Futures Fall On Tariff, Walmart Concerns; Gold Hits Another All-Time High

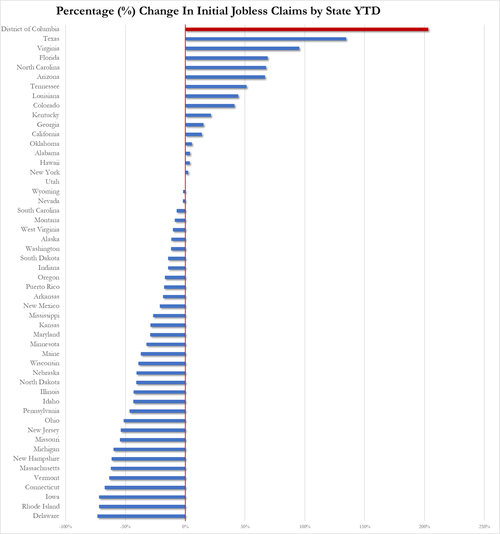

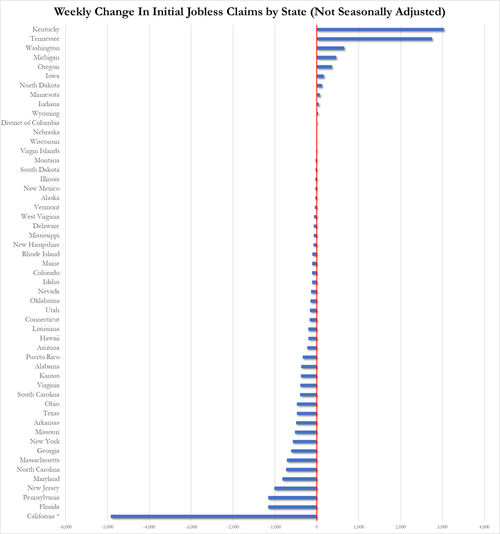

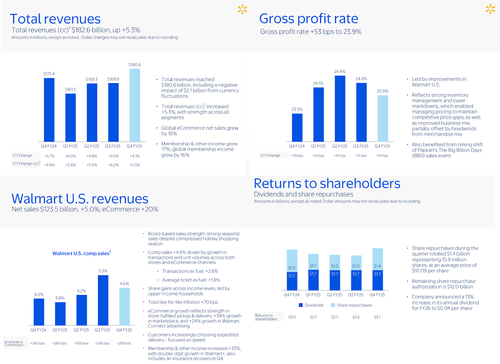

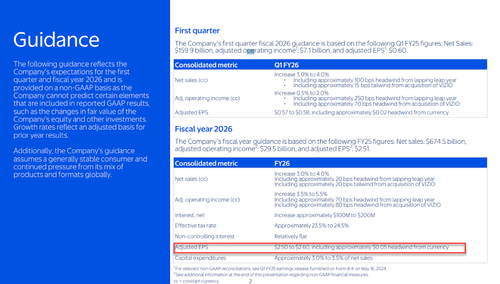

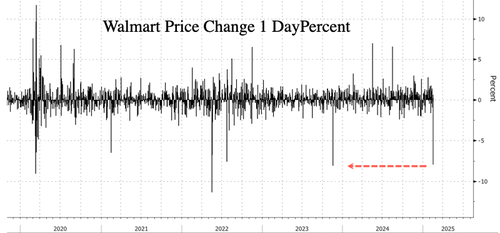

US equity futures slide from the latest record high as concerns around trade tariffs and a disappointing outlook from Walmart weighed on sentiment. As of 8:00am ET, contracts on the S&P 500 and the Nasdaq 100 slipped about 0.3% as Mag7 names are mixed with Semis lower. Palantir was among the biggest losers in US premarket trading, on track to extend Wednesday’s 10% slide, after Defense Secretary Pete Hegseth outlined plans to cut military spending by 8% over the coming years. Walmart plunged 8%, the most in a year, after the company's guidance disappointed Wall Street. Europe's Stoxx 50 continues its ascent rising 0.6% led by real estate and auto sector. The potential for a pausing of the Fed’s QT hinted in yesterday's FOMC minutes helped a late-day rally and Trump says a bigger China trade deal is possible but says there is a shot clock for Ukraine to find a deal. Bond yields are down 2-3bps with the USD weaker as the yen continues its recent surge. Commodities are seeing strength in both Ags and Metals; gold set a fresh all-time high above $2950. The macro data focus is on Jobless Claims and the Leading Indicator Index.

