How Trump's 'Liberation Day' Tariffs Are Set To Reshape Global Trade

Authored by Emel Akan and Andrew Moran via The Epoch Times,

President Donald Trump is set to announce reciprocal tariffs for all nations starting April 2, the date he has dubbed “Liberation Day.”

Companies, markets, and governments are on edge, expecting the move to send shockwaves across the globe.

Liberation Day will impact all countries, Trump told reporters over the weekend aboard Air Force One. However, some countries will be more vulnerable due to their high trade imbalances with the United States and significant trade barriers against American goods, including China, India, the European Union, Canada, Mexico, the United Kingdom, Vietnam, Japan, and South Korea.

The president will reveal details of his tariff plan at a White House Rose Garden event Wednesday afternoon after the stock markets close.

Speaking to reporters from the Oval Office on March 31, Trump stated that his tariff rates will be lower—and in certain instances “substantially lower”—than what other countries have been charging the United States.

“We are going to be very nice by comparison to what they were,” the president said. “We have a world obligation, perhaps, but we’re going to be very nice, relatively speaking. We’re going to be very kind.”

On Feb. 13, the president unveiled the concept, describing it as a “fair and reciprocal plan” for trade by raising U.S. levies to match duties that other nations impose on U.S. products.

He instructed his team to assess and recommend tariffs on countries that impose significant barriers to U.S. products, including tariffs, value-added taxes, and other non-tariff restrictions. The assessment will also consider the foreign exchange policies of America’s trading partners.

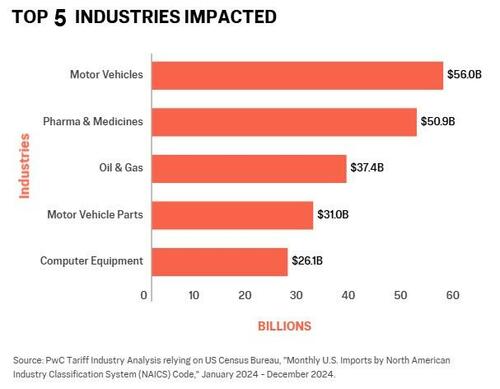

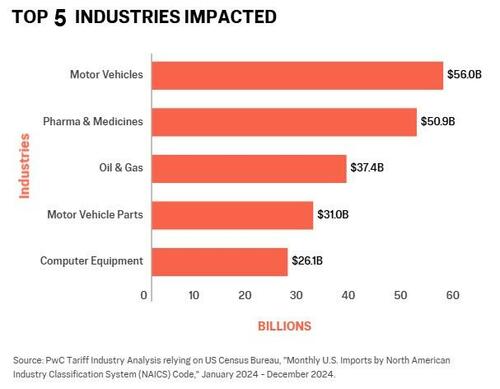

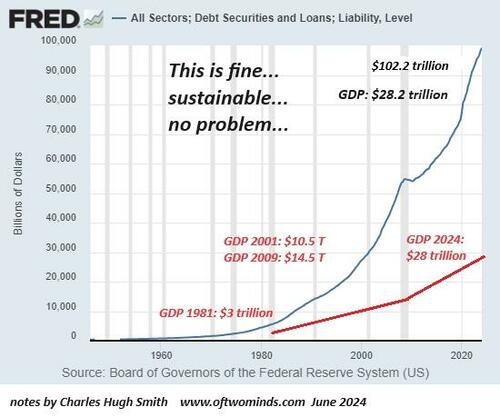

Trump’s tariff policies are anticipated to have a significantly broader impact on products, industries, and countries affected by tariffs compared to previous administrations. According to an estimate by consulting firm PwC, the measures could increase U.S. tariff revenues from $76 billion annually to almost $697 billion.

