Grifterism: The Economic Engine Of Democrats

Authored by Cynical Publius via American Greatness,

I am a political junkie and a political conservative. Like so many conservative political junkies, I spend a good portion of my waking hours trying to understand what the words and actions of Democrats actually mean. Like the Politburo of the former Soviet Union, the words of Democrats often bear little resemblance to the actions their words embody. “Equity” is an excellent example, as when Democrats say “equity,” they really mean highly inequitable policy solutions. Sometimes, however, Democrats deliberately fail to coherently describe the meaning of their actions, and then it becomes even harder to ascertain meaning. Such is the case with the basic economic policies of Democrats. Many on the right like to say that Democrats support socialism, but that’s not wholly true given how many capitalist components exist inside Democrat economic policies. Similarly, it is inaccurate to describe Democrat economics as being purely capitalistic because wealth redistribution is one of their core competencies. Some say that the Democrats enjoy government control of capitalist entities, rendering their economic persuasion fascist in nature. Yet, even that is inaccurate, given that fascist states view their economies as a source of nationalistic pride and strength, while Democrats tend to abhor nationalistic pride in the United States.

It’s not socialism. It’s not capitalism. It’s not fascism. What, then, is the overarching label that explains the economic policies and priorities of Democrats and their leadership?

It’s Grifterism.

(I did not invent that word, or at least that’s what Google tells me. However, I believe I am the first author to ever use that term to describe a formal system of national economic governance, so I’m going to run with it.)

Grifterism is, as the name suggests, a system run by and for the benefit of grifters. Webster defines the verb “grift” as “to acquire money or property illicitly.” Grifters have always been a part of human society, but it took the 21st-century Democratic Party to turn the idea into a comprehensive economic system. The best way to understand this system is to analyze the four classes of citizens upon which Grifterism relies, and into which all American citizens are divided one way or another: Billionaires, Productives, Dependents and, of course, Grifters.

(Before I explain these classes, I realize that there are some readers who will jump all over these categories and tell me I am being too absolute in describing them. Yes, Elon Musk is a good Billionaire. Yes, there are bad Productives who exploit the powerless. Yes, there are many entirely productive people in government who are not Grifters. Yes, the nice old blind lady down the street deserves the support given to the Dependent class. Yet, as the saying goes, these are the exceptions that prove the rule.)

On to the four classes of Grifterism:

1. The Billionaires: The Billionaires are the capital creators upon which much of the system relies. While the top 1% of income earners pay 46% of all federal taxes, estimates suggest the Billionaire portion of that demographic alone pays for somewhere between 5% and 10% of all federal taxes. While this Billionaire class is defined by that 5% to 10%, realize, too, that the Billionaires create the businesses that pay the executive salaries of so much of the rest of the 46%, so in effect, Billionaire-related taxes fund nearly half of the federal government’s gross revenue and are the de facto economic sponsors of the Grifter class. (In addition to the punishing taxes they pay, Billionaires also enjoy the privileged punishment of being endlessly vilified by the “Tax the Rich” likes of Bernie Sanders, AOC, and their brainwashed acolytes.)

Ah, yes, those poor, poor Billionaires. They are taxed and vilified to an extraordinary degree, seemingly all as punishment for their riches. However, they are actually complicit with the Grifters by funding Grifterism in exchange for their existence being tolerated, and when it comes to economic policies, they are actually on the same side as the Bernies and the AOCs, it’s just not that obvious.

You see, the Grifters rely on a vast regulatory state that makes it very, very difficult to found new, Billionaire-creating businesses—unless you are already a Billionaire. Regulatory regimes like Dodd-Frank, the 1934 Act, the CFPB and a host of other business-harassing federal regulations and agencies mean that the greatest wealth-creating businesses can only exist when they hire legions of white-shoe law firms and high-priced accountants to ensure compliance with the regulatory burden. As such, only Billionaire-owned companies have the wherewithal to fund such compliance measures, effectively creating monopolies that shut out anyone else from ever joining their club.

As an example, Dodd-Frank has done little for America other than ensure that the big banks are bigger and the small banks are fewer, all by imposing massive regulatory burdens on an ever-dwindling population of small banks. A regulatory scheme that was purportedly designed to help “the little guy” only helped the Billionaires, purposely and deliberately suppressing the ability of the Productives (more on them later) from climbing higher and threatening to join the elite circle of the Billionaires.

The tryst between the Billionaires and the Grifters gets even worse when considering the concept of regulatory capture—i.e., the Billionaires are busy writing the Grifters’ regulations that will govern the Billionaires. Remember when the health insurance industry wrote the Obamacare legislation? THAT is “regulatory capture.”

