Homeschooling And The Hypocrisy Of Illinois Politicians

By Ted Dabrowski and John Klinger of Wirepoints

Illinois politicians’ latest attempt to impose their will on homeschooling began with a single tragic story of one child’s abuse. Lawmakers took that case of parental neglect and twisted it, expanded on it, and turned it into an indictment of homeschooling in general. Now they want new legislation to control it.

Homeschooling risks truancy, they say. And abuse, educational neglect and poor accountability. That’s how lawmakers are fear-mongering about Illinois’ long-standing, hands-off approach to homeschooling in an attempt to gain more power over parents and children.

But if you know anything about Illinois’ public education system, you’ll recognize the rank hypocrisy immediately. Illinois schools are full of truancy, abuse, educational neglect and poor accountability. Yet lawmakers do little to nothing about that. Instead, they’ve turned their attention towards the last form of education they don’t control.

The bill at hand, House Bill 2827, would force homeschooling parents – and private schools – to annually submit a declaration form to their local school district, with the potential penalty of fines and even jail time if parents don’t comply. Among other items, the bill also requires administrative and curriculum standards.

The bottom line is, the proposed law is an infringement of the fundamental right of parents to make decisions concerning the care, custody, and control of their children (see the Supreme Court case Troxel v. Granville).

Yet Illinois State Rep. Terra Costa Howard, the lead sponsor of the legislation, justifies her bill by saying homeschooled children “lose daily contact with teachers and others who are mandated to report abuse and neglect.” That’s coming from someone who’s said and done nothing to address the source of the state’s biggest sexual abuse problem: Chicago Public Schools.

And State Rep. Michelle Mussman, another bill sponsor said, “We really are looking for a better way to capture the small, the very important subset of kids who are…missing an education or worse.” But Mussman and most Illinois legislators have done little to address the state’s own public school literacy collapse. Six out of every 10 children statewide are unable to read at grade level – that’s more than 1.1 million public school students.

Below we lay out the many hypocrisies of the homeschool bill supporters.

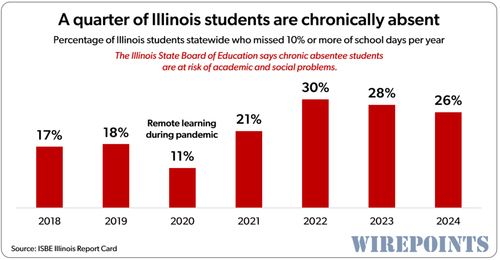

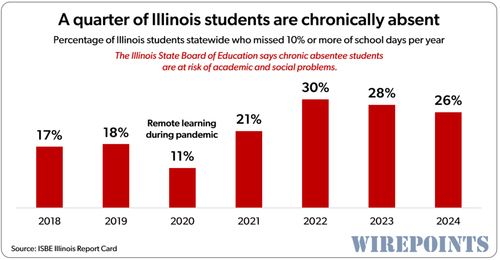

1. Rampant chronic absenteeism in public schools. Lawmakers’ concern about “truancy” in homeschooling falls flat considering they consistently allow up to a quarter of Illinois public school students to be “chronically absent” (10% or more missed school days in a year) each year. That’s based on data straight from the State Board of Education’s annual report card.

Chicago’s numbers are far worse – over 40% of CPS students were chronically absent in 2024. These kids are at risk of “academic and social problems” according to the State Board of Education.

Absenteeism skyrocketed during the covid years and has remained at elevated levels since.

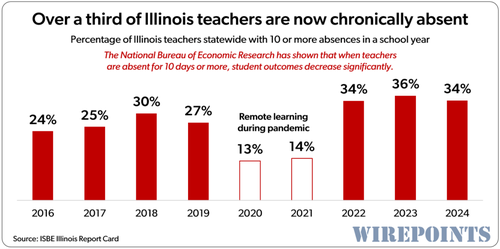

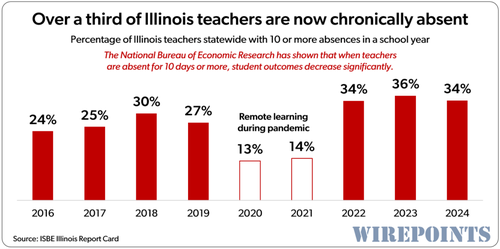

Many Illinois teachers also consistently fail to show up for class, again based on state education data. Over a third of all teachers statewide were considered “chronically absent” in 2024, meaning they missed 10 school days or more during the year. The National Bureau of Economic Research warns that student outcomes decrease significantly when teachers are absent for 10 days or more.

Who are lawmakers holding accountable for this? And why aren’t they holding themselves accountable?