In premarket trading, Walmart plunged 8% after forecasting lower-than-expected profit for the full year, citing an uncertain economic environment. Some retail stocks decline after Walmart’s profit outlook: Costco (COST) -1.4%, Dollar Tree (DLTR) -1%, Target (TGT) -2%. Video game platform Vimeo and used car retailer Carvana also slumped in premarket after disappointing earnings. China’s Alibaba was a bright spot, adding more than 10% after third-quarter revenues beat estimates. Its result also helped lift Chinese e-commerce peers, with JD.com Inc. and PDD Holdings Inc. both rallying in premarket trading. Amazon is among the laggards in the Magnificent Seven stocks (GOOGL +0.04%, AMZN -0.6%, AAPL -0.3%, MSFT +0.2%, META -0.5%, NVDA +0.06% and TSLA +0.3%). Here are some other notable movers:

- Amplitude (AMPL) rises 17% after the software company forecast adjusted earnings per share for 2025 above the average analyst estimate. DA Davidson issues an upgrade, noting a faster turnaround in the business than anticipated.

- BioMarin (BMRN) jumps 9% after the drugmaker forecast adjusted profits and revenue for 2025 that impressed Wall Street. Cantor says the guidance sets the stage for another year of strong growth.

- Carvana (CVNA) drops 9% after the used-car retailer reported lower gross profit per vehicle and shrinking wholesale volumes for the latest quarter.

- Clearwater Analytics Holdings (CWAN) jumps 16% after the financial technology company provided a 1Q and year revenue forecasts that topped estimates.

- Grab Holdings (GRAB) slides 8% after the delivery company issued full-year revenue guidance that disappointed analysts.

- Herbalife (HLF) jumps 19% after the nutrition company reported fourth-quarter adjusted earnings per share that beat consensus estimates. The company named Stephan Gratziani as its CEO.

- NerdWallet (NRDS) rises 10% after the consumer-finance company forecast 1Q revenue that beat the average analyst estimate. The company announced the appointment of Jun Hyung Lee as CFO.

- Palantir Technologies (PLTR) shares fall 4% and look set to extend losses after dropping 10% on Wednesday on Defense Secretary Pete Hegseth’s plan to reduce projected US military spending by 8% over the next five years.

- Vimeo (VMEO) slumps 20% after the video platform forecast adjusted Ebitda for 2025 below what analysts expected, citing a desire to invest as much as $30 million incrementally in the business.

- Wayfair (W) falls 6% after posting a wider-than-expected 4Q loss.

The mixed corporate results added to market jitters over Donald Trump’s threats to widen trade tariffs and his wavering support for Ukraine and its European allies. The geopolitical tensions lifted gold prices to a new record above $2,954 an ounce.The dollar and Treasury yields slipped after Federal Reserve’s minutes revealed policymakers had discussed pausing or slowing its balance-sheet runoff.

“We saw a shift in the tone of the US on how they are going to approach the Russia-Ukraine environment, and this shifting tone is bringing about some uncertainty for markets,” said Shaniel Ramjee, investment manager at Pictet Asset Management.

Data on US weekly jobless claims are due later, with economists expecting the figure to hold more or less steady from the previous week. The report may also give an early insight into the impact of the Trump administration’s sweep of the federal workforce.

Europe’s Stoxx 600 index edged higher after Wednesday’s decline, though sombre earnings capped the recovery. The

Stoxx 600 climbed 0.3% after logging its largest drop this year on Wednesday even as shares in Renault SA, Mercedes-Benz Group AG and Airbus SE slipped after their results, while US-exposed defense stocks, such as BAE Systems Plc and Qinetiq Group Plc, also lost ground. Resource stocks are leading gains, while US-exposed defense names were undermined by US plans to cut military spending. Here are some of the biggest movers on Thursday:

- Centrica is the best-performing stock on the wider European benchmark, gaining as much as 11%, the most since 2020, after the British Gas owner reported strong results and an additional £500m share buyback.

- Schneider Electric gains as much as 8.3% on the back of an impressive fourth-quarter report, according to analysts, which see solid upside to current consensus after both key 4Q figures and 2025 outlook beat, with shares expected to show some relief after Chinese AI platform DeepSeek shook investor views.

- Repsol shares climb as much as 5.3 % after the Spanish oil company’s 4Q profit beat estimates.

- Lloyds shares rise as much as 4% to hit their highest level since late-2019 after the bank reported fourth-quarter earnings. Profits came in weaker than expected as it booked more provisions related to motor finance, but analysts at Shore said this is not a surprise.

- Carrefour shares drop as much as 8.2% in Paris to the lowest intraday level since May 2020, after the grocer issued 2025 guidance that analysts viewed as weak, with several predicting downgrades to profit expectations.