Between Billionaire-friendly, compliance-driven monopolies and regulatory capture, the symbiotic relationship between the Billionaires and the Grifters becomes clear. Yes, the Billionaires pay far more than their fair share of taxes and face constant verbal abuse from the Grifter class, but they have a wink-wink acceptance of that because they sit secure on their wealth thanks to the Grifters’ penchant for regulatory entropy.

It’s pretty good to be a Billionaire—but not so much our next two classes.

2. The Productives: The Productives are the most important class of Grifterism, and its most abused class. The Productives are the people who do and make the services and things upon which we all depend. They are doctors; they are farmers; they are the guys running the oil rig; they are long-haul truck drivers; they are your green grocer; they are your lawn guy; they are your dry cleaners; they are your plumber; they are basically the people who serve as the engine of a productive society. They create, and they rarely take. They are small business owners, but they are also the W-2 employees who work for those small businesses. Not only do the Productives serve as the essential lubricant for a functioning society, they also mostly pay that 56% of federal taxes not paid by the top 1%. America cannot survive without the Productives.

Many Productives are wealthy small business owners, while other Productives are hourly wage earners. But everyone in the Productive class knows this—it could all crash down at any moment. Productives live a life of insecurity—their business could fail, a recession could rob them of everything they ever worked for, and “at will” employees know that every day on the job could be their last. Being a Productive is stressful.

But the most stressful thing about being a Productive is that you lead your economic life at the mercy of the Grifters. If you are a Productive farmer, a Grifter might shut you down by forbidding you to grow crops or by making sure you cannot irrigate your land. If you invest your company’s worth in oil exploration equipment, a Grifter might bankrupt you with new regulations. Even that Productive dry cleaner you go to weekly has to worry about a Grifter destroying their business because they accepted a shirt with a bloodstain.

Examples like what I cite above are seemingly infinite and often totally opaque to a Productive, until such time as a Grifter arbitrarily decides to enforce one of the millions of regulatory laws few even are aware of and shuts the Productive down.

Thus, while Productives are the class that society cannot live without, all Productives live an economic life of uncertainty, constantly teetering on the razor’s edge of failure, knowing that they exist only because of the largesse of Grifters, and those same Grifters can destroy them at any time with the click of a pen.

It ain’t easy being a Productive.

3. The Dependents: This is a tricky one. It’s kind of self-explanatory—Dependents are people that depend on government handouts to live. In many ways, this is just fine—an important function of any decent government is to ensure that people who are wholly incapable of taking care of themselves enjoy a social safety net. The nice widow lady up the block with crippling rheumatoid arthritis deserves our help. Alternatively, some Dependents are temporary—the Productive who lost his job deserves a safety net for several weeks until he finds a new place to be productive. These types of people are not what make Dependents worthy of shame.

It’s the able-bodied Dependent who would rather live on the dole than become a Productive that is shameful. It’s the young man on disability who really isn’t disabled. It’s the mother who has more children because her government pay-out goes up with each kid she births. These are the shameful Dependents. Dependents pay no taxes, live on the fruits of the Billionaires and the Productives, and give only one thing back—their loyal votes for the Grifters. Dependents are actually part of the Grifters’ big con, and the Grifter class has a symbiotic relationship with Dependents, just as it has with the Billionaires.

However, it is actually no fun being a Dependent. It’s too easy to become addicted to an idle life just above the poverty line, and in that regard, Dependents are not doing any exploiting; they are being exploited—by the Grifters.

4. The Grifters: Well, we’re finally here. By now, you probably have a pretty good idea of what the Grifters are up to, but let’s be clear that this class consists of more than just government workers. The Grifter class includes all of the intelligentsia: the university professors, the traditional journalists, the lobbyists, the Hollywood elite, the “BigLaw” attorneys, and, most of all, the NGO crowd. Further, not every government worker is a Grifter—the military, the police, the justice system, and many other government offices that provide what economists call “Public Goods” all house highly necessary government employees. (Those employees are not Grifters—they are Productives, but unfortunately, the overwhelming majority of government workers are in fact Grifters.)