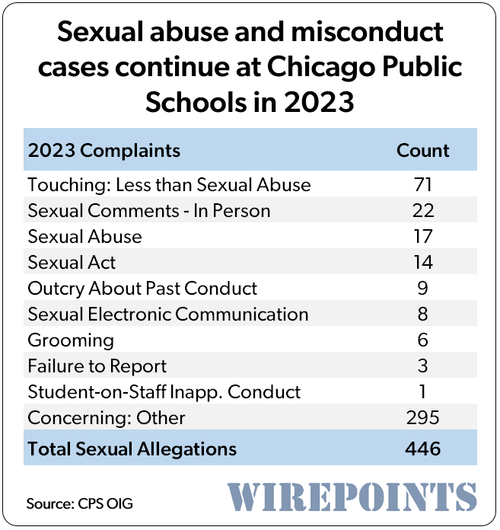

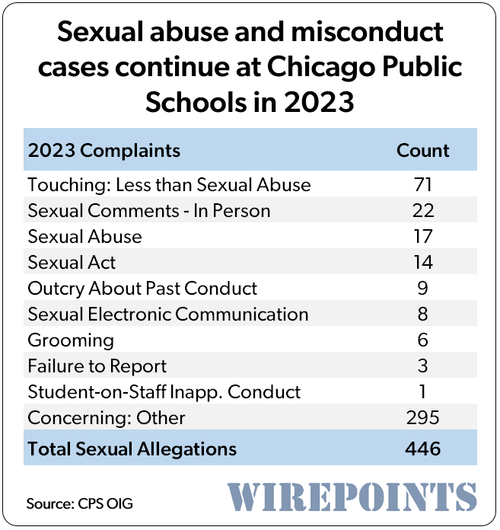

2. Ongoing sexual abuse in schools. If legislators really cared about the abuse of children, they would shut down Chicago Public Schools immediately. The district has recorded nearly 1,000 allegations in the last couple of years, many of them severe cases of molestation and abuse.

Here are some examples from the CPS Inspector General in 2024:

Case No. 20-01345. “A security guard sexually abused a 16-year-old student for approximately five months. In his capacity as a security guard, he pulled the student out of class to have sex in various locations in the school, such as storage rooms and janitor closets. He also sexually assaulted the student in his car and his home.”

Case No. 20-01530. “An intoxicated teacher groped an eleventh-grade student twice on the buttocks while at the school’s graduation. The student disclosed the teacher’s conduct to a staff member, who notified DCFS and the school’s then-principal. However, the principal failed to notify the Law Department of the allegations as required.”

Case No. 21-00326. “An employee of a vendor after-school program sexually assaulted an elementary school student at the student’s school on multiple occasions between 2014 and 2017, when the student was seven to ten years old. The student disclosed three separate incidents: one in which the vendor employee touched and rubbed the student’s genitals under their clothes, and two in which the vendor employee touched and rubbed the student’s buttocks under their clothes. The abuse took place in the school’s gym and cafeteria.”

Those are but a few of the 446 cases that range from misconduct and sexual harassment to nonsexual conduct that raises “the appearance of impropriety or possible grooming concerns.”

Illinois lawmakers have known about the rampant cases of abuse since the Chicago Tribune first exposed the depth of CPS’ crisis in 2018. The district should be under the same extreme public and political pressure as the Catholic Church was when its own sex abuse scandals broke. Yet lawmakers have done little to nothing about it.

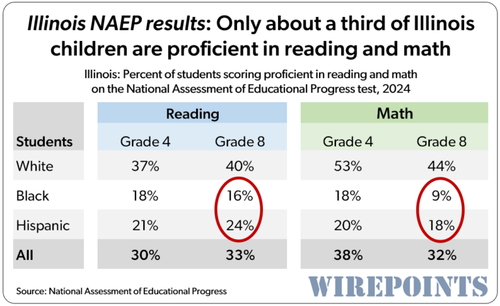

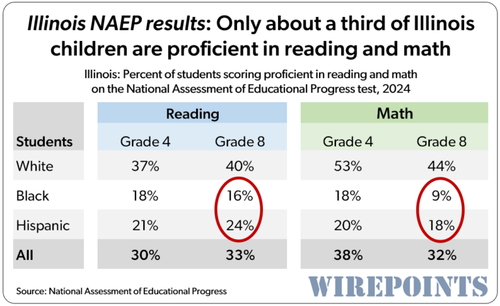

3. Public school students are unable to read or do math. Lawmakers’ supposed concerns about homeschool parents failing to provide an education to their children is particularly laughable given the dismal state of public education in Illinois.

