A Million Things To Parse

By Peter Tchir of Academy Securities

A Million Things to Parse?Given the nonstop barrage of headlines, it might seem like there are a million things to parse? But maybe there is a subset of things that we can focus on to try to determine the direction of the market? It won’t make the task of coming up with answers easier, but it might make it manageable. Messy, but manageable remains a theme.

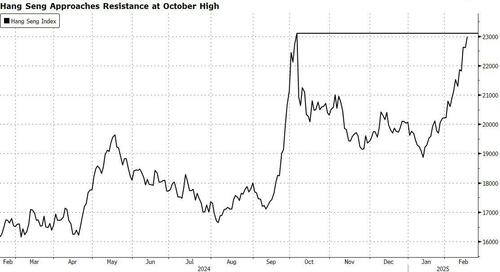

Academy was on Bloomberg TV on Friday, and I don’t think we could have scripted a set of issues this important to markets that are in Academy’s wheelhouse any better. The Full Clip starts at the 1:39:45 mark, but they also produced this smaller segment Tchir is Bullish on China, U.S. Chipmakers, and European Stocks.

Getting out of DOGENot a day goes by without a slew of DOGE-related headlines. I’m not sure if this is true, but it was so interesting that I figured I’d pass it along. Apparently, internet searches for “criminal lawyers” is “off the charts” in the D.C. area and a massive inventory of homes for sale has come on the market in recent weeks. Honestly, I’m not sure if those rumors are true, but the fact that the stories are circulating so widely is telling. I did find one “source” but the “source” for that “source” was GROK, which somehow seems fitting with everything going on.

On DOGE:

-

Headline after headline of waste that is being reduced. Even if a fraction of the headlines are accurate, the ability to cut spending seems high. That is without focusing their attention, yet, on some of the big-ticket items in the budget. DOGE alone seems able to help with the goal of reducing the deficit.

-

Accountability and Transparency. Or, simply, audits. There seems to be overwhelming support for accountability and transparency. As deficits have skyrocketed, in good and bad economic times, more people are left wondering where their tax dollars are going. Initial indications are that they are not being treated as carefully as we, the taxpayer, might like.

-

Mistakes as well. The “other side” of the story is also emerging. What if certain things being cut as “fat and waste” are actually useful and important? What happened to the cryptic tweet about “discrepancies in Treasuries?” That one seemed unlikely to be true and has quickly disappeared from the ether. Chatter about paying lots of people who are 150 years old seems to be getting debunked as it may be an issue with COBOL dates. Not sure whether the root of the issue has been figured out, but it seems insane to me that systems run on COBOL, which was already falling out of favor when I was programming, last century.

So far, I think DOGE has been helping support Treasuries. DOGE provides some element of hope that bigger chunks of the deficit can be trimmed, without major repercussions to the economy or markets, than previously thought. The excitement about what DOGE can do to the bigger line items is real. The risk that the approach is too simplistic (with too many mistakes) is there as well, but so far, there seems to be enough low hanging fruit to feed an army.

The fact that Secretary Bessent and others seem focused on longer term yields (and not just the front end of the yield curve) is also encouraging. Their task of slowing the steepening may be Herculean, but it is helping, and something, as a Treasury bear, that I’m watching closely.

Enemies Close, Friends Less SoThe adage of “keep your friends close and your enemies closer” seems to be getting turned upside down.

-

China got hit with “only” a 10% “fentanyl” round of tariffs. TikTok remains under Chinese ownership. The administration seems to be reaching out to Xi, as much, or more, than Xi seems to be reaching out to us.

-

Tossing out the idea of China, the U.S., and Russia cutting their defense spending in half seems a bit dubious. We mentioned transparency earlier, and that is never a word I would use to describe China’s official data. Of all the things that have been “tossed out there” as ideas, this one seems, uhm, not so great? If I’m China, I sign on the dotted line instantly and then spend more than ever. Probably the same for Russia, though not sure what they have to spend, though that could change on the back of any agreement to end the fighting in Ukraine.

-

-

Russia back in the G-7? Not sure Europe wants that at all (see the title of this section). Not sure if calling it the G-7 was a slip, as it should be the G-8 if Russia is back, or it is a veiled threat that one member might get kicked out? This could be like quantum physics – with both answers being true at the same time!