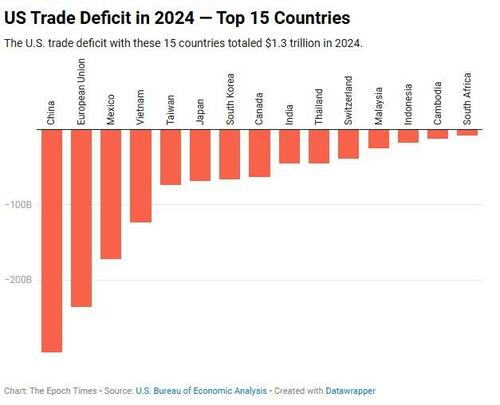

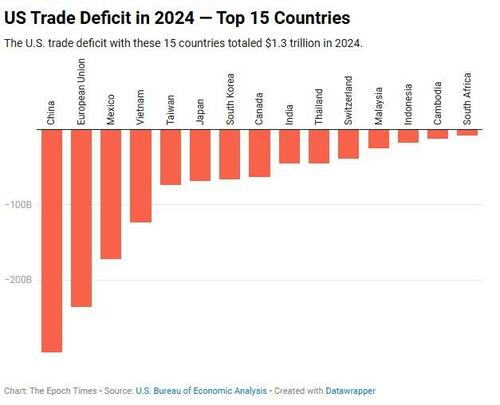

A key objective behind the administration’s tariff plans is to reverse America’s decades-long trade deficit.

The United States has recorded trade deficits every year since 1976. Last year, the U.S. goods and services trade gap surpassed $918 billion—a 17 percent increase from 2023.

Many factors have contributed to this decades-long trend. A low national savings rate, for example, has resulted in a higher dependence on foreign capital to fund investments. Foreign markets’ comparative advantage, mainly in the form of lower labor costs, has also led to cheaper imports, satisfying ferocious domestic consumption.

White House officials, including U.S. Trade Representative Jamieson Greer, believe tariffs could be a part of the solution to undo ongoing trade deficits.

“Part of the question is how large of a trade deficit do we want, because the trade deficit represents, in large part, manufacturing jobs that have [gone] overseas,” Greer told the Senate Finance Committee in February.

He also noted that worsening trade imbalances with particular countries were a “huge problem.”

In 2024, China ranked first, with the U.S. trade deficit reaching $295 billion. This was followed by the European Union ($236 billion), Mexico ($172 billion), Vietnam ($124 billion), Taiwan ($74 billion), and Japan ($69 billion).

Economists argue that the administration’s sweeping trade policy changes will have the greatest impact on industries that have traditionally benefited from low or no tariffs. As a result, these industries will be forced to evaluate the costs and benefits—such as logistics, tax rates, and tariffs—of relocating production to the United States.

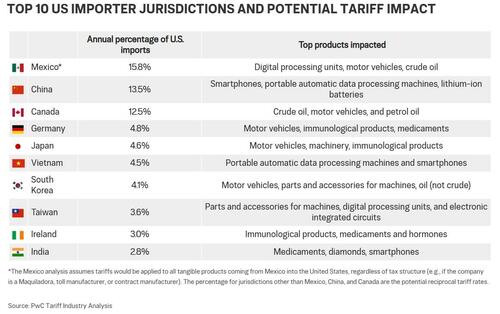

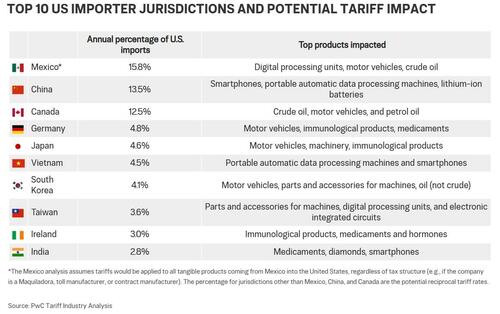

Last year, the top U.S. importer jurisdictions were Mexico, China, Canada, Germany, and Japan.

Sectors Most Affected By New Tariffs

Higher tariff rates will impact a wide range of sectors and countries.

Automobile manufacturing in Canada, Germany, Japan, and Mexico could be the hardest hit. The auto industry will navigate potential disruptions from reciprocal tariffs and Trump’s higher import duties on steel, aluminum, foreign vehicles, and car parts.

