And That Giant Squishing Sound

A must-read book is Michael Lewis' latest: The Big Short: Inside the Doomsday Machine, truly an outstanding description of the factors leading to the meltdown.

While I hold Mr. Lewis in utmost respect as a thoroughly intelligent observer and author, as well as thoroughly honest, I disagree with his conclusions as well as one item in his book.

As Mr. Lewis was utilizing public sources, he can be forgiven if he was redirected, or misdirected on one item (which he honestly doesn't pinpoint as a ground zero event), where he identifies Michael Burry as the instigator of the naked swap, so to speak.

I resolutely believe this was in place long before Mr. Burry inquired into its creation, and there is much extraneous data lying around to validate this assertion.

Michael Lewis makes use of a brilliant analysis and thesis paper by Anna Katherine Barnett-Hart, which she wrote while at Harvard.

From a Wall Street Journal blog by Peter Lattman,

Barnett-Hart says she wasn’t the most obvious candidate to produce such scholarship. She grew up in Boulder, Colo., the daughter of a physics professor and full-time homemaker. A gifted violinist, Barnett-Hart deferred admission at Harvard to attend Juilliard, where she was accepted into a program studying the violin under Itzhak Perlman. After a year, she headed to Cambridge, Mass., for a broader education. There, with vague designs on being pre-Med, she randomly took “Ec 10,” the legendary introductory economics course taught by Martin Feldstein.

[I can't help but notice the mention of the legendary economist, Martin Feldstein, in the above quote. For many unfamiliar with Mr. Feldstein, allow me to mention that he is a member of the Bretton Woods Committee, and he has a legendary background.

Back in the late 1990s, HCA was investigated for Medicare and Medicaid fraud and paid a settlement of $1.7 billion (at that time the largest fraud settlement in US history). Martin Feldstein was on their board of directors during that period.

Back in January of 2009, the largest criminal fine in US history was levied against Eli Lilly for the illegal marketing of the atypical antipsychotic drug, Zyprexa. Feldstein, of course, was an independent outside director of that corportion during that period.

And, as one might guess, during what many have described as the largest insurance swindle in human history, the A.I.G. Great Credit Default Swap bailout, Martin Feldstein was on the board of directors of the infamous A.I.G. Financial Products organization.

Truly, Feldstein is the stuff of legend. One almost wonders that such an exemplary student would muddle through his "legendary" course.

Should anyone wish to peruse an example of the "legendary" brilliance of Feldstein, please take a look at a recent article of his on Obamacare. I personally consider it to be a stunning example of the flaky reasoning so prevalent among too many academic economists today. Feldstein is an ardent foe of what he defines as "entitlements" -- Social Security which has been pre-paid long ahead of time by American workers. On the other hand, he believes the mega-rich are "entitled" to various and sundry forms of corporate welfare.

And curiously enough, these academic economists always are members of that Bretton Woods Committee. Feldstein's name should come right after Diana Farrell's name on their membership master list. For a review of Diana Farrell, an "economics" advisor to President Obama (odd position for a Harvard B-school grad -- wasn't the former President Bush only a Harvard B-school grad???) please see a former post on Matt Taibbi's article.]

I would highly recommend Ms. Barnett-Hart's thesis paper as mandatory reading, along with Mr. Lewis' most excellent book.

Instead of presenting a review of his book at this moment, I will present the wonderful and most illustrative graphs from Ms. Barnett-Hart's outstanding thesis paper, an interesting refresher on the factors leading to the financial collapse.

Two points I would like to make about Micael's book, though. He has a gift for lucidly describing the detrimental effects of credit default swaps and their compounding of risk to infinity.

I have often had difficulty in properly describing what, for some, must seem like an almost inscrutable abstraction.

Suffice it to repeat, the credit default swap is a Ponzi-Tontine financial construct, an instrument of insurance fraud and profiteering.

Now, there are many who would disagree with me and claim that, of and by itself, there is nothing wrong with the concept of the credit default swap; it was simply abused.

To those I would reply, you simply don't understand nor comprehend it. Again, it is a Ponzi-Tontine financial construct, leading to irreparable damage. (Even Nathaniel Rothschild, of the internationally-known Rothschild family, has warned against it! OK, I admit he only mentioned the sovereign CDSes, but eventually he'll get it.)

Also, I would like to refer to a previous post on securitization, because Lewis' book examines a single component of the financial collapse, the subprime market, while that is but a small drop in the large pond of what is to come.

Those securitized infrastructure projects peddled to city and state governments, in North America and throughout the planet, under the aegis of "public-private partnerships," represent the subprime market for public governments.

Again, this may sound a bit abstract, but it becomes obvious under closer examination. The underlying foundation of fraud, securitization, is the root cause and source of abuse.

