When I diaried last week that we were in the midst of the biggest deflation since the Great Depression, I was met by a number of naysayers (at another blog) who criticized the diary on the grounds that the deflation was just the artifact of the bursting of the Oil bubble, nothing more.

That is not the case. We are undergoing a real deflation for the first time in over 50 years because consumers are full of debt and tapped out of cash, their assets (homes and stocks) are going down in price, and they are unable or unwilling to spend the money they have begun to save at the gas pump. With consumers not buying, demand for manufactured goods has cratered as well. I'll show why below the fold.

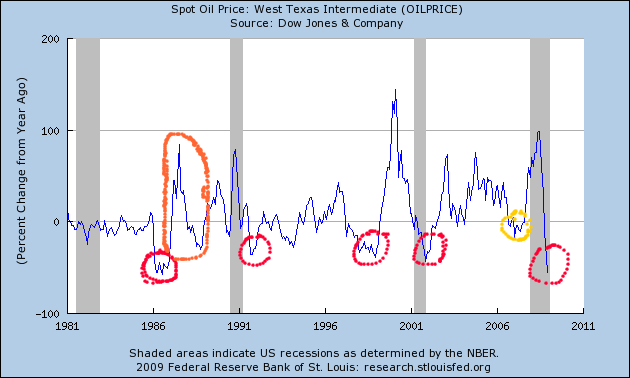

If the critics are right, then a serious reduction in the price of Oil, especially back in the 1980s when our manufacturing was less efficient, should have given rise to deflation then as well. With that in mind, here is a graph of Oil prices year over year since 1981:

As of December 2008, the monthly reported price of Oil fell to $41 from its high of $139 in June and July, a decrease of 69.3%. [Note: all of the figures and percentages in this diary are from the data reported monthly by the St. Louis Fed.]

But as the above graph shows, that isn't the only time Oil prices have declined dramatically.Look at the red circles: from October 1990 to September 1991 they declined 39.2%. From November 1997 to August 1998 they declined 37.2%. From November 2000 to November 2001 they declined 42.8%.

In 1991, 1998, and 2001, despite the signficant declines, there was no deflation. Inflation over the same periods was +2.8%, +1.1%, and +1.9%. By contrast, by October 2008 Oil prices had declined a similar 42.6%, and there was already a deflation of - 1.5%.

And in the granddaddy of all prior declines, from November 1985 to July 1986, Oil prices declined 62.4% -- almost as much as in 2008! So what was the inflation rate during that period? +0.4%. There was no deflation whatsoever in response to a 62.4% decline in the price of oil! To the contrary, consumers refinanced debt at lower interest rates, and there was a modest housing boom.

But, you might say, on those occasions there was no previous large spike in prices. And that is where the orange oval in 1987-88 comes in. In 1987, Oil prices spiked 85%. Then in 1988 they declined 30%. During that period of time there was not a single negative number in inflation, and during the 1988 oil decline, consumer prices increased 4.2%

Contrast that with a deflation of - 4.4% -- the most since the 1930s -- during the last 5 months of 2008.

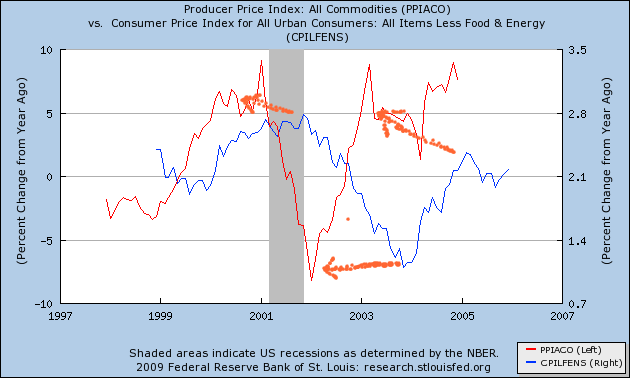

In a separate vein, my friend Bonddad suggests that this isn't a "true" deflation vs. a commodity bear market, because core inflation hasn't declined that much yet. The problem with this reasoning is that core inflation actually lags headline inflation by about a year, as energy prices in particular make their way through the system. To give you an example, here is the 2001 recession. Notice that commodity prices (the red line) both peaked and troughed over a year in advance of core CPI (the blue line):

Similar examples from the 1960s and 1970s exist, but I won't bore you with yet another graph on that score.

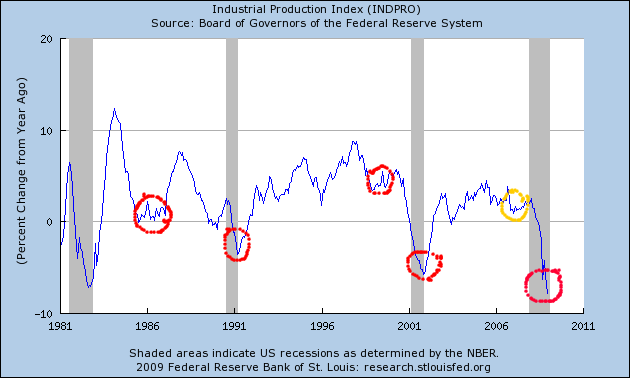

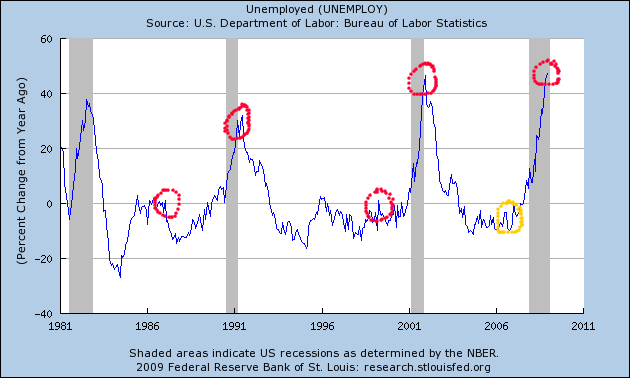

What makes our time so different is the breadth and scope of the general economic weakness. As the graphs below show, in 1986, 1998, and 2006 there was no recession at all.

