Futures Rebound From Biggest Drop Of 2025

US equity futures are higher, European bourses are mixed and Asian market are red following the worst session of the year for US stocks, as the S&P tumbled 1.7% leaving it about 2% below its ATHs. As of 7:30am, S&P futures are up 0.5% and Nasdaq futures rise 0.4%, with Mag7 names mixed as Nvidia rises in early trading; the Russell outperforms while Fins/Banks are bid this morning pointing to a rebound in Value/Cyclicals. Bond yields are 1-2bps higher with a flat USD. Commodities are mostly lower with WTI still above $70/bbl and precious metals with a slight bid sending gold to a new all time high. Weekend trade news was muted with the German election and the war in Ukraine in focus. Today’s macro data focus is on regional activity indicators.

In premarket trading, Berkshire Hathaway shares were up in the premarket on solid results boosted by a strong jump in insurance underwriting. Apple shares slid after it said it plans to spend $500 billion domestically over the next four years to hire workers and build out AI capacity. Nvidia and Amazon are leading premarket gains among the Magnificent Seven stocks on Monday; NVDA is up as much as 1.5% in early trading, days before its earnings release. Here are some other notable premarket movers:

- Hawaiian Electric which has signed settlement agreements tied to the wildfires in Maui, slips 4.6% after posting a net loss in its fourth-quarter report.

- Nike shares advance 2.5% after Jefferies upgraded the stock to buy from hold, seeing the sportswear company being positioned for a strong recovery over the next two years.

- Twilio shares rise 3.6% as Morgan Stanley upgrades to overweight from equal-weight, saying the software firm’s execution should help with growth and margin re-acceleration.

US stocks looked set to claw back ground after Friday’s sharp selloff, with Nvidia Corp. rising in early trading. German stocks gained after conservatives led by Friedrich Merz emerged as the winners in a weekend vote.

All eyes now turn to what may be the most important earnings release of the quarter when NVDA reports earnings on Wednesday: the result will be a key test of demand for US megacap stocks and the artificial intelligence frenzy that’s powered them. With recent advances in AI by China’s DeepSeek, Nvidia is under pressure to deliver blockbuster results to reassert its leadership.

“Markets are in wait-and-see mode until we see those bellwether AI earnings as that could be a key turning point,” Laura Cooper, head of global investment strategy at Nuveen, said in an interview.

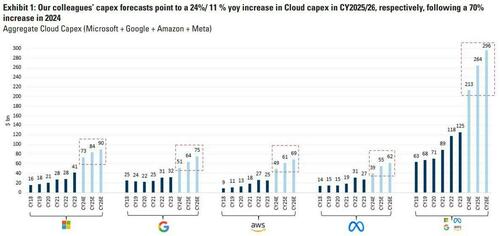

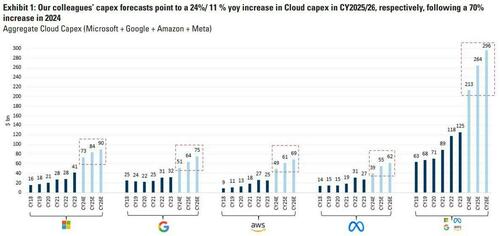

Meanwhile, doubts are starting to creep again that the exponential capex hockeystick forecast will fall well short. Last night we first reported that according to TD Cown, Microsoft has begun canceling leases for a substantial amount of datacenter capacity in the US, a move that may indicated the Mag7 giant is building more AI computing than it will need over the long term (see full report her). OpenAI’s biggest backer has voided leases totaling “a couple of hundred megawatts” of capacity, the US brokerage wrote Friday, citing channel checks or inquiries with supply chain providers. Microsoft has also stopped converting so-called statement of qualifications, which are agreements that usually lead to formal leases, TD Cowen said. That was a tactic rivals such as Meta Platforms employed previously, when it decided to cut back on capital spending, the brokerage wrote.

A potential pullback by Microsoft on spending and datacenter construction raises questions about whether the company — one of the frontrunners among Big Tech in AI — is growing cautious about the outlook for demand. If so, then much of the AI thesis - which is based on the chart below - will go down in flames.

But even without a Mag 7 wipeout, the S&P 500 Index is trailing international peers in 2025 after years of outperformance, as investors are put off by uncertainty from President Trump’s policies on tariffs and their potential to rekindle inflation. Friday’s tumble left the S&P 500 1.7% lower on the week. That said, top Wall Street strategists say the underperformance is unlikely to last long given the robust outlook for US economic growth.

“We’ve seen a lot of inflation fears, but now markets are shifting focus back to the potential growth effects of these US policies,” Nuveen’s Cooper said.