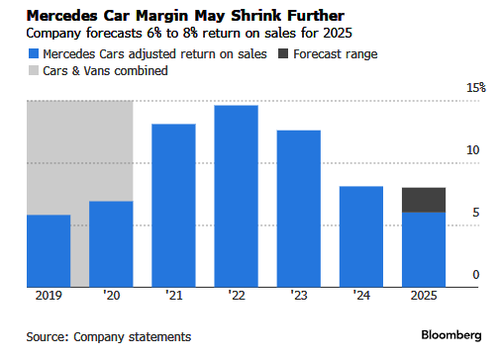

- Mercedes shares fall as much as 3.8% after the German automaker posts what Bernstein called “predictably weak” 2025 passenger cars outlook and its vans guidance missed estimates.

- Zealand Pharma shares drop as much as 7.3% after the Danish drug developer reported results for the full year and provided a forecast for net operating expenses in 2025.

- Airbus shares fall as much as 3.4%, the biggest intraday drop in three months, as analysts pointed to disappointing 2025 guidance from the plane maker, as well as an underwhelming result for its defense and space unit and dividend.

- BE Semi shares fall as much as 11% after the Dutch chip equipment firm reported quarterly orders that were nearly 30% below consensus estimates and provided guidance short of expectations.

- Tenaris shares fall as much as 4.5%, the most since August, on the back of its latest earnings. While the steel-tube and pipeline maker reported a solid beat on quarterly Ebitda, the company’s outlook is somewhat clouded by the threat of US tariffs.

Earlier in the session, stocks in Asia fell, as US-Ukraine tensions and the Fed's commentary on interest-rate cuts hurt sentiment. The MSCI Asia Pacific Index dropped 0.6%, the most in more than two weeks, with Hong Kong-listed shares among the biggest drags. Alibaba fell ahead of reporting earnings, while Meituan declined on a plan to expand its pension plan. Shares traded lower in Japan and Australia. The Fed’s openness to keeping rates on hold for longer, combined with increasing concerns about geopolitical tensions and trade wars, dented sentiment. Markets softened as investors watch whether remarks by US President Donald Trump that were highly critical of Ukraine’s leader might take “an ugly turn,” and what that would mean for Europe, said Charu Chanana, chief investment strategist at Saxo Markets.

In FX, the Bloomberg Dollar Spot index falls 0.3% as the Japanese yen strengthens 0.9% against the dollar, rising to its strongest level since December amid growing speculation the Bank of Japan will hike rates sooner rather than later. The Aussie dollar also outperforms its G-10 peers, adding 0.6% against the greenback after hiring topped estimates.

In rates, treasuries are steady, with US 10-year yields drop 3bps to 4.50%. Treasuries briefly ticked higher after Bessent said terming out US debt is “a long way off.” Bunds also little changed; gilts lag by about 3bp in the 10-year sector, bunds by about 1bp. Japanese 10-year government bond yields hit its highest level since 2009 on expectations of a strong inflation print on Friday. US session includes weekly jobless claims data, 30-year TIPS auction and four Fed speakers. Treasury sells $9b 30-year TIPS in a new-issue auction at 1pm New York time

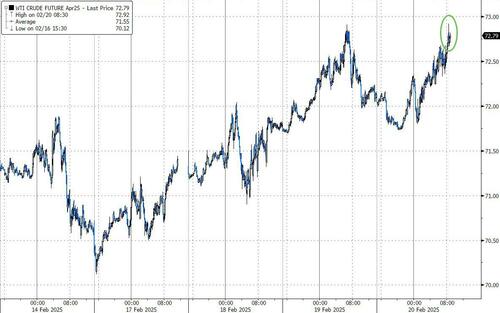

In commodities, oil prices tread water, with WTI near $72.20 a barrel. Spot gold rises $20 to a record high near $2,955/oz. Bitcoin rises 1% above $97,000.

Looking at today's calendar, US economic data calendar includes February Philadelphia Fed business outlook and weekly jobless claims (8:30am) and January Leading index (10am). Fed speaker slate includes Goolsbee (9:35am), Musalem (12:05pm), Barr (2:30pm) and Kugler (5pm)