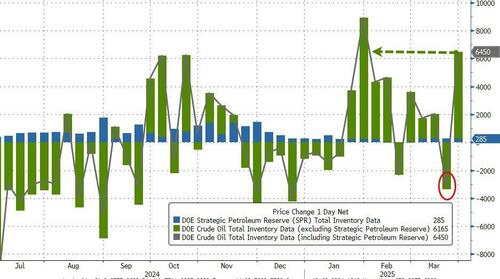

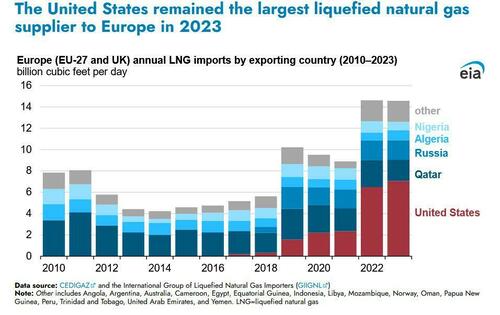

Canada’s oil and gas sector is also expected to be hammered. The United States imports more than 4 million barrels of crude per day—up significantly from 15 years ago.

Since returning to the White House, Trump has already imposed tariffs on China over its failure to address its role in illicit fentanyl trafficking into the United States. Now, with the introduction of reciprocal tariffs, China could face major disruptions in its exports of smartphone technology and lithium-ion batteries, the two items most heavily shipped to the United States.

Other industries facing significant impacts include critical medicines and health care equipment, which are primarily sourced from India, Ireland, and Switzerland.

The European Union and emerging markets could take a hit from reciprocal tariffs, says Mary Park Durham, a research analyst at JPMorgan Chase.

First, the E.U. accounts for approximately one-fifth of U.S. imports and registered a trade surplus.

“While the U.S. and EU have similar average tariff rates of 3.4% and 4.1% on each other’s imports, respectively, disparities arise at the product level,” she said in a note.

The U.S. government has highlighted the bloc’s value-added taxes (VATs), which it views as tariffs. VATs are consumption taxes absorbed by producers at each stage in the supply chain and consumers at the point of sale. The EU’s VAT rate averages 20 percent, higher than the average U.S. sales tax rate of 6.6 percent.

While the U.S. Trade Representative’s 2025 National Trade Estimate Report did not specify Europe’s VATs, White House officials have rebuked the policy, calling it a “double whammy.”

“No wonder Germany sells eight times as many cars to us as we do to them, and President Trump is no longer going to tolerate that,” an official told reporters in February.

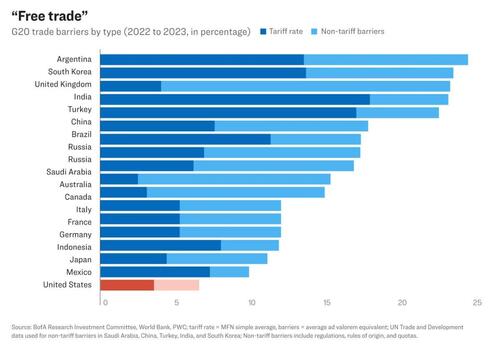

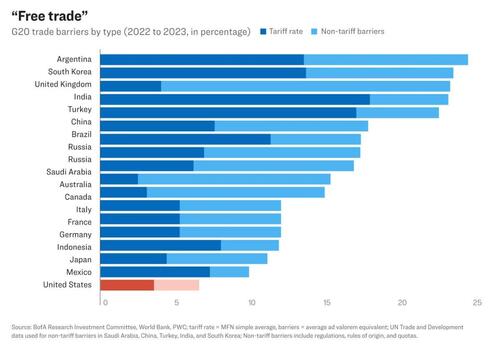

Second, emerging markets such as Brazil and India maintain high average tariff rates on all imports. These countries generally impose higher import duties to shield vulnerable domestic industries from foreign competition.

“The difference in tariff rates between emerging markets and the U.S. in their bilateral trade tends to be wider than that for developed markets,” said Brian Coulton, the chief economist at Fitch Ratings, in a report.

Brazil and India were spotlighted as examples of unfair trade practices in a White House fact sheet.

Brazil charges U.S. ethanol exports an 18 percent levy, compared to the U.S. rate of 2.5 percent. “As a result, in 2024, the U.S. imported over $200 million in ethanol from Brazil while the U.S. exported only $52 million in ethanol to Brazil,” the document stated.

India, meanwhile, imposes a 100 percent tariff on U.S. motorcycles. Conversely, the United States adds a 2.4 percent levy on Indian motorcycles, the White House said.