Europe's Stoxx 600 Index, and the euro, fluctuated as initial enthusiasm about Germany’s election gave way to concern the new government may lack a consensus to push through much-needed economic reforms, preventing bond yields from rising and keeping the bid in stocks in place. The DAX rises 0.9% after German conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government after he won Sunday’s federal election. Mid-cap stocks outperform, with the MDAX up 2.8%. Merz emerged as the winner in Sunday’s election, but the results gave his Christian Democrat-led bloc just one clear path to power and they face intense pressure to move quickly to form a government and rally support for measures including potentially looser borrowing rules. “Centrist parties failed to retain a constitutional majority, complicating the prospects of decisive fiscal regime change,” said Apolline Menut, an economist at Carmignac. “Tricky political compromises would be required, as well as fiscal creativity.” Electrification stocks, including Siemens Energy AG, ABB Ltd and Schneider Electric SE, fell as concerns grew around data centers spending after the abovementioned report that Microsoft has begun canceling leases for a substantial amount of datacenter capacity. Here are some other notable movers:

- European food-delivery stocks rise strongly after Prosus agreed to buy Just Eat Takeaway.com for €4.1 billion. Analysts at Bryan Garnier note this will raise speculation about bids for other firms in the sector

- Subsea 7 rises after announcing it agreed in principle to create a combined oil services company with Saipem, with an order backlog of €43 billion and expected revenue of about €20 billion. Analysts are positive

- Shares in German companies most exposed to hopes of higher government spending gain on Monday after conservative leader Friedrich Merz said he’ll move quickly to form a new government after he won Sunday’s election

- Almirall shares advance as much as 8.1%, the best performer on the Madrid Stock Exchange General Index, after the Spanish pharmaceutical company forecast Ebitda for 2025 of €220 million to €240 million

- Bank of Ireland shares rise as much as 3.7% to the highest since March 2023 after analysts at Barclays said the firm’s “strong” new guidance should lift earnings estimates. Analysts noted 2H profits were better than anticipated

- Shares of gym group Basic-Fit and food services stocks Elior and Sodexo all rise as Citi resumes coverage with buy ratings on each; Elior’s stock “does not look expensive” according to the broker

- Centrica shares rise as much as 3.6% after Jefferies raised its price target on the UK energy company’s shares, highlighting the strength of its balance sheet and possible increases to consensus earnings estimates

- National Grid shares rise as much as 1.5% after agreeing to sell its US onshore renewables unit to Brookfield Asset Management for $1.7 billion. Morgan Stanley analysts say that the deal will allow the UK electricity supplier to reinvest

- Naspers is the biggest drag by index points on South Africa’s benchmark on Monday, falling as much as much as 7.8%, the most since Jan. 7, after Prosus agreed to buy Just Eat Takeaway.com for €4.1 billion ($4.3 billion)

- B&M European shares fall as much as 6.8% after the retailer cut its earnings guidance and said CEO Alex Russo is retiring. Analysts said the weaker guidance and last year’s trading performance are disappointing

Earlier in the session, Asian equities fell, weighed by Chinese technology shares after Trump stepped up curbs on the world’s second largest economy. The MSCI Asia Pacific ex-Japan Index slipped as much as 0.7%, with TSMC, Tencent and Alibaba among the biggest drags. Japanese markets were closed for a holiday. Sentiment was cautious after US stocks had their worst session so far in 2025 following weaker-than-expected economic data and a surge in consumers’ long-run inflation views. Sino-American tensions flared up again, as Trump moved to restrict Chinese investment in some strategic US industries, while also considering further restrictions on outbound investment to Beijing in sectors including semiconductors and artificial intelligence. A selloff in India continued on Monday even as Citigroup Inc. upgraded the country’s stocks to overweight from neutral, citing a “meaningful upside” amid less demanding valuations. In South Korea, the top financial regulator said the nation is on track to lift its ban on short selling across all stocks starting March 31. A complete resumption of short selling is necessary and any market impact is expected to be short-lived, a top official said at a regular briefing.

China’s top leaders are expected to convene next week at the annual legislative meeting to lay out the economic blueprint for this year. Investors are closely watching for any new stimulus measures. Equities in Hong Kong and mainland China slipped after fluctuating in early trading.

In FX, the EUR/USD rallied by as much as 0.7% to 1.0528, only to pare the advance and trade around 1.0470; the currency was supported after the Asia open on relief that Germany’s far right party didn’t show up much stronger than expected. The Bloomberg Dollar Spot Index falls as much as 0.4% to the lowest since December, before erasing losses. USD/JPY reverses losses to rise 0.3% to 149.66; it earlier fell to 148.85, lowest since Dec. 3

In rates, US Treasury curve bull-steepens modestly; Treasuries trade cheaper across the curve, unwinding a portion of Friday’s steep flight-to-quality gains. Front end leads losses with yields ~2bp higher on the day, ahead of $29b 2-year note auction at 1pm New York time. 10-year yield rises 1bp to 4.44% while two-year yield is 2bps higher at 4.22%; German counterpart more than 2bp higher; Treasury 2s10s curve is ~1bp flatter on the day. Longer-dated German yields are higher after conservative opposition leader Friedrich Merz said he’ll move quickly to form a new government after winning Sunday’s federal election. This week’s Treasury auction cycle begins with 2-year notes and includes $70b 5-year and $44b 7-year note sales Tuesday and Wednesday. WI 2-year yield near 4.21% is close to January’s 4.211% result, 0.1bp higher than its WI at the bidding deadline.