Market Snapshot

- S&P 500 futures down 0.2% to 6,149.00

- STOXX Europe 600 up 0.3% to 553.77

- MXAP down 0.6% to 188.41

- MXAPJ down 0.7% to 593.51

- Nikkei down 1.2% to 38,678.04

- Topix down 1.2% to 2,734.60

- Hang Seng Index down 1.6% to 22,576.98

- Shanghai Composite little changed at 3,350.78

- Sensex down 0.3% to 75,733.72

- Australia S&P/ASX 200 down 1.1% to 8,322.82

- Kospi down 0.7% to 2,654.06

- German 10Y yield little changed at 2.55%

- Euro little changed at $1.0432

- Brent Futures little changed at $76.10/bbl

- Gold spot up 0.6% to $2,952.14

- US Dollar Index down 0.19% to 106.97

Top Overnight News

- U.S. President Donald Trump said on Wednesday he will announce fresh tariffs over the next month or sooner, adding lumber and forest products to previously announced plans to impose duties on imported cars, semiconductors and pharmaceuticals. Politico

- Trump said the golden age of the US is back and it is open for business, while he will be working with Congress to pass the largest tax cuts in US history and will dramatically cut taxes with no taxes on tips and hopefully no taxes on social security. Furthermore, Trump said they are considering a new concept where they will give 20% of the DOGE savings to American citizens and with 20% to go to paying down debt.

- Trump said he is not happy with Boeing (BA) about Air Force One and could buy a used plane or a plane from another country, but also commented that he would not consider buying a plane from Airbus.

- Senate Appropriations Chair Susan Collins told reporters Wednesday afternoon that funding negotiations with Democrats “are not going well” as lawmakers stare down a government shutdown deadline in just over three weeks. Politico

- US House Speaker Johnson says he is waiting on a "few" developments that "might have a big effect" on the reconciliation bill: Punchbowl

- Traders are ditching America-first wagers just a month into Trump’s second term. Instead of extending the period of US exceptionalism in global equities, the S&P’s record run has still left it trailing European, Chinese and Mexican benchmarks. BBG

- Fed Vice Chair Jefferson (voter) said the Fed can take time when weighing the next monetary policy move and US economic performance has been quite strong, while he added that US monetary policy remains restrictive, the US labor market is solid and inflation has eased but is still elevated.

- Fed's Goolsbee (2025 voter) said inflation has come down but it is still too high and once inflation has come down, rates can come down more.

- US Pentagon later commented that the budget review aims to save about USD 50bln which will be spent on programs aligned with US President Trump's priorities.

- US Commerce Secretary Lutnick said President Trump's goal is to abolish the Internal Revenue Service, according to a Fox interview cited by Reuters.

- TikTok makes global layoffs at trust and safety unit as part of restructuring, according to Reuters sources.

- Chinese officials on Thursday vowed to step up efforts to attract foreign direct investment as tensions with the US threaten to accelerate the exit of factories and research centers owned by multinational companies. China’s cabinet recently approved a 20-point action plan to stabilize investment from abroad. Nikkei

- The RBI is set to buy the biggest amount of bonds in four years to tackle a cash crunch in the banking system, according to economists. BBG

- More than 60% of Japanese companies — a record high percentage — plan to raise workers’ wages next year as they fight to recruit and retain staff. BBG

- The European Union is prepared to talk with the United States about reducing its 10 percent tariff on cars as part of a broader negotiation aimed at avoiding a transatlantic trade war. Politico

- UK consumer confidence sank to the lowest level since Labour came to power, the British Retail Consortium said. Half of those surveyed expect the economy to worsen over the next three months. BBG

- Fed officials can take their time before considering any additional rate cuts, Vice Chair Philip Jefferson said, citing the economy’s strength. Austan Goolsbee told an ABC affiliate that inflation is still too high. BBG

- Alibaba rose premarket after third-quarter revenue beat (ADR +6.5%). Revenue at Yuan 280B small beat with Est 277B, EPS at 21.4

Tariffs

- US President Trump said he will announce tariffs on cars, semiconductors, chips, pharma and probably lumber over the next month or sooner, while he is looking at a 25% tariff on lumber and forest products. Trump also said he is speaking to China on TikTok and later commented that a new trade deal with China is possible.

- EU Trade Commissioner Sefcovic said the EU is prepared to talk with the US about reducing its 10% tariff on cars as part of a broader negotiation aimed at avoiding a transatlantic trade war, according to POLITICO.

- China Commerce Ministry says China has been doing its best to push for EU negotiations. Hoped that the EU side will heed industry's calls and promote bilateral investment cooperation through dialogue. Urges the US to stop misleading the American people and international community. Urges the US to handle US-Sino relations in an objective and rational manner

A more detailed look at global markets courtesy of Newsquawk

APAC stocks mostly declined with sentiment dampened by ongoing geopolitical uncertainty and after US President Trump's latest comments in which he repeated criticism against Ukrainian President Zelensky and said he will announce tariffs on cars, semiconductors, chips, pharma and probably lumber over the next month or sooner. ASX 200 was pressured with mining, materials and financials among the worst performing sectors, while participants digested a slew of earnings releases including from the likes of Rio Tinto and Fortescue. Nikkei 225 suffered from the ill effects of a firmer currency and slipped beneath the 39,000 level as Japan's 10yr yield initially climbed to its highest since November 2009. Hang Seng and Shanghai Comp conformed to the downbeat mood amid trade frictions and US tariff threats, while China unsurprisingly maintained the Loan Prime Rates. However, the mainland index eventually returned to flat territory and there were recent reports that US President Trump is eying a bigger and better trade deal with China that would include substantial investment and commitments for China to buy more US products.