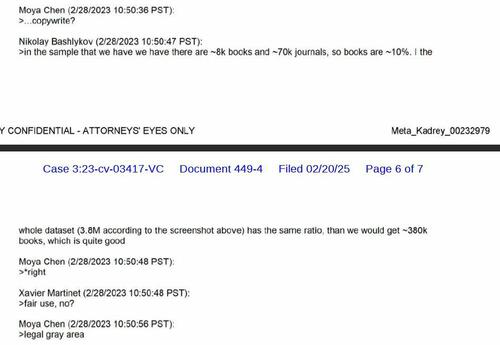

But let’s get back to the NGOs (a term I use in this article interchangeably with non-profit entities), as they reveal the true level of perfidy perpetuated by the Grifters. If you have been paying attention for the last two months, you are probably aware that DOGE and brilliantly relentless and patriotic volunteer data analysts like Data Republican have uncovered the widespread prevalence of U.S. federal agencies taking your tax dollars and using them to fund dubious efforts by various NGOs. This wicked grift cycle goes like this: (1) Taxpayers pay taxes required because Grifters establish programs that require funding; (2) Congress approves such funding in the vaguest possible terms of intent and appropriates those funds to a federal agency run by Grifters; (3) the Grifters in that agency interpret Congress’ intent in the broadest manner possible and provide funds to NGOs that employ other Grifters with six-figure salaries; and (4) that NGO then engages in some sort of woke cause such as training transgender farmers—a cause very few taxpaying voters would vote for if they only knew about it.

The cycle of grifting prospers beyond just NGOs: the universities receive taxpayer funding to indoctrinate our youth; the lobbyists curry favor with the Grifters to improve their business opportunities; the journalists cycle in and out of government, spreading the Grifter ethos as truth; Hollywood pays homage to it all, infecting American brains with woke ideas that Grifterism is noble; the BigLaw attorneys become rich navigating the vast regulatory schemes that are the lifeblood of Grifterism, and the members of the Grifter class constantly cycle in and out of the various organizations that benefit most from their economic parasitism.

The Grifters are the only class of Grifterism that fully benefits from the corrupt system; in fact, the system exists by, for, and because of the Grifters—almost all of whom are voting for Democrat candidates who themselves wallow in the pig trough of Grifterism. “But wait!” you may say, “Government workers are not Billionaires, they are not wealthy. How is that a grift?” Grifters in government generally enjoy wages in excess of the national median income; they are entitled to retirement plans largely unheard of in the private sector; they have healthcare and other benefits that far exceed those of equivalent private workers; and, most of all, they enjoy job security that is unmatched by any other sector of American society. Most Grifters are unfirable—they have life tenure. Finally, they have the power to pull the strings of the entire Grifter class for their own benefit—back-scratching and beak-wetting are their secret ways of communication.

It’s good to be a Grifter.

Grifterism exists by, for, and because of the Grifters. The Grifter class allows the Billionaires, the Productives, and the Dependents to exist, but only so long as they provide the resources necessary for the Grifters to thrive. Understanding this system—and the fact that the system is almost exclusively the province of Democrats—perfectly explains why Elon Musk and DOGE are treated as existential threats by Democrats. That is because Elon Musk and DOGE are, in fact, existential threats to Democrats. If Grifterism unravels, so do the lifestyle, beliefs, and lifelong motivations of most Democrats. Democrats treat DOGE as a life-or-death matter. Patriotic Americans should do the same. Unraveling Grifterism is the essential act in making America great again, and vocal, robust support for DOGE is a task all patriotic Americans should embrace. Grifterism must end if we are ever to be truly free, and if we are ever to have small, non-intrusive government and genuine economic opportunity, Grifterism must be extinguished as the metastasizing cancer that it is.

* * *

Cynical Publius is the nom de plume of a retired U.S. Army colonel, veteran of Iraq and Afghanistan, and reformed denizen of the Pentagon (where Grifterism still thrives) who is now a practicing corporate law attorney. You can follow Cynical Publius on X at @CynicalPublius.

Tyler Durden

Mon, 03/31/2025 - 17:00

Empty nuclear waste shipping containers sit in front of a waste isolation plant near Carlsbad, N.M., on March 6, 2014. AP Photo/Susan Montoya Bryan

The Problem

Empty nuclear waste shipping containers sit in front of a waste isolation plant near Carlsbad, N.M., on March 6, 2014. AP Photo/Susan Montoya Bryan

The Problem

Getty Images

Getty Images

Click pic... add to cart... (buy 2 for free shipping)... enjoy Multitool! Satisfaction guaranteed or your money back.

Click pic... add to cart... (buy 2 for free shipping)... enjoy Multitool! Satisfaction guaranteed or your money back.

Virginia Giuffre via Instagram

Virginia Giuffre via Instagram Prince Andrew, Virginia Giuffre, Ghislaine Maxwell

Prince Andrew, Virginia Giuffre, Ghislaine Maxwell

Donald Trump & Masoud Pezeshkian, file images

Donald Trump & Masoud Pezeshkian, file images

Recent comments