In commodities, oil prices advance, with WTI rising 0.1% to $70.50 a barrel. Spot gold climbs $7 to around $2,943/oz. Bitcoin is flat near $95,700.

Looking at today's calendar, we get the January Chicago Fed national activity index (8:30am) and February Dallas Fed manufacturing activity (10:30am). Fed speaker slate empty for Monday. Logan, Barr, Barkin, Bostic, Schmid, Bowman, Hammack, Harker and Goolsbee are scheduled to appear later this week.

Market Snapshot

- S&P 500 futures up 0.6% to 6,067.25

- STOXX Europe 600 up 0.2% to 554.98

- MXAP down 0.4% to 189.89

- MXAPJ down 0.5% to 598.74

- Nikkei up 0.3% to 38,776.94

- Topix little changed at 2,736.53

- Hang Seng Index down 0.6% to 23,341.61

- Shanghai Composite down 0.2% to 3,373.03

- Sensex down 1.1% to 74,501.68

- Australia S&P/ASX 200 up 0.1% to 8,308.24

- Kospi down 0.4% to 2,645.27

- German 10Y yield little changed at 2.47%

- Euro up 0.1% to $1.0473

- Brent Futures little changed at $74.48/bbl

- Gold spot up 0.3% to $2,945.02

- US Dollar Index little changed at 106.57

Top Overnight News

- Microsoft is canceling leases for AI data centers in the US, potentially reflecting concerns about overcapacity. ZH

- President Trump said Elon Musk is doing a good job but he would like to see him get more aggressive. It was separately reported that Elon Musk said consistent with President Trump’s instructions, all federal employees will receive an email requesting to understand what they got done last week and a failure to respond will be taken as a resignation, although some agencies told workers not to reply to Musk’s email.

- Trump nominated Air Force Lt General Dan Caine as the next Chairman of the Joint Chief of Staff to replace General Brown, while several other top officials were also pushed out.

- Trump reportedly told CEOs of pharmaceutical companies during a meeting to move their production to the US.

- American Airlines (AAL) flight was diverted to Rome over ‘possible security issue." However, the airline later stated that the flight landed safely in Rome and after inspection by law enforcement was cleared to re-depart with the issue determined to be non-credible: ABC

- America’s economy is more dependent on the wealthy than ever before (the top 10% of earners, or households earning $250K+ per year, now account for nearly 50% of all spending, the highest percent ever. WSJ

- US Republican email systems were reportedly breached by Chinese hackers in summer 2024; hackers reportedly had access "for months" - WSJ

- US Senator Warren has reportedly sent a letter to the White House requesting that Trump's nominee to Chair the Council of Economic Advisers commits to Fed independence, via FT

- Apple plans to invest $500 billion in the US over the next four years, hiring 20,000 workers and producing AI servers as it seeks relief from Donald Trump’s tariffs on goods imported from China. AAPL -1% in pre. BBG

- ECB official Pierre Wunsch warns that the Eurozone risks “sleepwalking” into making too many interest rate cuts and needs to stand ready to stop lowering bowering costs soon. FT

- Europe envisions sending ~30K of its troops into Ukraine to help preserve any peace deal struck with Russia, with the US providing technical, logistics, and weapons support (but no American troops would be involved). ABC

- Germany’s conservative leader Friedrich Merz said he’ll move to form a coalition government within two months after winning yesterday’s election. He pledged to strengthen Europe to achieve “real independence” from the US. The DAX rose and the euro strengthened. BBG

- China’s local governments are set to issue an unprecedented $233 billion of bonds in the first two months of the year, exacerbating a cash squeeze in the financial system. BBG

- Alibaba said on Monday it plans to invest at least 380 billion yuan ($52.44 bn) in its cloud computing and artificial intelligence infrastructure over the next three years. RTRS

- Australian Treasurer Jim Chalmers will meet Scott Bessent in Washington as he seeks tariff exemptions. South Korea’s industry minister will visit the US as soon as this week for trade talks. BBG

German Election

- Prelim. Final Results: CDU/CSU 28.6%, AFD 20.8%, SPD 16.4%, Greens 11.6%, Die Linke 8.8%, FDP 4.3% & BSW 4.9%. This means that FDP and BSW are below the 5% threshold and as such will not be entering the Bundestag. However, given their proximity to the 5% threshold BSW will almost certainly call for a recount.

- Seat Distribution: CDU/CSU 208, AfD 152, SPD 120, Greens 85, Die Linke 64, SSW 1. (316 needed for a majority government)

- CDU/CSU leader Merz will become the next Chancellor. However, he will need to form a coalition to govern. Mathematically, the options are a Grand coalition (CDU/CSU + SPD), Kenya (CDU/CSU + SPD + Greens) or a Midnight coalition (CDU/CSU + AfD). AfD’s Weidel has said that she is open to being in the coalition but expected-Chancellor Merz has made clear this is not an option.