-

“Friends” sometimes need to be reminded that they too need to act in certain ways to remain friends. From trade practices to defense issues, relationships need to benefit both sides. Friends that are only “take, take, take” don’t make for good friends for the longer term. Having said that, most relationships are rarely that one sided.

-

Canada and Mexico are dealing with the “third round” of tariffs. See Reciprocal Tariffs from Thursday for more thoughts on the subject as a whole. Two countries, which could be a big part of shifting supply chains back to one heavily dominated by the U.S., seem to be absorbing the brunt of the president’s ire so far. Not sure if that is the best strategy. So far, so good, but it does seem to go against the adage of what to do with friends.

-

Hegseth and Europe. The Munich speech was aggressive and presumably designed to motivate Europe to do more, so the U.S. can step its spending and efforts back. Reasonable, to some degree, but not without longer term risks.

-

My simplistic world view, which has served us well, has been:

-

On one side you have China. China is “circled” by their “bad actor” relations – Russia, Iran, and North Korea. Beyond that, China has wrapped their tentacles around many autocratic, resource-rich nations. China is a large importer of raw resources from certain nations, and in many cases, their Belt and Road Initiative is very involved in the infrastructure of those nations. I’m less worried about the BRICS as any sort of organization, than I am about their ability to act as an effective barter system for Chinese brands. There are openings into parts of Europe where current weak economic conditions, coupled with more reliance on China, make them susceptible to growing trade with China, potentially at the expense of the U.S.

-

On the other side you have Europe, Canada, Mexico, Central America, and South America as opportunities. Africa could be a bonanza for the U.S., as China’s behavior has not endeared it to some of the countries that they are involved with. Plenty of opportunities, but an interesting start on this front.

An interesting start to relationship building. So far, it seems to be working, but these things take time to play out. There may yet come a time when the U.S., in its efforts to “nudge” countries to do more, pushes too far. Not even close to being there yet, but I expect some pushback rather than “ring kissing” in the coming weeks, which should upset markets.

What Did You Think the End of Russian Hostilities Would Look Like?The level of global confusion, if not outrage, about a possible deal to stop the fighting between Russia and Ukraine is surprising. It is, for better or worse, following the path that Academy has been laying out. Our assessment wasn’t based on what people would “like” to happen, but what their experiences with the individuals involved and the current state of the battlefield led them to conclude would happen.

Two things that finally seem to be getting the attention they deserve with respect to the talks:

-

Russia’s frozen dollar reserves are a big bargaining chip. The U.S. is trying to determine how much can be legally kept. The more the better. But the reality is that any agreement will likely include Russia getting some back, with some being used to pay off Ukraine’s debts and to fund the rebuilding.

-

Zelensky isn’t that popular within Ukraine any longer. Now, it appears, out of nowhere, we are seeing articles about his inability to win an election and that is why he is choosing not to hold one. That has been part of our take on the situation for months, which is why he is likely going to take a deal that goes against a lot of what he publicly claimed he needed to do a deal.

There is one twist, which I’m still trying to make sense of:

- Getting access to Ukraine’s resources as payment for services already rendered. While fully on board with the idea that the U.S. will benefit from supporting the rebuilding efforts, “re-trading” something always rubs me the wrong way. The U.S. and U.S. companies should do well in the rebuilding. But do we change the terms of what was already done? Maybe, I guess, framing it as the way we want them to repay their debt makes it ok, but I cannot help but wonder if other nations will view it quite that cleanly? If they don’t, probably not a big deal in the here and now, but in the future?

When asked about the president’s two greatest strengths, I pounce on the phrase:

- Simple and Transactional. He is quick to cut to the chase. To see through a lot of the messiness and get to the point. Deals are good. They don’t need to be all-encompassing deals. Each deal can be struck on its own merit, and we can move along by keeping things simple and transactional.

Wow, I feel like we are back to quantum physics, but when thinking about the president’s two greatest weaknesses, I get right back to:

- Simple and Transactional. As great as KISS is, there are things that are complex. The devil can be in the details. While everyone likes a good deal, there is a tendency to do more deals with those you trust over time (where you build a rapport). The need to “win” every deal may not lead to optimal outcomes down the road.

As we examine everything this administration is trying to accomplish, and think about how it will affect businesses, the economy, and markets, it is the balance of the simple and transactional that we will be forced to weigh. What are we getting today? What are we getting set up for down the road?