Countries Offering Concessions

A Bank of America report showed that the United States has the lowest trade barrier of any Group of 20 (G20) nations; the world’s largest economies.

“We’ve been taken advantage of for 40 years, maybe more, and it’s just not going to happen anymore,” Trump told reporters aboard Air Force One on March 28.

However, he said many countries are willing to make concessions and he didn’t rule out making deals with those countries.

“It’s possible if we can get something for the deal,” Trump said. “I’m certainly open to that.”

Some countries have already begun offering concessions. On April 1, Israel announced that it will remove all remaining tariffs on American products.

Prior to his long-awaited reciprocal tariff roll out, Trump has threatened to impose levies on friends and foes alike.

During the campaign trail and shortly after winning the election, the president said he would impose 100 percent tariffs on countries that engage in anti-dollar activities.

He also threatened 25 percent tariffs on Colombian agricultural products over a short-lived spat involving President Gustavo Petro’s refusal to accept its nationals deported from the United States. Trump rescinded the levies once Petro caved and accepted his citizens.

After Ontario Premier Doug Ford vowed to cut off electricity flowing from the Canadian province to several U.S. states, Trump stated he would double tariffs on Canada. He reversed the decision after Ford confirmed he would not shut off the power or add taxes to electricity exports.

Trump recently revealed that he plans to announce tariffs on lumber, pharmaceuticals, and semiconductors.

A car hauler truck makes its way to the Ambassador Bridge to cross into Detroit from Windsor, Canada, on April 1, 2025. President Donald Trump has been referring to April 2 as “Liberation Day,” when his administration will begin implementing sweeping new tariffs on goods imported into the United States from other countries. Bill Pugliano/Getty Images

Days after implementing a blanket 25 percent tariff on cars and light trucks manufactured outside the United States, the president stated that he doesn’t care if automakers raise car prices for Americans.

If prices on foreign automobiles increase, customers will shift their buying preferences to American-made vehicles, he said.

“I couldn’t care less. I hope they raise their prices because if they do, people are gonna buy American-made cars. We have plenty,” Trump said in an interview with NBC’s Kristen Welker.

He added that higher prices would bolster U.S.-based manufacturers.

“If you make your car in the United States, you’re going to make a lot of money,” the president said. “If you don’t, you’re going to have to probably come to the United States, because if you make your car in the United States, there is no tariff.”

Auto tariffs are scheduled to take effect on April 3 and will be permanent.

Various individuals have been integral in crafting the president’s tariff plans.

White House press secretary Karoline Leavitt told reporters on March 31 that Vice President JD Vance has been “deeply involved” in trade discussions.

Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick, White House economist Kevin Hassett, U.S. Trade Representative Jamieson Greer, and senior counselor for trade and manufacturing Peter Navarro, have all contributed to shaping the tariff regime.

“All of these individuals have presented plans to the president on how to get this done, and it’s the president’s decision to make,” Leavitt said.

A trader works on the floor of the New York Stock Exchange on April 1, 2025. Stocks opened up low as the market reacts to President Donald Trump's April 2 expected proposal for a round of new tariffs. Michael M. Santiago/Getty Images

Tariffs Fuel Market Volatility

Financial markets have wiped out trillions of dollars in value over the last several weeks. Investors fear that tariffs will revive inflation and slow economic growth—surveys suggest the United States could slip into a recession.

The tech-heavy Nasdaq Composite Index has slumped 5 percent in March. The blue-chip Dow Jones Industrial Average fell about 1 percent last month. The broader S&P 500 has trimmed 3 percent to finish the first quarter.

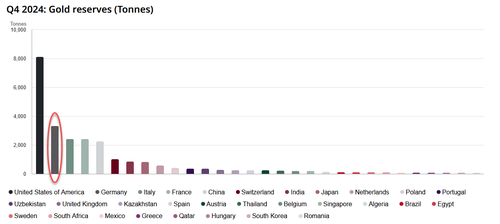

Gold prices have extended their gains from last year, reaching a record high of $3,100 per ounce. The yellow metal gained 19 percent in the first quarter, fueled by strengthening safe-haven demand amid market turmoil.