- The most likely outcome is a Grand coalition, though the SPD has made clear that the onus is on Merz to begin talks and find compromises for the government to work.

- Pertinently, the results mean that AfD and Die Linke command a blocking minority with over 1/3 of the Bundestag's seats. This means that the prospects of debt brake reform are reduced, though Merz may be able to come to a deal with Die Linke for non-defense spending related reform.

- Merz has said he ideally wants a functioning government by Easter. However, this is somewhat unlikely given the tense election campaign and political differences between the groups.

Tariffs/Trade

- US President Trump’s team is reportedly pushing Mexico towards tariffs on Chinese imports, according to Bloomberg.

- US President Trump said on Friday that the US will establish new rules to stop US firms from investing in industries that advance China’s national military-civil fusion strategy and will establish rules to stop China-affiliated people from buying critical US businesses and assets.

- US House Chair Jordan criticised EU tech fines and European taxes on US companies and wants the European Commission to brief the judiciary committee by March 10th and called for EU antitrust chief Ribera to clarify rules reining in big tech.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks began the week mixed after last Friday's sell-off on Wall St and amid holiday-quietened trade with Japanese markets closed for the Emperor's Birthday, while participants also reflected on the results from Sunday's German election. ASX 200 traded little changed as gains in financials and the defensives were counterbalanced by losses in tech and the commodity-related sectors, while there was also another deluge of earnings updates. KOSPI underperformed amid ongoing economic concerns and ahead of tomorrow's BoK rate decision. Hang Seng and Shanghai Comp were choppy but were ultimately pressured amid ongoing trade-related frictions, with the US said to be pushing Mexico towards tariffs on Chinese imports. Nonetheless, there were some encouraging reports with Chinese state-backed developers beginning to buy land at a premium again, while agricultural stocks were supported after China pledged to deepen rural reforms as part of efforts to revitalise the agricultural sector and bolster food security in the State Council's annual rural policy blueprint.

Top Asian News

- China is to further deepen rural reforms and advance rural revitalisation, while it will monitor and regulate pig production capacity to promote steady growth and will consolidate the results of soybean expansion, and expand rapeseed and peanut production. China is to improve the reward and subsidy systems for major grain-producing and increase support for large grain-producing counties. Furthermore, China will support the development of smart agriculture and expand application scenarios of technologies, while it will use monetary tools to encourage financial institutions to increase funding for rural revitalisation and will encourage local governments to pilot special loan interest subsidies for grain and oil crop cultivation, according to Xinhua.

- Chinese state-backed developers are beginning to buy land at a premium again after the government eased limits on home prices as the number of land parcels that sold for at least 20% above the asking price accounted for 37% of deals this year vs 14% for last year, according to a Bloomberg analysis of transactions worth at least CNY 1bln.

- Shein’s profit slumped in a fresh challenge to long-planned London IPO with its 2024 net profit down almost 40% to USD 1bln although FY sales rose 19% Y/Y to USD 38bln, according to FT.

- A report on Friday stated that a new coronavirus with pandemic potential was discovered in China, according to Daily Mail.

- UK and India relaunch trade talks in bid to boost investment opportunities, according to FT.

- China’s economic growth target is expected to be set at about 5% for 2025, while CPI will probably be lowered to 2% from 3% for previous years, according to a report in Securities Times on Monday, citing economists.

European bourses (STOXX 600 +0.2%) opened modestly, and on either side of the unchanged mark (though the DAX 40 outperformed after the German election). At the cash open, some pressure was seen, which then exacerbated in the hour following. Thereafter, a considerable bounce was seen across the complex; as it stands, indices are mostly firmer. European sectors are mixed; initially opened with a narrow breadth, but performance is now varied. Utilities takes the top spot, lifted by renewable names after the German Election; Merz has previously favoured their use. Strength in German auto names have lifted the Autos sector. Basic Resources is the laggard thus far, with downside attributed to mostly lower metals prices.

Top European News

- ECB's Escriva said monetary policy must be approached with caution given the current extraordinary uncertainty.

- ECB’s Villeroy reaffirmed that the ECB’s Deposit rate should be at 2% by this coming summer and said that European banking sector consolidation is generally speaking, necessary to have European banks that can compete at a global level.

- ECB's Wunsch said the ECB faces the risk of ‘sleepwalking’ into too many rate cuts, while he feels “relatively comfortable” with market expectation of 2% rates by year-end “give or take 50 basis points”, according to FT.

- Hungary's PM Orban said they are to exempt mothers of two or three children from income tax and said this will be a huge expense but the budget deficit and debt will decline, while he added the government is ready to impose food price caps unless talks with retailers on keeping prices under control succeed.

- Austria's biggest centrist parties in parliament hinted they were on the verge of agreeing to form a coalition government which would bring together Austria's conservatives, socialists and liberals, while it would sideline the far-right Freedom Party which won the election in September, according to euro news.

- EU Foreign Representative Kallas to meet with the US Foreign Secretary Rubio on Tuesday within the US.