Mar-a-Lago AccordIs all of this setting up for some push towards a “Mar-a-Lago Accord?” There has been an increasing amount of chatter about a so-called Mar-a-Lago Accord.

Most of what we’ve written about today, and in the past, fits well.

Talk of an External Revenue Service, which would focus on generating income from “foreign” sources, primarily trade. We haven’t discussed this specifically, but it fits well within our view (and concern) that the administration could decide that they like the revenue from tariffs so much that it becomes an increasingly important part of our budget process. My concern is that the benefits are felt immediately (more income), but the shifts in supply chains and relationships might be damaging longer term.

Discussions about moving more assets to the Sovereign Wealth Fund and valuing them at market prices. Our expectation is that we would look to move gold, some land, and other assets into a sovereign wealth fund.

-

For gold and some other assets, it might be a way to mark them to market. We’ve always tried to point out that for every corporation, people discuss the asset and liability side of the balance sheet, but for the government, we are only fixated on the liability side. I’m not a proponent for selling off national parks to the highest bidder, but trying to better account for U.S. assets would be good.

-

It may open the way for the government to strike deals with the private sector that ensure that the rights and privileges granted are not overturned by the next administration, or the one after that. My biggest concern about “refine baby refine” or now “National Security = National Production” has been whether corporations will be convinced that a favorable regulatory environment will remain in place for the duration of their project. I could see the sovereign wealth fund being a vehicle that could be used to structure deals with more regulatory certainty which would be good for my National Security = National Production view.

Paying for U.S. “trade protection” (the Navy in particular, but all branches of the armed forces) by “forcing” countries to buy Treasuries at off-market prices. Chatter of paying par for 100-year bonds with a 0% coupon. Lots of chatter on this, but this seems like it could hit a number of roadblocks, especially as it seems like the view is that countries may have to pay for protection that was already afforded to them. I assume this would have the “benefit” of reducing our spending (others now are paying for it) and lowering the cost of funding the debt (off-market prices would do that). Both might backfire, especially on the off-market pricing. We already “broke” one “covenant” when we froze Russia’s dollar reserves. It sent a clear signal that if you are a bad actor, your dollars are not necessarily yours. This would breach another covenant along the same lines. The debt we owe you is subject to our needs at some point in time. It won’t overwhelm markets on day one if something like this is implemented, but I’d bet against it helping yields in the longer run and it would likely hasten deglobalization.

Things do seem to be funneling in this direction, but I don’t think we’ve missed much by addressing the various topics individually rather than under the banner of the Mar-a-Lago Accord.

How Much More Good News Can Bitcoin Handle?I’m not sure I’ve ever been this confused about Bitcoin. I’ve lost count of how many states, countries, and companies are “discussing” Bitcoin or crypto reserves (I really wanted to write “spouting off” but restrained myself). Yet, here we are still below $100k on Bitcoin.

Maybe the average investor has figured out that crypto enthusiasts can pay people to pump crypto and some of the most vocal pundits are paid and heavily conflicted (I really wanted to use “shills,” but restrained myself, again). Maybe it was that in Argentina, which has been in the headlines, in a good way, of late, there was a “rug pull” of a meme coin that seemed to have President Milei’s endorsement. At least during the few moments when the meme coin (LIBRA) did well, though social media seems to have been scrubbed of those endorsements. Or maybe, and this seems weird, so many big institutions are showing up with Bitcoin ETFs rather than “physical” (an oxymoron for a bunch of 1s and 0s), then having to explain how it is easier to own in ETF form rather than in their own wallets. That does seem a bit strange.

With all the headlines, I’d expect crypto to be soaring. It isn’t.

Crypto seems much more correlated with the market of late. Partly because of real world links (the ETFs and crypto-focused firms in major indices) and partly because it’s all part of the same sentiment/trade. I’m keeping an eye on this closely, as crypto can lead the way, particularly to the downside, for U.S. risk assets.

The Gold ArbitrageArbitrage is a term thrown around loosely. It should only be used when you can buy and/or sell things where the up-front cost/fee of putting the trades on converges to a point where you are guaranteed a profit. I warn you not to Google “Bitcoin arbitrage” / ”Bitcoin yield” as they are currently being used because it might make your head explode.

There is a “real” arbitrage between the price of gold in New York and London. Gold is fungible. There are storage and delivery costs that need to be accounted for, but the potential for arbitrage exists.