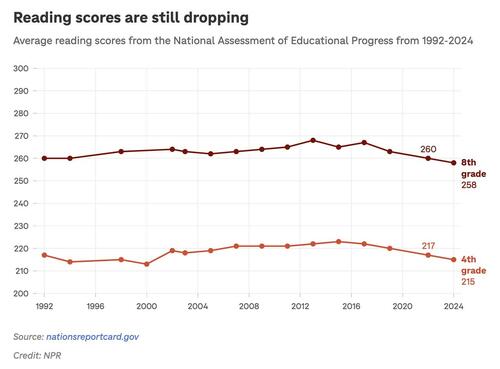

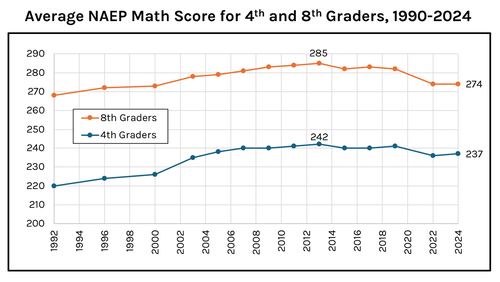

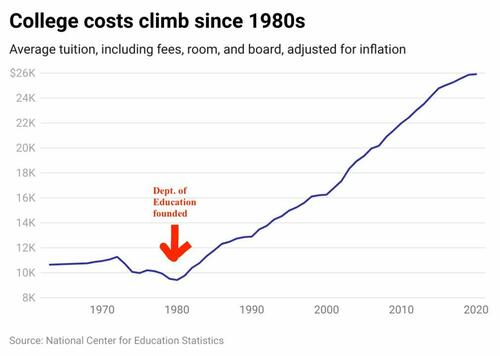

Illinois lawmakers haven’t made any serious attempt to restore literacy and numeracy – the long term data backs us up on that. Instead, all they’ve done is throw billions upon billions of dollars at the education system to no effect.

Overall, just 33% of all 8th-grade Illinois students scored proficient in reading on the 2024 Nation’s Report Card test. In math, it was just 32%.

The results for the state’s minority children were far worse. Just 16% reading and 9% math proficiency for blacks. For Hispanics, it was just 24% and 18%.

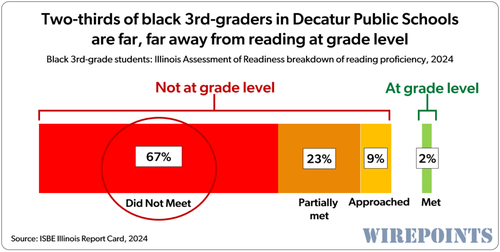

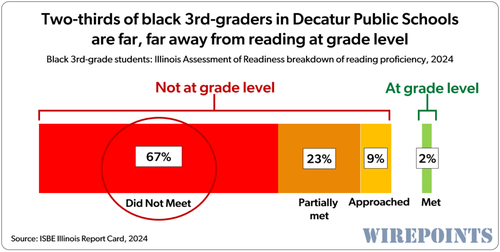

In many districts, kids are far, far away from proficiency. Take the Decatur Public Schools. There a full two-thirds of black third graders scored at the lowest possible level on the state IAR test in 2024. Most of those students are grade levels away from proficiency.

Then look at Decatur’s 11th graders. It’s the exact same thing: 69% were at the lowest level. These children have been abandoned by the system.