FX

- DXY is a touch lower and showing a diverging performance vs. peers (softer vs. cyclicals, firmer vs. havens) following a shaky performance last week as soft US data points acted as a drag on the USD. In terms of US newsflow, tariff actions remain in focus with President Trump's team reportedly pushing Mexico towards tariffs on Chinese imports. However, markets place greater weight on the April 1st tariff report deadline. Geopolitical headlines remain aplenty with Ukrainian President Zelensky stating he is willing to quit the presidency if it means peace in Ukraine which he said could be exchanged for NATO membership. DXY printed a fresh YTD low overnight at 106.12 but has since returned within Friday's 106.38-106.74 range.

- EUR is one of the better performers across the majors in the wake of the German election which will likely deliver a Grand Coalition (CDU/CSU + SPD). However, such an outcome would deliver a slim majority of 328/630 seats (316 required) and fall short of the Bundestag's two-thirds majority which is required for constitutional reform (i.e. the debt brake). EUR/USD ventured as high as 1.0528 but stopped shy of the 1.0532 YTD peak and eventually returned to a 1.04 handle.

- USD/JPY printed a fresh YTD low overnight at 148.85 but has since struggled for direction amid the mixed risk appetite in Asia and the absence of Japanese participants for a holiday. To the upside, focus is on a potential reclaim of 150 to the upside.

- GBP is a little firmer vs. the USD but softer vs. the EUR. UK-specific newsflow has been light over the weekend and this week's UK data calendar is a particularly slim one. However, today sees a busy speaker slate with BoE’s Lombardelli, Pill, Ramsden and Dhingra all due on the docket and speaking at the Bank of England’s 2025 BEAR Conference. Cable printed a fresh YTD peak overnight at 1.2690 before fading upside.

- Antipodeans are both a touch higher with not much in the way of fresh newsflow for either of the antipode nations. That being said, some positivity surrounding the Chinese property market overnight (Chinese state-backed developers beginning to buy land at a premium again) is helping to underpin sentiment.

- PBoC set USD/CNY mid-point at 7.1717 vs exp. 7.2495 (prev. 7.1696).

- Barclays FX Month-End rebalancing: Weak USD buying vs. most peers, with moderate signal against the EUR and JPY, via Barclays.

Fixed Income

- Bunds opened lower by a handful of ticks after the initial election results, (details on the German Election above) before falling further to a 132.02 low on confirmation that CDU/CSU is the largest party and that both FDP and BSW will not meet the 5% threshold to enter the Bundestag. However, as the full results were released (though likely subject to a recount given BSW coming in just below the 5% threshold) a bounce was seen in Bunds, taking them from the above low to a 132.50 peak and briefly back into the green on the session. A bullish move likely driven by the presence of a blocking minority in the Bundestag, with CSU's stance against Greens being involved in the coalition also a factor.

- USTs were slightly quieter overnight owing to the absence of cash trade as Japan was on holiday. Broadly speaking, USTs have been following their German counterpart but with magnitudes more contained and the early-morning bounce not occurring to quite the same degree with USTs remaining just in the red at all times. The docket ahead is headlined by USD 69bln of 2yr supply, potential remarks from Fed’s Barr (voter) and the January National Activity Index. Currently, USTs are in the red in a narrow 109-16 to 109-21 band.

- Gilts are directionally in-fitting with Bunds though, as with USTs, magnitudes are a little more contained but with Gilts managing to hold in the green for much of the morning. Gapped higher by 18 ticks from Friday’s 92.41 close, as the mentioned bounce in Bunds had already occurred by the time Gilts commenced trade, and then extended to a 92.66 peak. Since, the benchmark has reverted back towards opening levels as we await commentary from the numerous BoE speakers at today’s conference on “The Future of the Central Bank Balance Sheet”. Pill, Ramsden, Lombardelli and Dhingra all scheduled at different points today.

- EU sells EUR 2.392bln vs exp. EUR 2.5bln 2.875% 2027 and EUR 2.277bln vs exp. EUR 2.5bln 3.375% 2039

Commodities

- Crude is a little firmer after initially trading sideways for most of the morning; traders are awaiting further updates on geopolitics and OPEC+ amid growing noise surrounding a potential delay to the unwind of voluntary cuts. In recent trade, a slight bounce has been seen in the complex, taking Brent May to a session high of USD 74.35/bbl.

- Mixed trade across precious metals with little in terms of fresh fundamentals driving price action, although spot palladium could be lagging after US President Trump reiterated the auto tariff set to kick in on April 2nd. Spot gold resides in a USD 2,921.47-2,948.88/oz range thus far.

- Subdued trade across base metals as the Dollar recovered and sentiment waned in early European trade, with tariff woes still in the background amid Trump's reiterations. Prices were unfazed by the encouraging reports overnight suggesting Chinese state-backed developers beginning to buy land at a premium again. 3M LME copper trades on either side of USD 9,500/t in a current USD 9,485.00-9,558.55/t range.