Top Asian News

- PBoC holds a 2025 macro prudential work conference; will step up the analysis of macroeconomic and financial work. Real Estate: Will help the real estate market stop falling and stabilise. Support the construction of a new model of real estate development. Yuan: Will promote cross-border use of Yuan. Will develop Yuan offshore market. Will let currency swap and Yuan settlement play their roles.

- Times' Waterfield posts "Russia pressed the US to withdraw security guarantees from eastern European and Nordic Nato allies in Riyadh, a new “Yalta” to divide Europe into spheres of American and Russian influence, according to a senior Romanian official".

- Chinese Loan Prime Rate 1Y (Feb) 3.10% vs. Exp. 3.10% (Prev. 3.10%); 5Y 3.60% vs. Exp. 3.60% (Prev. 3.60%)

- RBNZ Governor Orr said he is feeling more positive about the inflation situation and expects the cash rate will be around 3% by year-end, while he added “in an environment of low and stable inflation”. Orr later commented that there would have to be an economic shock to cut by 50bps again.

- NetEase Inc (NTES) Q4 2024 (USD): EPS 1.89 (exp. 1.76), Revenue 3.70bln (exp. 3.71bln)

- Alibaba Group Holding Ltd (BABA) Q4 2024 (CNY): EPS 21.39 (exp. 19.12.), Revenue 280.154bln (exp. 279.34bln)

European bourses (STOXX 600 +0.3%) opened mixed, but sentiment has gradually improved as the morning progressed to display a more positive picture in Europe, paring back the hefty losses seen in the prior session. European sectors hold a positive bias vs initially opening mixed. Basic Resources is the clear outperformer, with gains facilitated by strength in metals prices alongside post-earning upside in Anglo American (+3%) and Rio Tinto (+1%). Banks are towards the middle of the pile; Lloyds (+3.6%) saw its profit plunge 20%, but optimism stems from a GBP 1.7bln share buyback. For the Autos sector, both Mercedes (-2.5%) and Renault (-2.4%) dip after their results.

Top European News

- French President Macron to visit the US early next week, it is unclear whether this will be a joint meeting with UK PM Starmer, is likely US President Trump will meet them separately, according to reporter Rahman.

- Nordea believes the Riksbank will not deliver any further rate cuts and will remain at 2.25% for the entire horizon (prev. expected a cut to 2.00% in May); due to inflation being higher than expected.

FX

- USD is softer vs. all peers with DXY hampered by strength in the JPY on account of widening yield differentials. US yields were knocked lower post-FOMC minutes after the account showed various participants believed it might be appropriate to pause/slow balance sheet runoff. Today's Fed speaker slate includes Goolsbee, Musalem, Jefferson & Barr. Elsewhere, today's other scheduled highlights include Treasury Secretary Bessent at 12:00GMT/07:00ET on Bloomberg TV with weekly claims and Philly Fed data to follow thereafter. DXY has returned to a 106 handle but is currently holding above Wednesday's 106.87 low.

- EUR is slightly firmer vs. the USD but to a lesser degree than most peers following losses on Tuesday and Wednesday. On the trade front, EU Trade Commissioner Sefcovic said the EU is prepared to talk with the US about reducing its 10% tariff on cars as part of a broader negotiation. EUR/USD is currently stuck within yesterday's 1.0400-61 parameters.

- USD/JPY retreated overnight amid initial gains in Japanese yields (and softness in their US counterparts post-FOMC minutes) alongside the negative risk appetite in Tokyo. The pair breached below the 150 mark in early European trade; further downside brings into play its 9th December low at 149.68.

- GBP is a touch firmer vs. the USD but to a lesser degree than peers. UK newsflow for today has been light in a week where markets have digested firmer than expected labour market data and a mixed inflation report. Direction for Cable may be dictated more by the USD leg of the equation; currently tucked within Wednesday's 1.2562-1.2639.