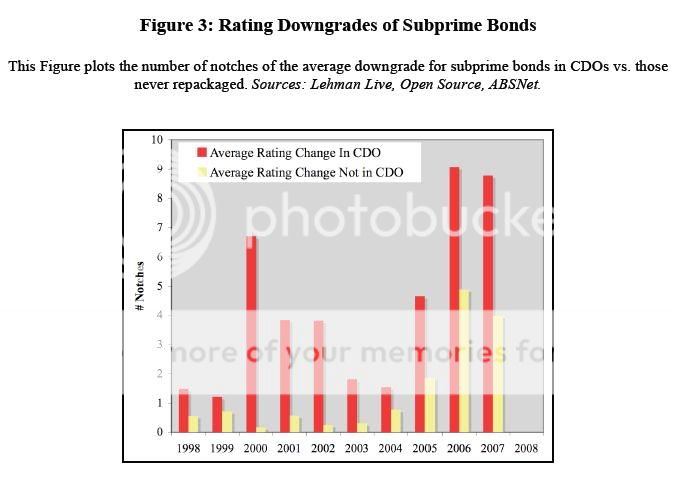

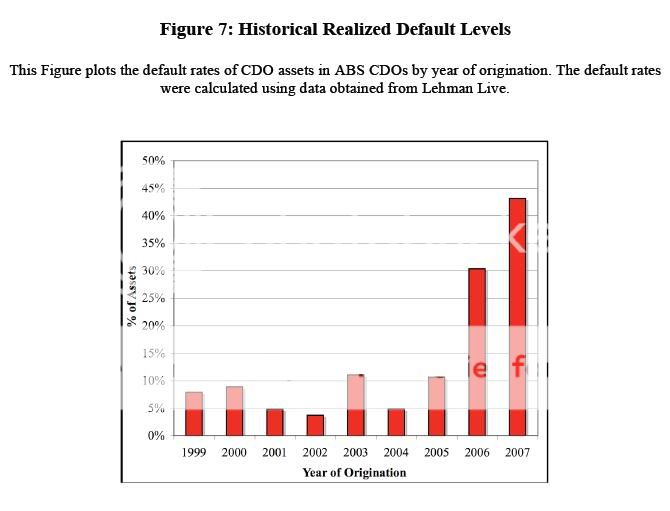

And now, Ms. Barnett-Hart's wonderful graph history:

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

Please click to enlarge

References

Barnett-Hart, Anna Katherine. Department of Economics, Harvard College. "The Story of the CDO Meltdown: An Empirical Analysis." March 19, 2009.

Feldstein, Martin. Short bio: http://www.speakers.com/listing.asp?sid=1890

Lattman, Peter. "Michael Lewis's 'The Big Short'? Read the Harvard Thesis instead!" Wall Street Journal Online Blog. March 15, 2010.

http://blogs.wsj.com/deals/2010/03/15/michael-lewiss-the-big-short-read-...

Lewis, Michael. The Big Short: Inside the Doomsday Machine. WW Norton & Co. Inc. 2009. ISBN: 9780393072235.

Comments

CBS interview

which is very well summed up, although he focuses on incentives (which is a major huge part of this),

Here it is: click here to watch.

His conclusions differ from his facts

When Alan Greenspan left as head of the Fed, he makes a boatload of money by betting on the collapse of the financial system.

Now who had a major input into the collapse of the financial system?

While I appreciate Michael Lewis' reportage, I strongly differ from his conclusions, the usual unintended consequences, or it just happened, or that "incentivizing" (a k a, bribery) thing....

Incentives

It's a little like saying banks provide an incentive for bank robbers by holding money on the premises. So in the end, no one is at fault! Every time I hear Geithner talk about how it's really too bad but we had to do it -- yeah, there's a mess but we are all to blame.

A special interest group called the Federal Reserve left their fingerprints all over it.

Frank T.

Frank T.

Lewis has an excerpt of the book

on Vanity Fair. It is very, very readable: Betting on the Blind Side

I think at least I, and I suspect most other EP readers, would benefit from any article you might write more fully explaining your disagreements with Lewis' conclusions. Especially since I have not read the book, and am unlikely, given the pinch I'm in, to buy it.

No longer worthy of further explanation

I appreciate the comment, but don't think it really warrants any expanded explanation (having already explained this thousands of times over the previous ten years I admit I am fully exhausted and burnt out on this avenue).

He presents significant data, as is the norm, then backs away from blaming anyone, but acknowledging that many walked away with millions and billions.

Thus, his book gets published and he receives much publicity. Jesse Ventura, for simply bringing up logical questions about an "untouchable" subject, is hit with flagrant censorship!

In the aftermath of that S&L meltdown in the '80s, which gave us the credit derivative instrument, one thousand (I repeat ONE THOUSAND) execs at various levels WENT TO JAIL.

Amazing, isn't it? That pales by significance to what has, and is still, transpiring (this economic meltdown and ensuing unemployment), yet no one has gone to jail.

(And no, Bernie Madoff wasn't really connected to it, his was just a straightforward Ponzi scheme, not that different from the typical Hollywood movie biz shelter scheme. And no, neither was Bradley Birkenfeld - recently jail for attempting to offer up tax evasion schemes of the mega-rich, nor Martha Stewart connected to this meltdown. Yet, they are, or were, jailed?)

One hundred percent corruption is no longer deserving of explanation upon explanation upon explanation. And one should always be suspicious of anyone and everyone craving those endless explanations.

It's time to begin jailing the guilty.

Yo, yo Tony Wikrent -- see Yves Smith's post

Yves Smith does an excellent post on Lewis' book:

at this link.

The Big Short Review

James I appreciate your concise and decriptive analysis of The Big Short! Nice to have an honest look that explores and gives insight too!

Sincerely,

Steven Sutherland

Courage To Win

http://www.eloquentbooks.com/CourageToWin.html

Thank you Mr. Sutherland

Thanks for your comment, much appreciated!