- Iraq’s Oil Minister said all procedures for exporting oil through the Turkey pipeline have been completed. It was separately reported that Kurdistan authorities agreed with the federal oil ministry to restart Kurdish crude exports based on available volumes, while Iraq denied reports that it would face US sanctions if oil exports from Kurdistan were not resumed. Furthermore, Iraq is to receive 185k BPD from the Kurdistan region in the first phase after the resumption of oil exports.

- Iraqi oil minister said exports from the Kurdish region will resume in a week. Iraq Oil Minister said they are waiting for Turkey's approval to restart oil flow, Kurdish oil exports will "hopefully be ready" in two days. Iraqi Oil Minister, when questioned if resumption of Kurdish oil exports will affect Iraq's OPEC compliance, said Iraq is committed to OPEC+ decision and exported volumes under control of ministry.

- BofA forecasts Brent crude at USD 75/bbl in 2025 and USD 73/bbl in 2026 with oil markets set to remain in a modest surplus in the near term. BofA said over the medium term, Brent should average between USD 60-80/bbl to keep the global oil market in balance.

Geopolitics: Middle East

- Israel sent tanks into the West Bank and told troops to prepare for an extended stay, according to Reuters.

- Israeli PM Netanyahu’s office said the release of Palestinian prisoners planned for Saturday was delayed until the release of the next hostages is secured with the delay due to Hamas’s repeated violations.

- Hamas strongly condemned Israel’s decision to postpone the release of Palestinian prisoners and said Israel’s claim that a handover ceremony is humiliating is false and a pretext to evade its obligations.

Geopolitics: Ukraine

- Ukraine Deputy PM said Ukrainian and US teams are in the finally stages of negotiations on the minerals deal; Kyiv is committed to complete the deal "as swiftly as possible".

- Russia's Kremlin said "we welcome and support new US approach to dialogue with Russia". Russian President Putin is to make an international phone call this morning as part of informing partners about talks with the US. Further talks with US this week will focus on eliminating irritants in ties and on work of foreign missions. "Don't see any possibility to renew dialogue with Europe at the moment; European approach contrasts with the effort we are making with the US"

- Ukrainian President Zelensky said the issue of elections is a step to apply pressure on Ukraine and he is willing to quit the presidency if it means peace in Ukraine which he said could be exchanged for NATO membership, but also commented that false statements about his ratings and the amount of US aid are dangerous steps to weaken Ukraine. Zelensky said he sees Turkey as an important security guarantor for Ukraine and that Ukraine is working on Patriot system alternatives, as well as noted if the US strikes a deal with Russia to end the war, it won’t be successful if Ukraine does not agree to its conditions.

- Ukrainian President Zelensky commented that Ukraine-US talks on a minerals deal are moving forward and all is okay, while he stated that the minerals deal draft said Ukraine should return two dollars for each dollar of aid supplied by the US. Zelensky also said the USD 500bln figure is not being considered in the minerals deal anymore and a top aide said he had a constructive new round of talks with the US on the minerals deal. It was also reported that the US could cut Ukraine’s access to Starlink internet services over minerals, according to sources cited by Reuters.

- US President Trump said he thinks the US is pretty close to a minerals deal with Ukraine and that they are asking for rare earth, oil and anything they can get from Ukraine to recoup the money the US put into Ukraine.

- US Secretary of State Rubio told Ukraine’s Foreign Minister that US President Trump remains committed to ending the conflict in Ukraine.

- US Treasury Secretary Bessent said an economic partnership will protect the Ukrainian people and the US taxpayer, while he added that Ukraine’s economic future in peace can be more prosperous than at any other point and a partnership with the US will ensure this prosperity. Furthermore, Bessent said the US-Ukraine partnership proposal is for revenue received by Ukraine from natural resources, infrastructure and assets to be allocated to a fund focused on reconstruction which the US will have the rights over investments, according to FT. It was separately reported that Bessent said he is quite hopeful when asked if he expected a minerals deal with Ukraine this week.

- US President Trump’s envoy Witkoff said there be an expectation that US companies may do business in Russia if a peace deal is reached in the Russia-Ukraine war, according to CBS News.

- Russian President Putin convened a meeting of his security council and discussed relations with post-Soviet states at the meeting, while he received reports from Foreign Minister Lavrov’s recent trips and asked him to share them with the security council, according to TASS. It was also reported that Putin said boosting Russia’s armed forces and meeting the needs of troops fighting in Ukraine are key strategic priorities.

- Russian sovereign wealth fund chief Dmitriev was appointed Special Envoy on International Economic Cooperation and his new mandate will include ties with the US.

- Russian Deputy Foreign Minister Ryabkov said a second meeting between representatives of Russia and the US is planned for the next two weeks and said that Russia will hold talks with the US to address irritants in bilateral relations, according to TASS. It was separately reported that Ryabkov said the US wants to achieve a quick ceasefire in Ukraine without long-term settlement and he explained to the US that a sole ceasefire in Ukraine is unacceptable, according to RIA.

- Russian Foreign Minister Lavrov is to visit Turkey on Monday and will discuss a range of topics including recent US talks on the Ukraine war and how Turkey can contribute.