The relationship between New York and London gold prices has generally been stable. Of late, the price of gold in the U.S. is now significantly more than the price in London, relative to history.

Presumably, it is largely because of concerns about tariffs. When going through my notes on tariffs, thoughts and concerns on gold were, ummm, nowhere on my list. Or at least far enough down, that I hadn’t thought about it.

Yet, here it is, being influenced by tariffs.

There is only one reason why I bring this up – it is the first sign of tariffs affecting liquidity.

When we gets shifts in relationships (arbitrage conditions, volatility, cross-asset correlation) there is increased risk that one or more dealers get caught “offsides.”

That can tend to reduce the liquidity, obviously in the market in question, but it can also reduce liquidity more broadly.

If liquidity in precious metals breaks down, could it hit other commodities? As it hits other commodities, it leaks into the stocks (and bonds) of those companies that are related.

So on and so forth.

At the moment, what is going on in gold is registering as “mildly intriguing,” but given my view of market structure (the faux liquidity of algo-driven market making), it is yet another thing to keep an eye on.

National Security = National ProductionI’ve given up on getting “Refine Baby Refine” to resonate. But, I have not given up on my belief that everything that is considered necessary for national security will generate a lot of attention from this administration. With the goal of being as independent as possible (and certainly independent of China, Russia, etc.) for those items.

Those items include commodities, the processed (or refined) versions of the commodities, chips, and some medical/pharma/biopharma items as well. Energy production certainly falls into this camp as well, since if we want to dominate AI and chips, we will need energy and power to do that.

If you position your portfolio around National Security = National Production, you should fare well under this administration. Maybe that will resonate better than “Refine Baby Refine.” In any case, “Drill Baby Drill” barely scratches the surface of what national security is pushing for and what seems to be getting a very positive reception from this administration.

Over time, this will keep a lid on inflation, but I don’t see how we get to extracting, processing, or producing anything in scale, without first experiencing some inflation.

Bottom LineMillions of things are going on, but using terms like “simple” and “transactional” can help us focus on what is most important. However, we need to be aware of the failings of simple and transactional, at the same time, to avoid getting blindsided.

Credit still seems boring.

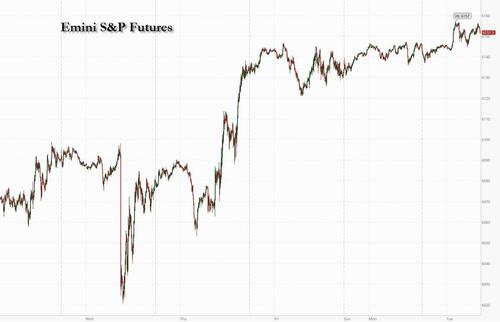

Yields are lower than my targets, but I do understand why. I’m not buying into the bullish arguments as much as the market is, but I am considering them, and wondering if I’ve underestimated the positives for bond yields? I don’t think so, but I have to keep it in mind.

Equities have plenty of opportunities, but I’m focused on the most shorted, least loved assets right now. We haven’t had a really good (meaning vicious) rotation lately, and I’m betting that we see that coming soon. Look for foreign markets to outperform. Look to own companies that will benefit from the National Security = National Production view of this administration.

Bitcoin has so many positives, but it keeps muddling along, so I’d be very tempted to dump it or short it here. This probably means that by Tuesday morning we will be at new all-time highs, but something is rotten in the state of Denmark (separate from Greenland – yeah, I had to go there!).

Good luck, and I am hoping for a Canada/U.S. rematch in the 4 nations series, as Saturday night’s game embodied the old joke, “I went to a fight and a hockey game broke out” with 3 fights in the first 9 seconds! Old school hockey! Both sides will be putting on the foil if we get to that rematch!

This is the same kind of preparation we need for dealing with these markets and the slew of headlines (for those who think we have a few weeks of no tariff-related headlines after last week’s vague announcements, I wouldn’t bet on that!).

Tyler Durden Tue, 02/18/2025 - 13:45

Hungarian PM Viktor Orbán, George Soros

Hungarian PM Viktor Orbán, George Soros

Hungarian Minister of Foreign Affairs and Foreign Economic Relations Peter Szijjarto, via TASS

Hungarian Minister of Foreign Affairs and Foreign Economic Relations Peter Szijjarto, via TASS

Recent comments