- Antipodeans are both notably stronger vs. the USD with AUD bolstered by stronger-than-expected jobs data in Australia in which employment change topped forecasts at 44k (exp. 20k) and was solely fuelled by full-time jobs. Sentiment was also bolstered by comments from US President Trump that a new trade deal with China is possible.

- PBoC set USD/CNY mid-point at 7.1712 vs exp. 7.2856 (prev. 7.1705).

Fixed Income

- USTs are modestly firmer. Action for USTs was pronounced in the later part of the US session given FOMC Minutes, 20yr supply, Trump/tariff updates and a handful of speakers. Since, US-specific newsflow has slowed a touch and we are now largely awaiting further details on Trump’s latest remarks, US data, Fed speak and the US Treasury Secretary. As it stands, USTs are holding toward session highs of 109-04+ having eclipsed Wednesday’s 109-00 best.

- Bunds are in the red. Bear-steepened on Wednesday before lifting off worst in-fitting with Treasuries, a move which slowed in APAC trade but briefly recommenced early doors this morning to a 131.63 peak. Though, this proved fleeting with the constructive European risk tone, ongoing reassessment following Schnabel’s hawkish remarks on Wednesday and the implications of Trump’s latest rhetoric weighing. Given this, Bunds continue to bear-steepen with the German 10yr yield notching an incremental new 2.55% WTD peak.

- On auctions, Spain was strong but spurred no move while the record French offering saw a 5x cover for the 2029 line and the top-amount sold. Lifting OATs from a 123.00 low by 15 ticks, sending them just into the green for the session.

- Gilts are echoing EGBs. The arguments around tariffs are much the same. Specifics include confirmation that UK PM Starmer will be visiting the US next week to meet with US President Trump. Potentially of note, initially reporting around this intimated it could be a joint visit with French President Macron - updates since suggest this is not the case. Currently at the lower-end of a 91.96-92.29 band.

- Italian Foreign Minister says they need European bond issuance to finance defence spending.

- Spain sells EUR 5.5bln vs exp. EUR 4.5-5.5bln 2.40% 2028, 2.70% 2030 & 3.55% 2033 Bono.

- France sells EUR 13.5bln vs exp. EUR 11.5-13.5bln 2.4% 2028, 0.0% 2029, 2.75% 2030 OAT.

Commodities

- A choppy session for crude prices thus far with the complex subdued in early European trade after experiencing gains in late APAC trade, and following Wednesday's indecisive performance amid geopolitical uncertainty due to the recent US turnaround in foreign policy and with prices contained after bearish private sector inventory data. Brent resides in a 75.72-76.30/bbl range.

- Subdued action in natural gas with prices in Europe subdued by the prospect of milder weather in the upcoming period. Earlier today, a Russian attack damaged Ukrainian gas production facilities, according to the Energy Minister.

- Precious metals trade higher across the board amid the ongoing geopolitics, tariffs, USD weakness from FOMC minutes, and broader momentum after spot gold hit a fresh record high this morning. Spot gold topped USD 2,950/oz to a USD 2,954.95/oz peak at the time of writing (vs low 2,933.85/oz).

- Base metals trade higher across the board following a choppy APAC session but with the complex later supported by the softer Dollar and as sentiment during early European trade tilts higher. 3M LME copper resides in a 9,452.95-9,547.00/t range at the time of writing.

- Russian attack damaged Ukrainian gas production facilities, according to the Energy Minister. Brent resides in a 75.72-76.30/bbl range.

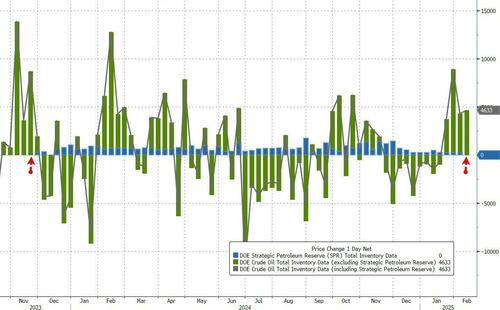

- US Private Inventory Data (bbls): Crude +3.3mln (exp. +2.2mln), Distillate -2.7mln (exp. -3.5mln), Gasoline +2.8mln (exp. +0.8mln) Cushing +1.7mln.

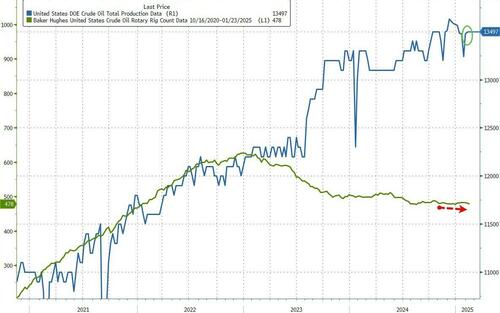

- US President Trump said they will fill up the SPR fast and will cut taxes on domestic producers of oil and gas.