- Russian Defence Ministry said Russian forces captured the villages of Ulakly and Novoandriivka in eastern Ukraine’s Donetsk region.

- Greek PM Mitsotakis told Ukrainian President Zelensky that it is up to Ukraine to decide on the peace framework acceptable to it and nothing can be decided without Ukraine.

- Poland’s President Duda told US President Trump that US presence in Poland and central Europe should be boosted.

- Hungary's PM Orban said Ukraine will never be a member of the EU against Hungary’s interests.

- EU Council President Costa said they decided to convene a Special European Council regarding Ukraine and EU defence on March 6th.

- Canadian PM Trudeau and US President Trump spoke on Saturday in which they discussed the war in Ukraine and combating fentanyl.

- Two EU Diplomats say EU Foreign Ministers approve 16th sanctions package against Russia.

Geopolitics: Other

- China defended its recent naval drills in the Tasman Sea and accused Australia of ‘deliberately hyping’ military exercises.

US Event Calendar

- 08:30: Jan. Chicago Fed Nat Activity Index, est. -0.05, prior 0.15

- 10:30: Feb. Dallas Fed Manf. Activity, est. 6.4, prior 14.1

DB's Jim Reid concludes the overnight wrap

Five years ago today, global markets first began to panic after a weekend that saw 11 Italian towns emerge from it in Covid lockdown. Five years later we had a mini panic on Friday as attention focused on a report earlier in the week about a new coronavirus discovery in bats, from the infamous Wuhan lab, with similar properties to Covid-19. Note there has been no reported transmission to humans as yet and as far as we know it's just been found in a lab. We're all probably paranoid and it's difficult to know what to do with that information but ahead of a weekend, and with memories of that fateful weekend five years ago, it was no surprise people wanted to lighten up with the S&P 500 (-1.71%) seeing its worst day of the year so far, extending declines after earlier stagflationary data that we'll discuss at the end. In overnight trading, US stock futures are back up with those on the S&P 500 (+0.49%) and NASDAQ 100 (+0.48%) higher.

Talking of five years, will the German election be seen as a pivotal moment when we look back on it in 2030? For financial markets the make-up of the Bundestag was probably as important as the overall results and the one line summary is that the centre-right and centre-left should have sufficient seats to form a grand coalition but overall the centrist parties are short of a two-thirds majority. This latter means that any future reforms of the debt break will be challenging and may require compromise and horse trading.

In terms of the details, the provisional results confirm a victory for the centre-right CDU/CSU (28.6%), followed by the far-right AfD (20.8%), centre-left SPD (16.4%) and Greens (11.6%). Of the smaller partis, the leftist Linke (8.8%) comfortably exceeded the 5% threshold, but the far-left BSW (4.97%) and liberal FDP (4.3%) fell short. BSW’s narrow failure to enter the Bundestag, which may take a few days to be definitively confirmed, has the important consequence of leaving the CDU/CSU and SPD combined with a projected 52% of the seats. That leaves the grand coalition as the most likely outcome, being the only option to avoid the need for three-party coalition given that mainstream parties have ruled out partnering with the AfD. Our Germany economists see the prospect of a two-party coalition led by a strong CDU/CSU as a positive for Germany's corporate sector, promising less policy gridlock and uncertainty than under the outgoing government. See their reaction here for more. Earlier in the night, CDU leader Merz said he wanted to form a coalition within the next two months.

While the outcome may reduce the risks of particularly fractious coalition talks, it still confirms an ongoing anti-establishment trend that has been visible both in Germany and Europe as a whole. The result marks the lowest ever vote share for the two major parties, even as the turnout (82.5%) was the highest since at least 1990. And it leaves the centrist parties short of a 2/3rds constitutional majority, with the CDU/CSU, SPD and Greens jointly at just under 66% of seats. That means any debt brake reform, including for defence spending, would require support from one of the fringe parties. This may not be impossible, but it would require significant political compromises.

After a nervy night, European assets gained traction as the likelihood of simple ‘grand coalition’ majority emerged. The euro is trading +0.58% higher this morning, touching a one-month high against the dollar, while DAX futures are up just over a percent and Euro Stoxx 50 futures are +0.46% higher. Meanwhile Bund futures are slightly down as I check my screens.

In terms of other events this week, Nvidia's earnings on Wednesday could be the biggest mover of markets. Interestingly of the 62 analysts who cover the stock on Bloomberg, 56 have a buy rating with only one sell. DB are currently one of only 5 with a hold rating. Outside of that inflation takes centre stage with US core PCE, German, French and Italian flash CPI, as well as Tokyo CPI all out on Friday with Spain's equivalent coming out on Thursday. In terms of the rest of the main global releases, the German Ifo survey today will be less relevant given the election but later we have the Dallas and Chicago Fed manufacturing surveys. Tomorrow sees the US Conference Board consumer confidence release which will be interesting after Friday's weak UoM equivalent. Wednesday sees US new home sales and Australian inflation. Thursday sees US durable goods and the ECB account of their January meeting and Friday sees US personal income and spending data and the ECB consumer expectations survey. There are also lots of central bank speakers through the week, including at the G20 central bankers and finance minister meeting in Cape Town on Wednesday and Thursday. You can see the main ones detailed in the day-by-day calendar at the end as usual, along with key earnings releases and all the other data.