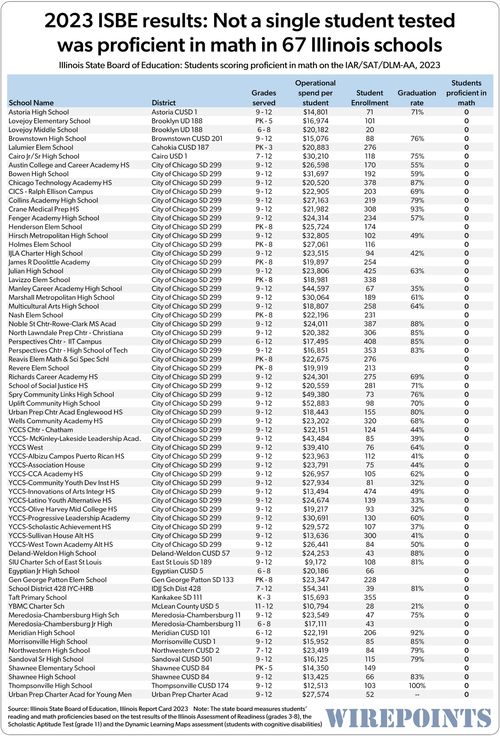

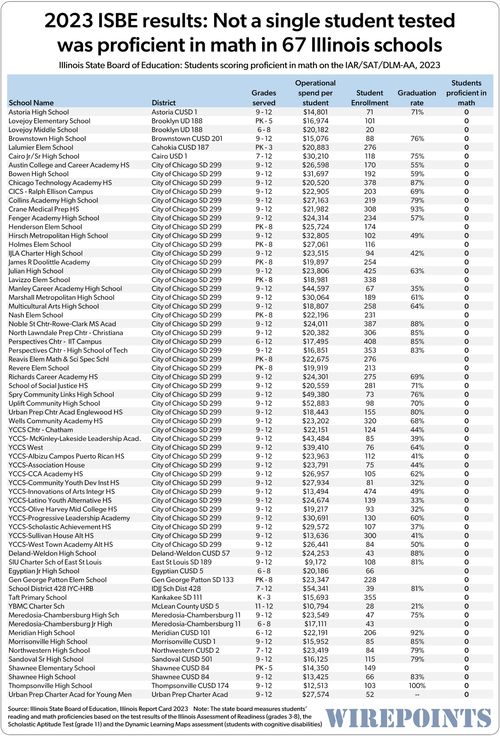

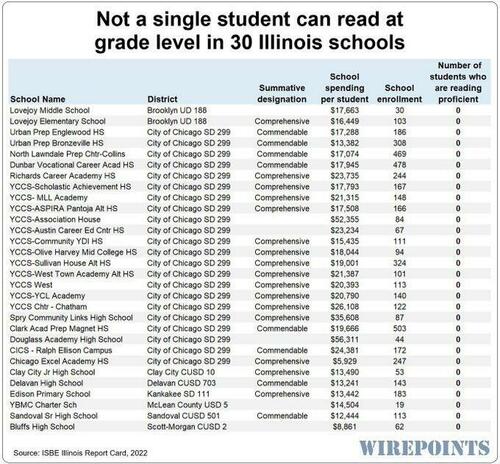

And not a single kid can read proficiently at all in some schools. Last year, Wirepoints analyzed report card data directly from the Illinois State Board of Education and found 67 schools across the state, enrolling over 11,500 students, where not a single child could do math at grade level. There were another 32 schools where zero children were proficient in reading.

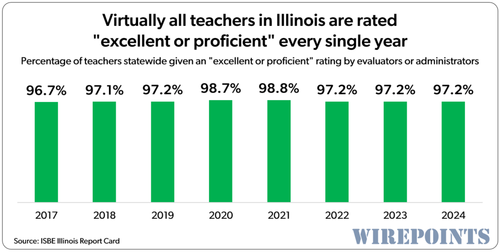

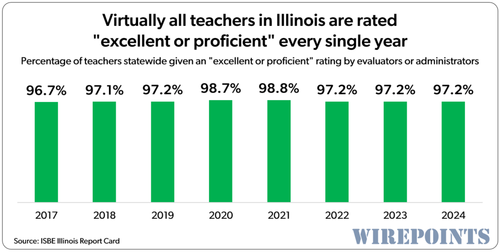

4. Unhelpful teacher evaluations. And for those lawmakers so concerned about accountability, there’s the open question about why they’ve done nothing to fix the state board’s broken “accountability” metrics for teachers.

Despite all the failures we’ve tallied above, the system allows virtually every teacher in Illinois to be rated “excellent or proficient” year after year. It’s apparent that lawmakers don’t truly care about accountability.

This homeschooling bill is an attempt by lawmakers to take over the last part of education that isn’t under their explicit control – and a way for the teachers unions to squash another form of competition.

It’s hypocrisy, and government overreach, at its worst.

Tyler Durden

Wed, 03/26/2025 - 20:55

A person holds a 3D-printed ghost gun during a statewide gun buyback event held by the office of the New York State Attorney General in the Brooklyn borough of New York on April 29, 2023. Yuki Iwamura/AFP via Getty Images

A person holds a 3D-printed ghost gun during a statewide gun buyback event held by the office of the New York State Attorney General in the Brooklyn borough of New York on April 29, 2023. Yuki Iwamura/AFP via Getty Images

JPost/Flash90

JPost/Flash90

Unarmed and posing no threat of death or serious harm, Babbitt was shot to death by Capitol Police on Jan. 6 (via

Unarmed and posing no threat of death or serious harm, Babbitt was shot to death by Capitol Police on Jan. 6 (via

Scene at Belarusian border, via LRT

Scene at Belarusian border, via LRT Via BBC

Via BBC Satisfaction guaranteed. If it doesn't work for you, simply ask for a refund...

Satisfaction guaranteed. If it doesn't work for you, simply ask for a refund... Via Associated Press

Via Associated Press

Recent comments