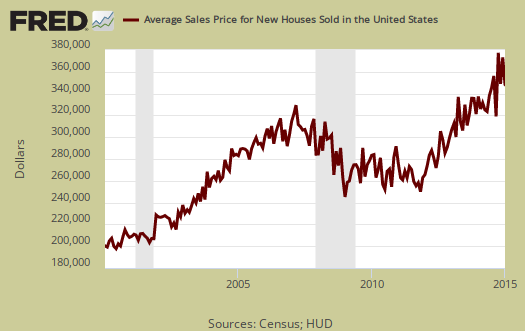

What continues is the never ending, increasing home average price. For January 2015 the average home sale price was $348,300, a 3.3% increase from a year ago.

The median new home price is also very frightening as it is almost $294,300. These prices are still clearly outside the range of what most wages can afford. From January 2014, the median new home sales price has increased 9.1%. Median means half of new homes were sold below this price and both the average and median sales price for single family homes is not seasonally adjusted.

Inventories: New homes available for sale is now 218,000 units. This is a 15.3% increase from a year ago.

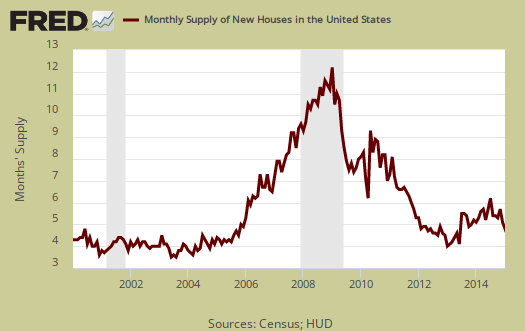

Below is a graph of the months it would take to sell the new homes on the market at each month's sales rate, currently at 5.4 months

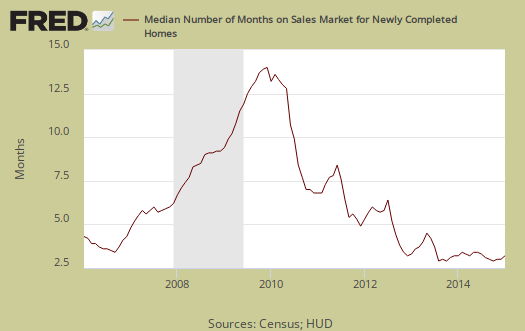

The median time a house was completed and on the market for sale to the time it sold was 3.3 months. From a year ago that time period was 3.2 months. so the median time to move new residential property appears to be stable.

Overall this report shows new home sales are staying at their six year high levels but inventories are increasing. The median price is now out of reach for most people and that's a problem. Inventories increasing isn't a good sign either although more supply might alleviate the soaring prices.

The variance in monthly housing sales statistics is so large, in part, due to the actual low volume overall, along with the fact this is a survey. One needs to look at least a quarter to get a real feel for new home sales, but a year of sales data is more in order. Additionally this report, due to it's huge margin of error, is almost always revised significantly the next month. Buyer beware on month to month comparisons and reacting to primarily figures and why we graph up the statistics so one can identify a real trend versus press headline buzz. This is also why we produce so many graphs, one needs to see the overall trend, not focus on just monthly headline buzz percentage change figures.

The Census notes that the average revision is about 5% of the original reported. Here are our overviews of residential real estate statistics, only some graphs revised.

Recent comments