Digging into the main US data this week now. According to our economists, Friday's personal income (+0.3% forecast vs +0.4% previously) and consumption (+0.2% vs. +0.7%) will likely be softer due to the LA wildfires and poor weather with the all-important core PCE deflator (+0.27% vs. +0.16%) higher but not as extreme as CPI due to softer subcomponents in the subsequent PPI. This would lower the YoY core PCE two tenths to 2.6%. In the US consumer confidence tomorrow, the jobs-plentiful / jobs hard-to-get series is important as a good proxy for the unemployment rate. For claims on Thursday our economists are looking to the DC area in particular given press reports of substantial federal government layoffs. Around 20% of the ~2.3mn federal government employees live in Washington DC, Maryland and Virginia. Our estimates are that there have been roughly 14k potential federal layoffs since the Trump Administration took office with another 12k pending the resolution of court cases. Clearly this is just within the first month.

Asian equity markets are mostly drifting lower at the start of the week following Friday’s significant losses on Wall Street. Across the region, the Hang Seng (-0.64%) with the Shanghai Composite (-0.26%) is also down. The KOSPI is -0.42% lower. Japanese markets are closed for a public holiday but Nikkei futures are around a percent lower. With this holiday there is no cash Treasuries trading in Asia.

Now recapping last week, which ended with a big risk-off move on Friday following more stagflationary US data alongside some scares around the reporting of the new coronavirus discovered by researchers at the Wuhan Institute of Virology. On the fifth anniversary of the first proper slump in markets associated with Covid that's the last thing the world wanted to hear. According to the journal that reported the story as long ago as last Friday the virus hasn't been detected in humans yet but this virus apparently enters cells using the same gateway as the Covid-19 virus. So that scared markets a bit and led to a spike in vaccine stocks like Moderna (+5.34% on Friday) just around the time Europe closed for the day.

However, the earlier data started the softness. First were the February flash PMIs, which saw the headline services reading (49.7 vs 53.0 expected) slump into contractionary territory for the first time in 13 months. At the same time, the PMI manufacturing input prices soared to their highest since October 2022 (+6.1pts to 63.5). Then 15 minutes later, the final University of Michigan consumer survey showed 5-10 year median inflation expectations spiking to a post-1995 high of 3.5% (up from 3.3% in the flash release), even as headline consumer sentiment slumped to a 15-month low. So that added to concerns over the US consumer that had emerged with a weak January retail sales print the previous Friday and Walmart’s disappointing results on Thursday morning. As ever we note that for long-term inflation expectations, the results are extreme along party lines with Democrat supporters expect 4.2% and Republicans 1.5%.

Nevertheless the overall backdrop weighed on risk assets, with the S&P 500 (-1.71%) posting its worst day of 2025 so far, leaving it -1.66% lower on the week. Most affected were small caps, with the Russell 2000 slumping -2.94% on Friday (-3.71% on the week), as well as tech stocks, with the Mag-7 down -2.51% (-3.52% on the week). Both indices fell into negative territory YTD. By contrast, in Europe equity markets closed before the worst of the US slump with the Stoxx 600 (+0.52% Friday) just about posting a ninth consecutive weekly gain (+0.26%).

Other risk assets also suffered on Friday, with US high yield credit spreads seeing their biggest daily spike YTD (+10bps to 271bps). And in the commodity space, Brent crude saw its largest decline since October (-2.97%), leaving it -0.71% down on the week to $74.21/bbl. However, gold advanced +1.86% on week to $2,936/oz despite a marginal retreat on Friday (-0.10%) from Thursday’s all-time high.

Bonds rallied amid Friday’s risk-off environment, with 10yr Treasury yields falling -7.4bps to 4.43% and posting a sixth consecutive weekly decline (-4.5bps). Over in Europe, 10yr bund yields also fell -6.4bps on Friday, but were still +3.7bs higher on the week to 2.47% after an earlier rise amid increased expectations of higher European defence spending.

Tyler Durden

Mon, 02/24/2025 - 07:59

Washington, D.C. Mayor Muriel Bowser speaks during a press conference as emergency response units continue to search the crash site of the American Airlines plane on the Potomac River in Arlington, Va., on Jan. 30, 2025. Kayla Bartkowski/Getty Images

Washington, D.C. Mayor Muriel Bowser speaks during a press conference as emergency response units continue to search the crash site of the American Airlines plane on the Potomac River in Arlington, Va., on Jan. 30, 2025. Kayla Bartkowski/Getty Images

Sen. Rand Paul is pushing for all Americans to have access to Health Savings Accounts, regardless of the specifications of their insurance coverage

Sen. Rand Paul is pushing for all Americans to have access to Health Savings Accounts, regardless of the specifications of their insurance coverage

Photo: NY Post

Photo: NY Post

Recent comments