Geopolitics

- Russia's Kremlin says if the UK were to deploy 30,000 European troops in Ukraine, it would be a concern.

- Russia's Kremlin say they have resumed talks on the prisoner exchange with the US

- Ukrainian President Zelensky is scheduled to meet Thursday in Kyiv with US envoy Kellogg and said it is crucial that this discussion and the overall cooperation with the US remain constructive, according to Axios' Ravid.

- US President Trump said he spoke with Russian President Putin and Ukrainian President Zelensky to end the war, while he repeated language that suggested Ukraine started the war, as well as stated that Zelensky could have come to talks if he wanted to and had done a terrible job. Furthermore, Trump said he hopes to see a ceasefire soon and separately noted a deal can be made with Russia, while he also stated that they are going to resurrect the critical mineral deal with Ukraine and that Greenland is needed from a security standpoint.

- Russian Deputy Chief of Staff said Ukraine's losses exceeded one million military since the start of the military operation 3 years ago, according to Al Jazeera.

- Russian general staff said more than 800 square km of the Kursk region were taken back from Ukrainian forces which is about 64% of the total taken by Ukraine and Russia is advancing in all directions in the Kursk region.

- Russia conducted an attack on Kyiv on Wednesday evening in which powerful explosions were reported to shake the capital, while authorities reported air defences were in action, according to Kyiv Post.

US Event Calendar

- 08:30: Feb. Initial Jobless Claims, est. 215,000, prior 213,000

- 08:30: Feb. Continuing Claims, est. 1.87m, prior 1.85m

- 08:30: Feb. Philadelphia Fed Business Outl, est. 14.3, prior 44.3

- 10:00: Jan. Leading Index, est. -0.1%, prior -0.1%

Fed speakers

- 09:35: Fed’s Goolsbee Speaks in Moderated Q&A

- 12:05: Fed’s Musalem Speaks to Economic Club of NY

- 14:30: Fed’s Barr Speaks on Supervision and Regulation

- 17:00: Fed’s Kugler Speaks on Inflation, Phillips Curve

DB's Jim Reid concludes the overnight wrap

Markets put in a divergent performance over the last 24 hours, with US assets continuing to reach fresh highs, even as the rest of the world struggled on the back of President Trump’s tariff threats and concerns about Ukraine. By the close, that meant the S&P 500 (+0.24%) was at another record, whilst the 10yr Treasury yield (-1.8bps) fell to 4.53%. But over in Europe it was a very different story, as the STOXX 600 (-0.91%) suffered its biggest daily decline of 2025 so far, and a bond sell-off sent 10yr yields up to a 3-week high across much of the continent. Moreover, that slump has continued in Asia overnight, as the Nikkei (-1.30%) and the Hang Seng (-0.93%) have both lost ground, and the 10yr Japanese government bond yield has hit a post-2009 high of 1.43%. So the moves mark a pretty big shift from the trend so far in 2025, as US risk assets have generally underperformed their global counterparts, particularly in Europe.

As a reminder, the latest slump for European assets came as they reacted to President Trump’s tariff threats on Tuesday night. That’s where he said he’d impose automobile tariffs “in the neighbourhood of 25%”, and that for semiconductors and pharmaceuticals “it’ll be 25% and higher, and it’ll go very substantially higher over a course of a year”. And even though President Trump said that the tariff rate on autos would probably be announced on April 2, the sector quickly saw decent losses in anticipation of that. For instance, Germany’s DAX (-1.80%) experienced the biggest decline of the major European indices, with automakers like Volkswagen (-2.78%) and BMW (-2.28%) underperforming. Similarly in the US, automakers like Stellantis (-2.11%) and General Motors (-0.69%) also lost ground. And there were struggles for trade-sensitive areas more broadly, as the NASDAQ Golden Dragon China Index (which includes companies traded in the US which do a majority of business in China) fell -0.38%.

European markets also weren’t helped by the latest developments over Ukraine, as there was a reversal in hopes for a resolution of the conflict. That followed a social media post from President Trump that was highly critical of Ukrainian President Zelenskiy, referring to him as “a dictator without elections”. This followed President Zelenskiy’s comments earlier in the day that US proposals on Ukrainian minerals were “not a serious conversation”. So that backdrop led to a renewed underperformance for regional assets, including Ukraine dollar bonds and CEE currencies.