Moreover, the 1991 and 2001 recessions each featured pockets of strength. In 2001, industrial production suffered:

and unemployment spiked:

But in the 1991 recession, as the above graphs show, manufacturing remained relatively strong, and there was a less intense spike of unemployment.

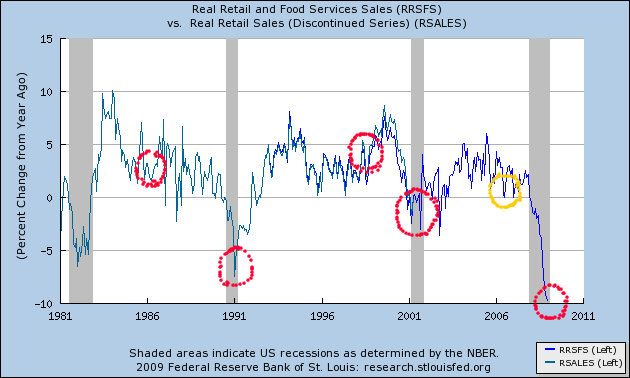

Contrarily, in the recession of 1991, it was the consumer who folded, as retail sales tanked:

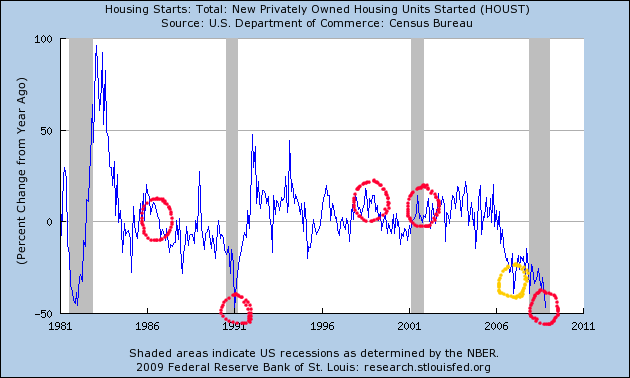

as did housing starts:

But in the 2001 recession, retail sales declined modestly, and housing starts showed no signs of distress!

What is different about this recession is that all elements of the economy -- industrial production, retail sales, unemployment, and housing -- are all showing dramatic declines. There is nowhere to hide. Which is why the now nearly daily stories of wage cuts are so worrisome. The scope of the collapse of Oil prices, while partly due to a bubble bursting, is even moreso a manifestation of that universal and global downturn in consumer and producer confidence; which is why I believe that by mid-year we are likely to see year-over-year deflation of more than - 3.0%.

The Deflationary Recession of 2009 is more than just Oil. It is an old-fashioned 19th Century style decline, that has unfolded in slow motion, " just as I predicted a year and a half ago.

Comments

Corroboration

Barry Ritholz has an excellent article on BP cafe titled The Great Experiment. It supports your claims and then some!!!

Thanks for this!

I just scanned the article briefly. Yes, Bernanke et al are conducted a huge, high-stakes real-world experiment to see if Milton Friedman was right.

Thanks again.

excellent piece

I think you proved your point Q.E.D.!

inflation

I take a strong interest in this subject because I still have most of my money in a gold ETF.

It seems to me that if the government wants to avoid a deflationary spiral, they can print as much money as necessary to prevent it. The real challenge will be trying to limit the inflation that will come as soon as we get out of the woods deflation-wise.

Do you see deflation as a long term (measured in years) situation or a relatively short term (measured in months) situation?

I certainly don't want to lose money holding gold in the midst of a deflationary situation, but I also don't want to miss out on big gains if short term deflation is followed by hyper-inflation.

miasmo.com

A way around that

Would be the Wörgl Solution, in which special money is printed to stop the deflation, but said money loses 5% of it's value a month unless a special tax is paid to "refill" it.

Everything, however, points to the Obama admin taking the Milton Friedman/Kenseyan approach, and borrowing money from the FED to use in bailouts and infrastructure.

This would argue for short term deflation followed by hyperinflation instead.

-------------------------------------

Maximum jobs, not maximum profits.

January CPI will tell re deflation and Oil

With January over, it is apparent that Oil prices were essentially flat for the month. So if the deflation has only been about Oil, we should expect a significant seasonal uptick in inflation. If January CPI is flat or negative, we can pretty much rule out the "it's just about Oil" thesis. If January CPI is mildly upward on a non-seasonal basis, (+.1% or +.2%), the Jury is out.

jury might still be out even if negative CPI

I'm thinking of a deflationary wage spiral effect. Those layoffs stats are going to hit consumer spending, probably a little more delays because the true hemorrhage just started.

Ya gonna do a post on the correlation to unemployment?

I think in terms of raw data we have big woes because the stats, data collection has been repeatedly changed in order to make the employment picture look better (IMHO).