U.S. Treasury yields have slumped since reaching a mid-January peak as traders concentrate on the economy’s long-term prospects.

The benchmark 10-year yield has fallen about 65 basis points to below 4.16 percent.

The U.S. Dollar Index (DXY), a metric of the greenback against a basket of currencies, has declined 4 percent this year. Tariffs and structural changes have fueled the recent weakness.

Uncertainty has been a sizable force behind the enormous volatility but April 2 should resolve some of the anxieties plaguing investors, says Jeffrey Buchbinder, the chief equity strategist at LPL Financial.

“April 2 is a big day for the stock market,” Buchbinder said in a note emailed to The Epoch Times. “There will still be trade policy uncertainty after that date but the Trump administration is expected to clear up some of the biggest questions investors have right now.”

Tyler Durden

Wed, 04/02/2025 - 11:40

Private jets are seen on the tarmac at Friedman Memorial Airport ahead of the Allen & Company Sun Valley Conference in Sun Valley, Idaho on July 4, 2022. Kevin Dietsch/Getty Images

Private jets are seen on the tarmac at Friedman Memorial Airport ahead of the Allen & Company Sun Valley Conference in Sun Valley, Idaho on July 4, 2022. Kevin Dietsch/Getty Images

Protesters hold signs at a rally in support of federal workers at the Office of Personnel Management in Washington, on March 4, 2025. Alex Wroblewski/AFP via Getty Images

Protesters hold signs at a rally in support of federal workers at the Office of Personnel Management in Washington, on March 4, 2025. Alex Wroblewski/AFP via Getty Images

Kirill Dmitriev (right) is in Washington this week. Getty Images

Kirill Dmitriev (right) is in Washington this week. Getty Images

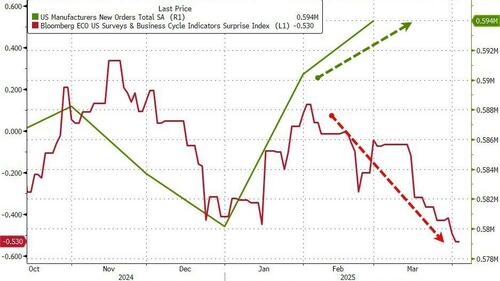

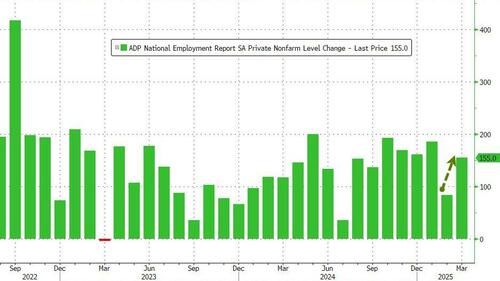

Source Bloomberg

Source Bloomberg

Source: Goldman's Jack McFerran

Source: Goldman's Jack McFerran

Senate Minority Leader Chuck Schumer (D-N.Y.) in Washington on March 13, 2025. Kayla Bartkowski/Getty Images

Senate Minority Leader Chuck Schumer (D-N.Y.) in Washington on March 13, 2025. Kayla Bartkowski/Getty Images

Click pic, buy ZeroHedge gold bars, puzzle future historians... Only 40 left in stock! These have been flying.

Click pic, buy ZeroHedge gold bars, puzzle future historians... Only 40 left in stock! These have been flying.

Ambulances transport the coffins of Hezbollah fighters and civilians killed in the recent war with Israel, during their funeral procession in the southern border village of Kfar Kila, Lebanon, on March 9, 2025. Rabih Daher/AFP via Getty Images

Ambulances transport the coffins of Hezbollah fighters and civilians killed in the recent war with Israel, during their funeral procession in the southern border village of Kfar Kila, Lebanon, on March 9, 2025. Rabih Daher/AFP via Getty Images The CDU’s Michael Kretschmer, via dpa

The CDU’s Michael Kretschmer, via dpa Source:

Source:  Sources say Turkey intends to deploy air defence systems like the Hisar (pictured) at T4 air base in Syria (handout).

Sources say Turkey intends to deploy air defence systems like the Hisar (pictured) at T4 air base in Syria (handout). Map via BBC

Map via BBC

Recent comments