There wasn’t much respite for European fixed income either, where yields on 10yr bunds (+6.4bps), OATs (+8.4bps) and BTPs (+9.4bps) all hit a 3-week high. One factor behind that were comments from the ECB’s Isabel Schnabel, who said in an FT interview that they should begin to discuss a “pause or halt” to rate cuts, and that inflation risks were becoming “skewed to the upside”. So even though another rate cut is still widely expected at the next meeting in two weeks’ time, there’s now more doubt among investors about whether that’ll be followed up by many more. Indeed, overnight index swaps are only pricing in 36bps of rate cuts by the meeting-after-next in April, meaning that one 25bp cut is fully priced, but then there’s only a 44% probability of a second cut by then.

On top of Schnabel’s comments, investors also had to grapple with the ongoing prospect of higher defence spending and more borrowing. We should get a better idea on this after the German election on Sunday, where there’s a lot of attention on whether the next government will relax the constitutional debt brake. Our economists have published an extensive primer on this weekend’s vote (link here), which runs over what the different outcomes would mean for the likelihood of a fiscal regime change.

Here in the UK, gilts lost ground as well after the January CPI print surprised on the upside. It showed headline inflation jumping up to +3.0% (vs +2.8% expected), which is its highest level in 10 months. Moreover, the core CPI reading was even higher, jumping up to a 9-month high of +3.7%, in line with expectations. So just like their counterparts on the continent, 10yr gilt yields (+5.3bps) hit a 3-week high of 4.61%, which came as investors dialled back the likelihood of rate cuts from the Bank of England. And more widely, there are still several global inflationary pressures in the pipeline, as Bloomberg’s Commodity Spot Index (+0.24%) moved up to a fresh two-year high yesterday.

Over in the US, Treasury yields moved lower after the minutes of the Fed’s January meeting featured a discussion about slowing the pace of QT. Specifically, it said that given “the potential for significant swings in reserves over coming months related to debt ceiling dynamics, various participants noted that it may be appropriate to consider pausing or slowing balance sheet runoff until the resolution of this event”. For more on the balance sheet discussions, see our US rates strategists’ reaction here. On rates, the minutes echoed the signal that there was no hurry to adjust policy, as “many participants noted that the committee could hold the policy rate at a restrictive level if the economy remained strong and inflation remained elevated.” But with the QT news, that meant by the close, 10yr yields were down -1.7bps to 4.53%, while 2yr yields were down -3.8bps to 4.27%. That’s continued overnight as well, with the 10yr yield down another -2.0bps to 4.51%.

US equities also saw a much better performance than in Europe, with the S&P 500 (+0.24%) advancing to a new record. The advance was led by defensive sectors, with health care (+1.26%) and consumer staples (+0.79%) leading the way, while energy stocks (+0.70%) also outperformed as WTI crude oil prices (+0.56% to $72.25/bbl) advanced for the second day in a row. However, homebuilders saw a significant decline after the latest housing data surprised on the downside. In particular, housing starts fell to an annualised pace of 1.366m in January (vs. 1.390m expected), which was a -9.8% drop from the previous month.

Overnight in Asia, markets have continued to lose ground, with all the major equity indices moving lower. In Japan, that’s come amidst mounting expectations of future rate hikes, which have pushed the 10yr yield up to a post-2009 high of 1.43%, whilst the Japanese Yen has moved up to its strongest against the dollar so far in 2025, at 150.30. The Nikkei itself is also down -1.30%, and consensus is expecting headline inflation to jump up to +4.0% in tomorrow’s CPI report, the highest in two years.

Elsewhere in the region, Australia’s S&P/ASX 200 is down -1.14%, which follows a stronger-than-expected employment report for January out this morning. That showed employment up +44k (vs. +20k expected), so investors dialled back the likelihood of another rate cut from the RBA in response, and the Australian Dollar has strengthened +0.28% against the US Dollar overnight. Elsewhere in the region, those equity declines are also evident, with the Hang Seng (-0.93%), the KOSPI (-0.84%), the CSI 300 (-0.25%) and the Shanghai Comp (-0.03%) all losing ground as well. And looking forward, even US equity futures are pointing towards a slip back from their record highs, with those on the S&P 500 down -0.29%.

To the day ahead, and data releases from the US include the weekly initial jobless claims, and the Conference Board’s leading index for January. Over in the Euro Area, we’ll also get the European Commission’s preliminary consumer confidence reading for February. From central banks, we’ll hear from the Fed’s Goolsbee, Musalem, Barr and Kugler, along with the ECB’s Makhlouf and Nagel. Lastly, today’s earnings releases include Walmart.

Tyler Durden

Thu, 02/20/2025 - 08:24

Via TOI

Via TOI

Members of the US-backed SDF, file image

Members of the US-backed SDF, file image

Recent comments